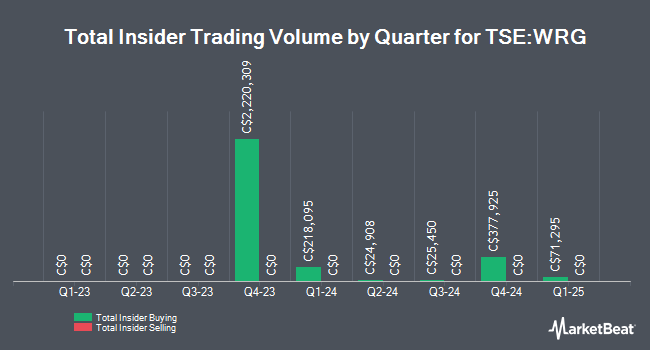

Western Energy Services Corp. (TSE:WRG - Get Free Report) insider Sime Armoyan bought 14,300 shares of the stock in a transaction on Friday, April 4th. The stock was purchased at an average price of C$2.20 per share, with a total value of C$31,460.00.

Sime Armoyan also recently made the following trade(s):

- On Thursday, April 10th, Sime Armoyan purchased 1,000 shares of Western Energy Services stock. The shares were acquired at an average price of C$2.10 per share, for a total transaction of C$2,100.00.

- On Tuesday, April 8th, Sime Armoyan acquired 200 shares of Western Energy Services stock. The stock was bought at an average cost of C$2.10 per share, with a total value of C$420.00.

- On Monday, March 10th, Sime Armoyan bought 14,800 shares of Western Energy Services stock. The shares were bought at an average cost of C$2.15 per share, for a total transaction of C$31,820.00.

- On Thursday, March 6th, Sime Armoyan purchased 75,700 shares of Western Energy Services stock. The stock was bought at an average cost of C$2.10 per share, with a total value of C$158,970.00.

- On Tuesday, March 4th, Sime Armoyan acquired 5,000 shares of Western Energy Services stock. The shares were bought at an average cost of C$2.30 per share, for a total transaction of C$11,500.00.

- On Friday, February 28th, Sime Armoyan bought 200 shares of Western Energy Services stock. The stock was purchased at an average price of C$2.35 per share, with a total value of C$470.00.

- On Wednesday, February 26th, Sime Armoyan purchased 800 shares of Western Energy Services stock. The shares were purchased at an average price of C$2.35 per share, for a total transaction of C$1,880.00.

- On Monday, February 24th, Sime Armoyan acquired 13,100 shares of Western Energy Services stock. The stock was purchased at an average price of C$2.35 per share, with a total value of C$30,785.00.

- On Tuesday, February 18th, Sime Armoyan bought 25,000 shares of Western Energy Services stock. The stock was purchased at an average price of C$2.40 per share, for a total transaction of C$60,000.00.

- On Thursday, February 13th, Sime Armoyan purchased 25,800 shares of Western Energy Services stock. The shares were acquired at an average cost of C$2.50 per share, with a total value of C$64,500.00.

Western Energy Services Price Performance

Shares of WRG traded down C$0.09 during trading hours on Friday, hitting C$2.10. 1,000 shares of the stock were exchanged, compared to its average volume of 13,061. The stock's 50-day moving average price is C$2.29 and its two-hundred day moving average price is C$2.55. Western Energy Services Corp. has a 12-month low of C$1.85 and a 12-month high of C$3.31. The company has a debt-to-equity ratio of 37.49, a quick ratio of 1.46 and a current ratio of 1.82. The company has a market cap of C$71.06 million, a price-to-earnings ratio of -10.00, a price-to-earnings-growth ratio of 0.09 and a beta of 1.49.

Analysts Set New Price Targets

A number of research firms have weighed in on WRG. ATB Capital set a C$3.25 price objective on Western Energy Services and gave the company a "sector perform" rating in a research note on Wednesday, January 15th. Atb Cap Markets upgraded Western Energy Services to a "hold" rating in a research report on Wednesday, January 15th.

Read Our Latest Analysis on WRG

About Western Energy Services

(

Get Free Report)

Western Energy Services Corp operates as an oilfield service industry in Canada and the United States of America. The company functions its drilling services through two segments namely, Contract drilling and Production services. Its contract drilling segment is involved in drilling rigs with ancillary equipment as well as provides such services to crude oil and natural gas exploration and production companies.

Featured Stories

Before you consider Western Energy Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Western Energy Services wasn't on the list.

While Western Energy Services currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.