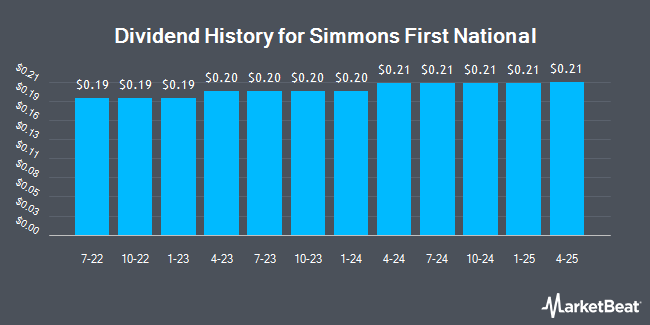

Simmons First National Co. (NASDAQ:SFNC - Get Free Report) announced a quarterly dividend on Tuesday, November 12th,RTT News reports. Stockholders of record on Friday, December 13th will be paid a dividend of 0.21 per share by the bank on Thursday, January 2nd. This represents a $0.84 dividend on an annualized basis and a dividend yield of 3.36%.

Simmons First National has increased its dividend payment by an average of 5.6% per year over the last three years and has increased its dividend every year for the last 13 years. Simmons First National has a dividend payout ratio of 51.5% meaning its dividend is sufficiently covered by earnings. Analysts expect Simmons First National to earn $1.58 per share next year, which means the company should continue to be able to cover its $0.84 annual dividend with an expected future payout ratio of 53.2%.

Simmons First National Trading Down 0.8 %

Shares of Simmons First National stock traded down $0.20 during trading hours on Tuesday, reaching $24.98. 765,778 shares of the company's stock were exchanged, compared to its average volume of 538,758. The firm has a market capitalization of $3.14 billion, a price-to-earnings ratio of 24.75 and a beta of 0.86. The company has a current ratio of 0.80, a quick ratio of 0.80 and a debt-to-equity ratio of 0.40. The company has a fifty day moving average of $22.19 and a 200-day moving average of $19.87. Simmons First National has a 52-week low of $14.59 and a 52-week high of $25.95.

Simmons First National (NASDAQ:SFNC - Get Free Report) last posted its quarterly earnings results on Friday, October 18th. The bank reported $0.37 EPS for the quarter, topping the consensus estimate of $0.33 by $0.04. Simmons First National had a net margin of 8.94% and a return on equity of 5.15%. The firm had revenue of $203.20 million for the quarter, compared to the consensus estimate of $204.91 million. During the same period last year, the firm posted $0.39 earnings per share. The business's revenue was up 3.6% compared to the same quarter last year. Sell-side analysts forecast that Simmons First National will post 1.33 EPS for the current fiscal year.

Wall Street Analyst Weigh In

SFNC has been the subject of a number of research analyst reports. Piper Sandler increased their target price on Simmons First National from $18.00 to $20.00 and gave the company an "underweight" rating in a report on Friday, July 26th. Stephens raised Simmons First National from an "equal weight" rating to an "overweight" rating and upped their price target for the company from $27.00 to $28.00 in a report on Monday, October 21st. StockNews.com upgraded Simmons First National from a "sell" rating to a "hold" rating in a research note on Monday, October 21st. Finally, Keefe, Bruyette & Woods boosted their price target on Simmons First National from $20.00 to $22.00 and gave the company a "market perform" rating in a research note on Thursday, July 25th. One equities research analyst has rated the stock with a sell rating, three have given a hold rating and one has issued a buy rating to the company. According to MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus target price of $23.00.

View Our Latest Analysis on Simmons First National

Insider Activity at Simmons First National

In other news, CAO David W. Garner sold 3,600 shares of the stock in a transaction dated Friday, August 23rd. The shares were sold at an average price of $21.21, for a total transaction of $76,356.00. Following the transaction, the chief accounting officer now directly owns 64,966 shares in the company, valued at $1,377,928.86. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this link. 1.91% of the stock is owned by corporate insiders.

About Simmons First National

(

Get Free Report)

Simmons First National Corporation operates as the holding company for Simmons Bank that provides banking and other financial products and services to individuals and businesses. The company offers checking, savings, and time deposits; consumer, real estate, and commercial loans; agricultural finance, equipment, and small business administration lending; trust and fiduciary services; credit cards; investment management products; treasury management; insurance products; and securities and investment services.

Featured Stories

Before you consider Simmons First National, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Simmons First National wasn't on the list.

While Simmons First National currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.