UniSuper Management Pty Ltd trimmed its position in shares of Simon Property Group, Inc. (NYSE:SPG - Free Report) by 8.9% during the fourth quarter, according to its most recent Form 13F filing with the SEC. The firm owned 115,262 shares of the real estate investment trust's stock after selling 11,196 shares during the period. UniSuper Management Pty Ltd's holdings in Simon Property Group were worth $19,849,000 at the end of the most recent reporting period.

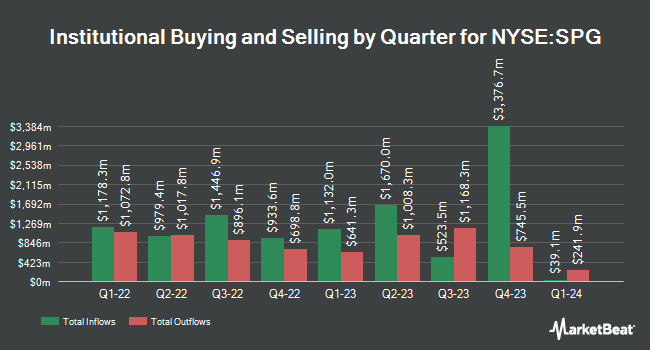

A number of other institutional investors also recently added to or reduced their stakes in the company. Hopwood Financial Services Inc. purchased a new position in Simon Property Group during the fourth quarter worth about $28,000. WR Wealth Planners LLC increased its position in shares of Simon Property Group by 328.2% in the fourth quarter. WR Wealth Planners LLC now owns 167 shares of the real estate investment trust's stock valued at $29,000 after buying an additional 128 shares in the last quarter. New England Capital Financial Advisors LLC acquired a new position in shares of Simon Property Group during the 4th quarter worth $30,000. TCTC Holdings LLC acquired a new stake in Simon Property Group during the 4th quarter valued at $34,000. Finally, Synergy Asset Management LLC acquired a new position in Simon Property Group in the 4th quarter valued at about $41,000. Hedge funds and other institutional investors own 93.01% of the company's stock.

Wall Street Analyst Weigh In

SPG has been the topic of a number of recent analyst reports. Deutsche Bank Aktiengesellschaft began coverage on shares of Simon Property Group in a research note on Tuesday, December 17th. They set a "hold" rating and a $195.00 price target on the stock. Mizuho lifted their price target on shares of Simon Property Group from $158.00 to $182.00 and gave the company a "neutral" rating in a research report on Wednesday, December 4th. Jefferies Financial Group raised Simon Property Group from a "hold" rating to a "buy" rating and raised their price objective for the company from $179.00 to $198.00 in a research report on Thursday, January 2nd. Piper Sandler raised Simon Property Group from a "neutral" rating to an "overweight" rating and boosted their price target for the stock from $175.00 to $205.00 in a research report on Wednesday, February 5th. Finally, Scotiabank set a $186.00 target price on shares of Simon Property Group in a research report on Friday, February 28th. Six investment analysts have rated the stock with a hold rating and four have given a buy rating to the stock. According to MarketBeat.com, Simon Property Group has a consensus rating of "Hold" and an average price target of $180.33.

Read Our Latest Stock Analysis on Simon Property Group

Simon Property Group Stock Performance

NYSE:SPG traded up $1.51 during mid-day trading on Monday, hitting $165.79. The stock had a trading volume of 851,765 shares, compared to its average volume of 1,436,747. The company has a 50 day simple moving average of $175.42 and a 200-day simple moving average of $174.53. Simon Property Group, Inc. has a 52 week low of $139.25 and a 52 week high of $190.14. The stock has a market capitalization of $54.09 billion, a price-to-earnings ratio of 22.84, a P/E/G ratio of 10.10 and a beta of 1.78. The company has a current ratio of 1.28, a quick ratio of 2.00 and a debt-to-equity ratio of 7.19.

Simon Property Group (NYSE:SPG - Get Free Report) last announced its earnings results on Tuesday, February 4th. The real estate investment trust reported $3.68 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.98 by $1.70. Simon Property Group had a net margin of 41.49% and a return on equity of 74.02%. On average, research analysts expect that Simon Property Group, Inc. will post 12.54 earnings per share for the current fiscal year.

Simon Property Group Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Monday, March 31st. Shareholders of record on Monday, March 10th will be given a $2.10 dividend. The ex-dividend date of this dividend is Monday, March 10th. This represents a $8.40 dividend on an annualized basis and a yield of 5.07%. Simon Property Group's dividend payout ratio (DPR) is 115.70%.

Simon Property Group Company Profile

(

Free Report)

Simon Property Group, Inc NYSE: SPG is a self-administered and self-managed real estate investment trust (REIT). Simon Property Group, L.P., or the Operating Partnership, is our majority-owned partnership subsidiary that owns all of our real estate properties and other assets. In this package, the terms Simon, we, our, or the Company refer to Simon Property Group, Inc, the Operating Partnership, and its subsidiaries.

Read More

Before you consider Simon Property Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Simon Property Group wasn't on the list.

While Simon Property Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.