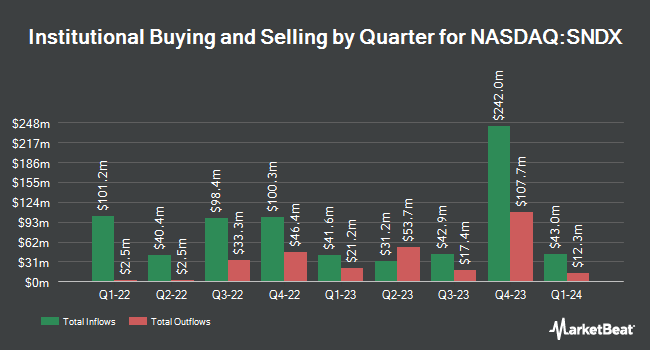

Simplify Asset Management Inc. boosted its holdings in shares of Syndax Pharmaceuticals, Inc. (NASDAQ:SNDX - Free Report) by 62.5% during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 122,185 shares of the company's stock after acquiring an additional 46,992 shares during the quarter. Simplify Asset Management Inc. owned approximately 0.14% of Syndax Pharmaceuticals worth $2,352,000 at the end of the most recent reporting period.

Several other hedge funds and other institutional investors have also recently added to or reduced their stakes in SNDX. Northwestern Mutual Wealth Management Co. acquired a new position in Syndax Pharmaceuticals during the second quarter valued at approximately $27,000. Values First Advisors Inc. acquired a new position in Syndax Pharmaceuticals during the third quarter valued at approximately $30,000. nVerses Capital LLC acquired a new position in Syndax Pharmaceuticals during the second quarter valued at approximately $33,000. Mirae Asset Global Investments Co. Ltd. grew its holdings in Syndax Pharmaceuticals by 21.3% during the third quarter. Mirae Asset Global Investments Co. Ltd. now owns 3,078 shares of the company's stock valued at $58,000 after purchasing an additional 541 shares during the last quarter. Finally, Quarry LP grew its holdings in Syndax Pharmaceuticals by 75.0% during the second quarter. Quarry LP now owns 6,125 shares of the company's stock valued at $126,000 after purchasing an additional 2,625 shares during the last quarter.

Wall Street Analyst Weigh In

SNDX has been the topic of several analyst reports. HC Wainwright increased their price target on Syndax Pharmaceuticals from $47.00 to $49.00 and gave the company a "buy" rating in a report on Tuesday. The Goldman Sachs Group increased their price target on Syndax Pharmaceuticals from $30.00 to $33.00 and gave the company a "buy" rating in a report on Thursday, November 7th. Stifel Nicolaus raised their price objective on shares of Syndax Pharmaceuticals from $40.00 to $41.00 and gave the stock a "buy" rating in a research note on Monday, October 14th. Citigroup raised their price objective on shares of Syndax Pharmaceuticals from $30.00 to $34.00 and gave the stock a "buy" rating in a research note on Friday, August 16th. Finally, UBS Group initiated coverage on shares of Syndax Pharmaceuticals in a research note on Thursday, October 24th. They issued a "buy" rating and a $37.00 price objective on the stock. Two analysts have rated the stock with a hold rating and ten have assigned a buy rating to the stock. Based on data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $36.00.

Get Our Latest Research Report on Syndax Pharmaceuticals

Syndax Pharmaceuticals Trading Down 5.7 %

SNDX stock traded down $0.96 during midday trading on Friday, hitting $15.83. The stock had a trading volume of 5,023,028 shares, compared to its average volume of 1,128,477. The firm has a market capitalization of $1.35 billion, a price-to-earnings ratio of -4.36 and a beta of 0.92. Syndax Pharmaceuticals, Inc. has a 52 week low of $14.50 and a 52 week high of $25.34. The stock has a 50-day simple moving average of $18.94 and a 200 day simple moving average of $20.25.

Syndax Pharmaceuticals (NASDAQ:SNDX - Get Free Report) last issued its earnings results on Tuesday, November 5th. The company reported ($0.98) EPS for the quarter, topping the consensus estimate of ($1.13) by $0.15. The firm had revenue of $12.50 million during the quarter, compared to the consensus estimate of $9.16 million. During the same period last year, the business earned ($0.73) earnings per share. On average, equities analysts forecast that Syndax Pharmaceuticals, Inc. will post -3.61 EPS for the current year.

Syndax Pharmaceuticals Profile

(

Free Report)

Syndax Pharmaceuticals, Inc, a clinical-stage biopharmaceutical company, develops therapies for the treatment of cancer. Its lead product candidates are revumenib, a potent, selective, small molecule inhibitor of the menin-MLL binding interaction for the treatment of KMT2A rearranged, acute leukemias, and solid tumor; and SNDX-6352 or axatilimab, a monoclonal antibody that blocks the colony stimulating factor 1, or CSF-1 receptor for the treatment of patients with chronic graft versus host disease (cGVHD) and idiopathic pulmonary fibrosis (IPF).

Recommended Stories

Before you consider Syndax Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Syndax Pharmaceuticals wasn't on the list.

While Syndax Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.