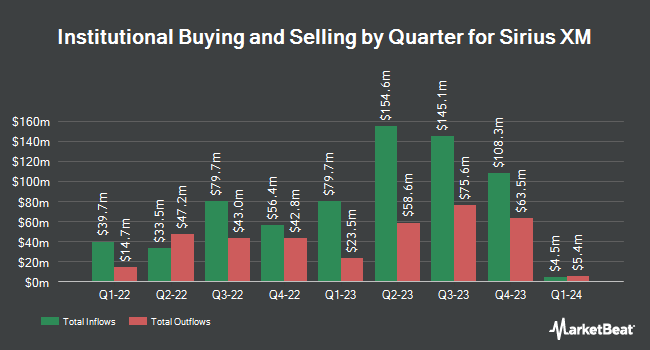

FMR LLC raised its stake in shares of Sirius XM Holdings Inc. (NASDAQ:SIRI - Free Report) by 472.6% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 497,514 shares of the company's stock after buying an additional 410,621 shares during the quarter. FMR LLC owned about 0.15% of Sirius XM worth $11,766,000 at the end of the most recent reporting period.

Other institutional investors also recently modified their holdings of the company. Savant Capital LLC acquired a new position in shares of Sirius XM during the 2nd quarter worth about $613,000. Cetera Advisors LLC lifted its holdings in shares of Sirius XM by 102.8% during the 1st quarter. Cetera Advisors LLC now owns 36,295 shares of the company's stock valued at $141,000 after purchasing an additional 18,401 shares in the last quarter. Dynamic Advisor Solutions LLC bought a new position in shares of Sirius XM during the 2nd quarter valued at about $59,000. Strategic Financial Concepts LLC bought a new position in shares of Sirius XM during the 2nd quarter valued at about $36,000. Finally, Picton Mahoney Asset Management bought a new position in shares of Sirius XM during the 2nd quarter valued at about $159,000. 10.69% of the stock is currently owned by institutional investors and hedge funds.

Sirius XM Stock Down 2.8 %

Shares of Sirius XM stock traded down $0.71 on Thursday, reaching $24.81. 3,711,897 shares of the company were exchanged, compared to its average volume of 3,649,368. Sirius XM Holdings Inc. has a one year low of $22.18 and a one year high of $57.80. The company has a market capitalization of $8.42 billion, a price-to-earnings ratio of -4.02 and a beta of 1.03. The company has a current ratio of 0.37, a quick ratio of 0.37 and a debt-to-equity ratio of 0.93. The company has a 50-day moving average of $26.29 and a 200 day moving average of $28.60.

Sirius XM Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Thursday, November 21st. Investors of record on Tuesday, November 5th were issued a dividend of $0.27 per share. The ex-dividend date was Tuesday, November 5th. This is a positive change from Sirius XM's previous quarterly dividend of $0.27. This represents a $1.08 dividend on an annualized basis and a dividend yield of 4.35%. Sirius XM's payout ratio is presently -17.03%.

Insider Buying and Selling at Sirius XM

In other news, major shareholder Berkshire Hathaway Inc bought 1,259,259 shares of the stock in a transaction dated Friday, October 11th. The shares were bought at an average price of $24.95 per share, for a total transaction of $31,418,512.05. Following the completion of the purchase, the insider now owns 108,719,088 shares in the company, valued at approximately $2,712,541,245.60. This trade represents a 1.17 % increase in their ownership of the stock. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Insiders acquired 2,646,761 shares of company stock valued at $65,952,329 in the last quarter. 0.79% of the stock is currently owned by insiders.

Analyst Ratings Changes

SIRI has been the topic of several recent analyst reports. Rosenblatt Securities lifted their price objective on Sirius XM from $28.00 to $29.00 and gave the company a "neutral" rating in a report on Wednesday. Seaport Res Ptn cut Sirius XM from a "strong-buy" rating to a "hold" rating in a report on Tuesday. Bank of America reiterated an "underperform" rating and set a $23.00 price objective on shares of Sirius XM in a report on Thursday, October 24th. Morgan Stanley restated an "underweight" rating and issued a $23.00 target price on shares of Sirius XM in a research note on Tuesday, September 24th. Finally, JPMorgan Chase & Co. boosted their target price on Sirius XM from $20.00 to $21.00 and gave the company an "underweight" rating in a research note on Thursday, November 7th. Six analysts have rated the stock with a sell rating, five have given a hold rating and four have given a buy rating to the company's stock. Based on data from MarketBeat.com, Sirius XM currently has a consensus rating of "Hold" and an average target price of $29.04.

View Our Latest Report on SIRI

About Sirius XM

(

Free Report)

Sirius XM Holdings Inc operates as an audio entertainment company in North America. It operates in two segments, Sirius XM, and Pandora and Off-platform. The company's Sirius XM segment provides music, sports, entertainment, comedy, talk, news, traffic and weather channels, and other content, as well as podcast and infotainment services on subscription fee basis; and live, curated, and exclusive and on demand programming services through satellite radio systems and streamed through applications for mobile and home devices, and other consumer electronic equipment.

Featured Articles

Before you consider Sirius XM, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sirius XM wasn't on the list.

While Sirius XM currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.