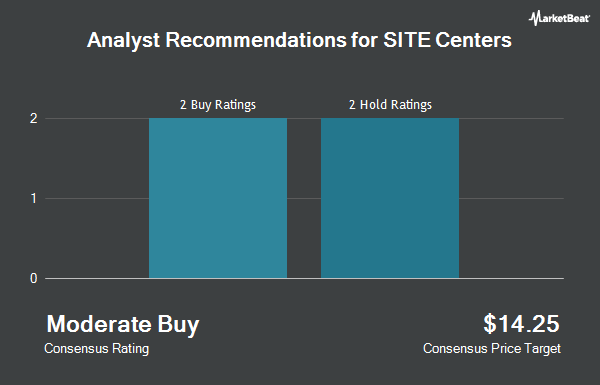

Shares of SITE Centers Corp. (NYSE:SITC - Get Free Report) have received a consensus rating of "Hold" from the nine brokerages that are presently covering the stock, MarketBeat.com reports. Seven research analysts have rated the stock with a hold recommendation and two have assigned a buy recommendation to the company. The average 1 year target price among analysts that have updated their coverage on the stock in the last year is $39.38.

SITC has been the subject of a number of recent research reports. Wells Fargo & Company cut shares of SITE Centers from an "overweight" rating to an "equal weight" rating and lowered their price target for the company from $68.00 to $19.00 in a research report on Wednesday, October 2nd. Piper Sandler decreased their target price on shares of SITE Centers from $23.00 to $20.00 and set an "overweight" rating for the company in a report on Monday, November 4th. StockNews.com started coverage on shares of SITE Centers in a report on Wednesday. They issued a "hold" rating for the company. Truist Financial boosted their price objective on shares of SITE Centers from $56.00 to $58.00 and gave the company a "hold" rating in a report on Wednesday, August 28th. Finally, Morgan Stanley boosted their price objective on shares of SITE Centers from $56.00 to $57.00 and gave the company an "equal weight" rating in a report on Monday, September 30th.

View Our Latest Stock Analysis on SITE Centers

Institutional Investors Weigh In On SITE Centers

Several hedge funds and other institutional investors have recently made changes to their positions in the company. Dimensional Fund Advisors LP grew its holdings in shares of SITE Centers by 1.2% in the second quarter. Dimensional Fund Advisors LP now owns 2,719,081 shares of the company's stock worth $39,426,000 after purchasing an additional 31,529 shares during the last quarter. APG Asset Management US Inc. boosted its holdings in shares of SITE Centers by 145.0% in the 2nd quarter. APG Asset Management US Inc. now owns 905,000 shares of the company's stock valued at $12,996,000 after buying an additional 535,550 shares in the last quarter. Renaissance Technologies LLC boosted its holdings in shares of SITE Centers by 6.8% in the 2nd quarter. Renaissance Technologies LLC now owns 882,336 shares of the company's stock valued at $12,794,000 after buying an additional 56,013 shares in the last quarter. Bank of Montreal Can boosted its holdings in shares of SITE Centers by 3,017.5% in the 2nd quarter. Bank of Montreal Can now owns 763,670 shares of the company's stock valued at $11,081,000 after buying an additional 739,174 shares in the last quarter. Finally, Peregrine Capital Management LLC boosted its holdings in shares of SITE Centers by 13.3% in the 2nd quarter. Peregrine Capital Management LLC now owns 488,993 shares of the company's stock valued at $7,090,000 after buying an additional 57,281 shares in the last quarter. Hedge funds and other institutional investors own 88.70% of the company's stock.

SITE Centers Price Performance

Shares of SITE Centers stock traded down $0.24 on Thursday, hitting $15.38. 913,635 shares of the company traded hands, compared to its average volume of 696,663. The firm's 50-day simple moving average is $19.03 and its 200 day simple moving average is $125.94. The company has a current ratio of 6.55, a quick ratio of 6.55 and a debt-to-equity ratio of 0.12. The company has a market cap of $806.11 million, a P/E ratio of 1.13 and a beta of 1.61. SITE Centers has a 12-month low of $15.31 and a 12-month high of $64.44.

SITE Centers (NYSE:SITC - Get Free Report) last issued its earnings results on Wednesday, October 30th. The company reported $6.07 EPS for the quarter, topping analysts' consensus estimates of $0.87 by $5.20. The company had revenue of $89.43 million for the quarter, compared to analysts' expectations of $104.55 million. SITE Centers had a net margin of 164.10% and a return on equity of 34.20%. The firm's revenue was down 37.5% compared to the same quarter last year. During the same quarter last year, the company earned $1.32 EPS. Analysts expect that SITE Centers will post 2.9 earnings per share for the current fiscal year.

SITE Centers Company Profile

(

Get Free ReportSITE Centers is an owner and manager of open-air shopping centers located in suburban, high household income communities. The Company is a self-administered and self-managed REIT operating as a fully integrated real estate company, and is publicly traded on the New York Stock Exchange under the ticker symbol SITC.

Further Reading

Before you consider SITE Centers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SITE Centers wasn't on the list.

While SITE Centers currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.