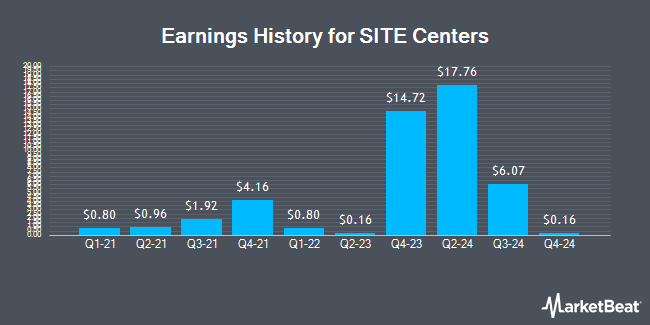

SITE Centers (NYSE:SITC - Get Free Report) is projected to announce its earnings results before the market opens on Tuesday, February 11th. Analysts expect the company to announce earnings of ($0.21) per share and revenue of $43.58 million for the quarter.

SITE Centers Stock Down 0.9 %

Shares of SITC stock traded down $0.14 on Friday, hitting $15.01. 707,780 shares of the stock were exchanged, compared to its average volume of 777,743. The business has a 50-day moving average of $15.24 and a 200 day moving average of $55.60. SITE Centers has a fifty-two week low of $14.55 and a fifty-two week high of $32.22. The firm has a market capitalization of $786.97 million, a P/E ratio of 1.10 and a beta of 1.60. The company has a current ratio of 6.55, a quick ratio of 6.55 and a debt-to-equity ratio of 0.12.

Insider Activity at SITE Centers

In related news, Director Dawn M. Sweeney sold 3,768 shares of the company's stock in a transaction dated Monday, December 16th. The shares were sold at an average price of $15.54, for a total value of $58,554.72. Following the transaction, the director now owns 29,082 shares in the company, valued at approximately $451,934.28. This represents a 11.47 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CEO David R. Lukes sold 168,895 shares of the stock in a transaction dated Tuesday, December 10th. The shares were sold at an average price of $15.39, for a total transaction of $2,599,294.05. Following the completion of the transaction, the chief executive officer now directly owns 136,008 shares in the company, valued at approximately $2,093,163.12. This represents a 55.39 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 181,457 shares of company stock worth $2,791,693. Insiders own 10.10% of the company's stock.

Analysts Set New Price Targets

Several equities analysts have recently weighed in on SITC shares. Compass Point decreased their price target on shares of SITE Centers from $64.00 to $17.00 and set a "neutral" rating for the company in a research note on Tuesday, October 15th. StockNews.com initiated coverage on shares of SITE Centers in a research report on Wednesday, December 4th. They issued a "hold" rating for the company. Wells Fargo & Company cut their price target on shares of SITE Centers from $17.50 to $17.00 and set an "equal weight" rating on the stock in a research report on Wednesday, January 29th. Piper Sandler decreased their price objective on SITE Centers from $23.00 to $20.00 and set an "overweight" rating for the company in a report on Monday, November 4th. Finally, Citigroup dropped their target price on SITE Centers from $18.00 to $16.00 and set a "neutral" rating on the stock in a report on Monday, December 9th. Eight equities research analysts have rated the stock with a hold rating and two have assigned a buy rating to the company. Based on data from MarketBeat.com, the stock has an average rating of "Hold" and a consensus price target of $35.75.

View Our Latest Stock Analysis on SITE Centers

About SITE Centers

(

Get Free Report)

SITE Centers is an owner and manager of open-air shopping centers located in suburban, high household income communities. The Company is a self-administered and self-managed REIT operating as a fully integrated real estate company, and is publicly traded on the New York Stock Exchange under the ticker symbol SITC.

See Also

Before you consider SITE Centers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SITE Centers wasn't on the list.

While SITE Centers currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.