Sivik Global Healthcare LLC increased its stake in shares of Baxter International Inc. (NYSE:BAX - Free Report) by 50.0% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 150,000 shares of the medical instruments supplier's stock after buying an additional 50,000 shares during the period. Baxter International comprises 2.4% of Sivik Global Healthcare LLC's portfolio, making the stock its 17th largest holding. Sivik Global Healthcare LLC's holdings in Baxter International were worth $5,696,000 as of its most recent filing with the Securities and Exchange Commission.

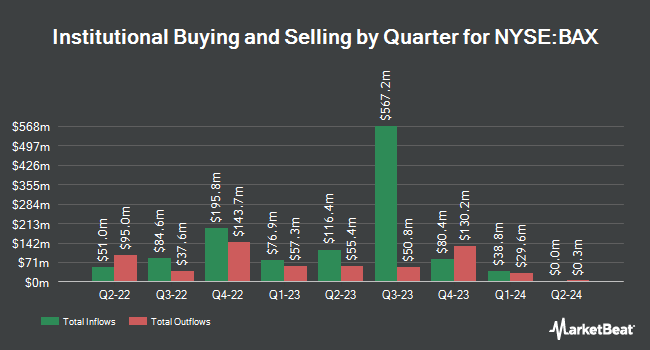

A number of other institutional investors and hedge funds have also modified their holdings of BAX. Wintrust Investments LLC grew its position in shares of Baxter International by 76.8% in the first quarter. Wintrust Investments LLC now owns 41,708 shares of the medical instruments supplier's stock valued at $1,783,000 after purchasing an additional 18,114 shares during the last quarter. Poehling Capital Management INC. purchased a new position in Baxter International during the first quarter worth $719,000. Covestor Ltd raised its holdings in shares of Baxter International by 42.1% in the first quarter. Covestor Ltd now owns 6,676 shares of the medical instruments supplier's stock worth $286,000 after acquiring an additional 1,978 shares during the last quarter. Rockport Wealth LLC purchased a new stake in shares of Baxter International in the first quarter valued at $297,000. Finally, Bessemer Group Inc. boosted its stake in shares of Baxter International by 17.3% during the first quarter. Bessemer Group Inc. now owns 5,159 shares of the medical instruments supplier's stock valued at $221,000 after acquiring an additional 762 shares during the last quarter. Institutional investors and hedge funds own 90.19% of the company's stock.

Baxter International Price Performance

Shares of NYSE BAX traded down $0.92 during midday trading on Thursday, reaching $31.71. The company's stock had a trading volume of 5,659,437 shares, compared to its average volume of 4,078,072. Baxter International Inc. has a one year low of $31.61 and a one year high of $44.01. The company has a market cap of $16.18 billion, a price-to-earnings ratio of 161.66, a price-to-earnings-growth ratio of 11.44 and a beta of 0.60. The company has a 50 day moving average price of $37.13 and a 200 day moving average price of $35.94. The company has a current ratio of 1.40, a quick ratio of 0.91 and a debt-to-equity ratio of 1.35.

Baxter International (NYSE:BAX - Get Free Report) last announced its earnings results on Friday, November 8th. The medical instruments supplier reported $0.80 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.78 by $0.02. Baxter International had a net margin of 0.77% and a return on equity of 18.19%. The company had revenue of $3.85 billion for the quarter, compared to the consensus estimate of $3.85 billion. During the same period in the previous year, the business earned $0.68 EPS. The company's revenue was up 3.8% on a year-over-year basis. On average, equities research analysts expect that Baxter International Inc. will post 2.33 EPS for the current year.

Baxter International Cuts Dividend

The business also recently announced a quarterly dividend, which will be paid on Thursday, January 2nd. Shareholders of record on Friday, November 29th will be given a $0.17 dividend. The ex-dividend date is Friday, November 29th. This represents a $0.68 dividend on an annualized basis and a yield of 2.14%. Baxter International's payout ratio is 580.03%.

Wall Street Analysts Forecast Growth

BAX has been the topic of several recent analyst reports. JPMorgan Chase & Co. cut their price target on Baxter International from $44.00 to $42.00 and set a "neutral" rating on the stock in a research note on Wednesday, August 7th. StockNews.com downgraded shares of Baxter International from a "buy" rating to a "hold" rating in a research note on Monday. Stifel Nicolaus dropped their target price on shares of Baxter International from $46.00 to $38.00 and set a "buy" rating for the company in a research report on Monday. Wells Fargo & Company reduced their price target on shares of Baxter International from $44.00 to $40.00 and set an "equal weight" rating on the stock in a research report on Wednesday, August 7th. Finally, Citigroup boosted their price objective on Baxter International from $38.00 to $40.00 and gave the company a "neutral" rating in a research report on Tuesday, October 1st. One research analyst has rated the stock with a sell rating, eight have assigned a hold rating and three have assigned a buy rating to the company. Based on data from MarketBeat.com, the company has a consensus rating of "Hold" and an average price target of $40.91.

Check Out Our Latest Stock Analysis on BAX

Baxter International Company Profile

(

Free Report)

Baxter International Inc, through its subsidiaries, develops and provides a portfolio of healthcare products worldwide. The company operates through four segments: Medical Products and Therapies, Healthcare Systems and Technologies, Pharmaceuticals, and Kidney Care. The company offers sterile intravenous (IV) solutions; infusion systems and devices; parenteral nutrition therapies; generic injectable pharmaceuticals; surgical hemostat and sealant products, advanced surgical equipment; smart bed systems; patient monitoring and diagnostic technologies; and respiratory health devices, as well as advanced equipment for the surgical space, including surgical video technologies, precision positioning devices, and other accessories.

Featured Articles

Before you consider Baxter International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Baxter International wasn't on the list.

While Baxter International currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.