Sixth Street Specialty Lending (NYSE:TSLX - Get Free Report)'s stock had its "outperform" rating reiterated by investment analysts at Royal Bank of Canada in a report released on Tuesday,Benzinga reports. They currently have a $23.00 price target on the financial services provider's stock. Royal Bank of Canada's price target points to a potential upside of 12.83% from the company's previous close.

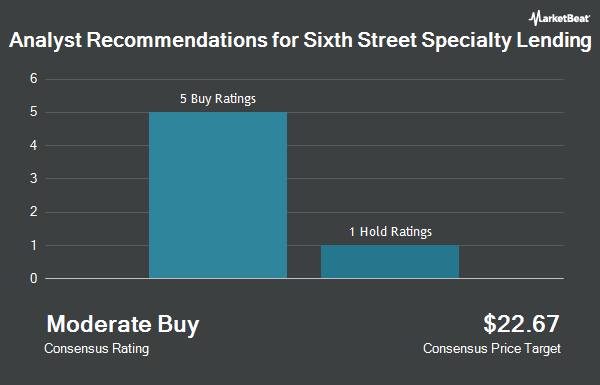

A number of other equities analysts have also weighed in on the company. Keefe, Bruyette & Woods reduced their price objective on Sixth Street Specialty Lending from $23.00 to $21.50 and set an "outperform" rating for the company in a research note on Thursday, November 7th. LADENBURG THALM/SH SH upgraded shares of Sixth Street Specialty Lending from a "neutral" rating to a "buy" rating and set a $21.00 price objective for the company in a research note on Wednesday, November 6th. Finally, Wells Fargo & Company lowered their price target on shares of Sixth Street Specialty Lending from $22.00 to $21.00 and set an "overweight" rating on the stock in a research note on Tuesday, October 29th. Six investment analysts have rated the stock with a buy rating, According to data from MarketBeat.com, the stock has an average rating of "Buy" and an average price target of $22.00.

Check Out Our Latest Report on TSLX

Sixth Street Specialty Lending Stock Up 0.0 %

Sixth Street Specialty Lending stock traded up $0.01 during mid-day trading on Tuesday, hitting $20.39. The company had a trading volume of 420,504 shares, compared to its average volume of 352,096. Sixth Street Specialty Lending has a 12 month low of $19.50 and a 12 month high of $22.35. The stock's 50 day moving average price is $20.62 and its two-hundred day moving average price is $21.05. The company has a current ratio of 2.50, a quick ratio of 1.90 and a debt-to-equity ratio of 1.17. The company has a market capitalization of $1.90 billion, a PE ratio of 9.92 and a beta of 1.06.

Sixth Street Specialty Lending (NYSE:TSLX - Get Free Report) last released its quarterly earnings data on Tuesday, November 5th. The financial services provider reported $0.57 earnings per share for the quarter, hitting analysts' consensus estimates of $0.57. Sixth Street Specialty Lending had a return on equity of 13.55% and a net margin of 39.05%. The firm had revenue of $119.22 million during the quarter, compared to analyst estimates of $119.85 million. During the same quarter in the prior year, the company posted $0.60 earnings per share. As a group, sell-side analysts anticipate that Sixth Street Specialty Lending will post 2.31 earnings per share for the current fiscal year.

Institutional Trading of Sixth Street Specialty Lending

Large investors have recently added to or reduced their stakes in the company. EntryPoint Capital LLC acquired a new position in shares of Sixth Street Specialty Lending in the 1st quarter valued at approximately $35,000. nVerses Capital LLC bought a new stake in Sixth Street Specialty Lending during the second quarter valued at approximately $70,000. Ridgewood Investments LLC bought a new stake in shares of Sixth Street Specialty Lending in the 2nd quarter worth approximately $77,000. Future Financial Wealth Managment LLC purchased a new position in Sixth Street Specialty Lending during the 3rd quarter valued at $86,000. Finally, Atlas Capital Advisors LLC bought a new position in Sixth Street Specialty Lending during the 2nd quarter valued at about $109,000. 70.25% of the stock is owned by institutional investors.

About Sixth Street Specialty Lending

(

Get Free Report)

Sixth Street Specialty Lending, Inc NYSE: TSLX is a business development company. The fund provides senior secured loans (first-lien, second-lien, and unitranche), unsecured loans, mezzanine debt, and investments in corporate bonds and equity securities and structured products, non-control structured equity, and common equity with a focus on co-investments for organic growth, acquisitions, market or product expansion, restructuring initiatives, recapitalizations, and refinancing.

See Also

Before you consider Sixth Street Specialty Lending, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sixth Street Specialty Lending wasn't on the list.

While Sixth Street Specialty Lending currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.