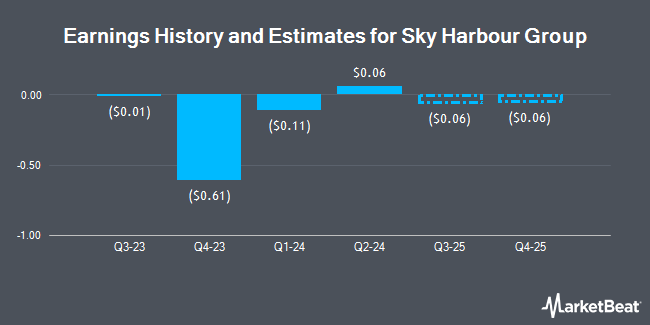

Sky Harbour Group Co. (NYSEAMERICAN:SKYH - Free Report) - Stock analysts at Northland Capmk raised their FY2024 EPS estimates for shares of Sky Harbour Group in a research note issued to investors on Wednesday, November 13th. Northland Capmk analyst G. Gibas now anticipates that the company will earn $0.30 per share for the year, up from their prior estimate of $0.11. Northland Capmk currently has a "Strong-Buy" rating on the stock. The consensus estimate for Sky Harbour Group's current full-year earnings is $0.30 per share. Northland Capmk also issued estimates for Sky Harbour Group's Q4 2024 earnings at ($0.07) EPS.

Separately, Northland Securities started coverage on shares of Sky Harbour Group in a report on Tuesday, September 24th. They issued an "outperform" rating and a $16.00 target price for the company.

View Our Latest Stock Analysis on Sky Harbour Group

Sky Harbour Group Trading Down 5.5 %

SKYH traded down $0.68 during trading on Monday, hitting $11.59. 56,920 shares of the company's stock were exchanged, compared to its average volume of 56,164. Sky Harbour Group has a fifty-two week low of $7.62 and a fifty-two week high of $13.60. The company has a market cap of $776.88 million, a price-to-earnings ratio of -5.69 and a beta of 1.84.

Institutional Inflows and Outflows

A number of hedge funds have recently added to or reduced their stakes in SKYH. MetLife Investment Management LLC purchased a new stake in shares of Sky Harbour Group in the 3rd quarter worth about $79,000. Apis Capital Advisors LLC purchased a new stake in shares of Sky Harbour Group in the 2nd quarter worth about $92,000. Rhumbline Advisers purchased a new stake in shares of Sky Harbour Group in the 2nd quarter worth about $103,000. Barclays PLC grew its position in shares of Sky Harbour Group by 326.5% in the 3rd quarter. Barclays PLC now owns 16,315 shares of the company's stock worth $181,000 after buying an additional 12,490 shares during the period. Finally, Bank of New York Mellon Corp bought a new position in Sky Harbour Group in the 2nd quarter worth about $271,000. 14.75% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling at Sky Harbour Group

In other Sky Harbour Group news, Director Alexander Buffett Rozek acquired 52,632 shares of the stock in a transaction dated Thursday, October 24th. The stock was purchased at an average cost of $9.50 per share, for a total transaction of $500,004.00. Following the acquisition, the director now owns 52,632 shares in the company, valued at $500,004. The trade was a ∞ increase in their position. The acquisition was disclosed in a legal filing with the SEC, which is available at this link. 45.18% of the stock is currently owned by company insiders.

Sky Harbour Group Company Profile

(

Get Free Report)

Sky Harbour Group Corporation operates as an aviation infrastructure development company in the United States. It develops, leases, and manages general aviation hangars for business aircraft. The company is based in White Plains, New York.

See Also

Before you consider Sky Harbour Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sky Harbour Group wasn't on the list.

While Sky Harbour Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.