Skye Global Management LP purchased a new position in Coupang, Inc. (NYSE:CPNG - Free Report) in the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor purchased 612,000 shares of the company's stock, valued at approximately $15,025,000. Coupang makes up approximately 0.4% of Skye Global Management LP's portfolio, making the stock its 22nd biggest holding.

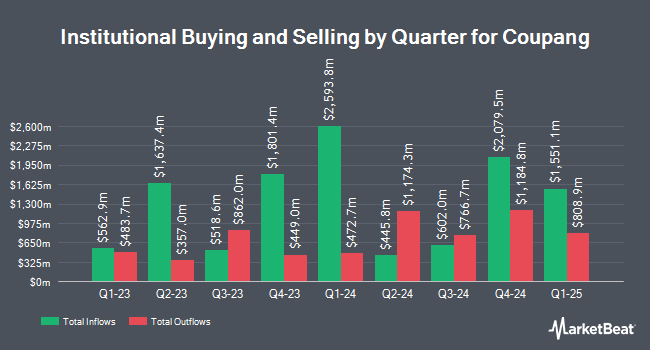

Several other large investors also recently modified their holdings of CPNG. Baillie Gifford & Co. grew its holdings in shares of Coupang by 1.6% during the second quarter. Baillie Gifford & Co. now owns 171,350,025 shares of the company's stock worth $3,589,783,000 after buying an additional 2,749,027 shares in the last quarter. FMR LLC grew its holdings in shares of Coupang by 32.0% during the third quarter. FMR LLC now owns 27,153,608 shares of the company's stock worth $666,621,000 after buying an additional 6,584,910 shares in the last quarter. Dorsal Capital Management LP grew its holdings in shares of Coupang by 26.3% during the second quarter. Dorsal Capital Management LP now owns 6,000,000 shares of the company's stock worth $125,700,000 after buying an additional 1,250,000 shares in the last quarter. Coronation Fund Managers Ltd. grew its holdings in shares of Coupang by 139.1% during the third quarter. Coronation Fund Managers Ltd. now owns 4,817,030 shares of the company's stock worth $118,258,000 after buying an additional 2,802,325 shares in the last quarter. Finally, Assenagon Asset Management S.A. grew its holdings in shares of Coupang by 55.5% during the second quarter. Assenagon Asset Management S.A. now owns 4,524,994 shares of the company's stock worth $94,799,000 after buying an additional 1,615,448 shares in the last quarter. 83.72% of the stock is currently owned by institutional investors.

Insider Activity

In other Coupang news, Director Greenoaks Capital Partners Llc purchased 687,700 shares of the firm's stock in a transaction that occurred on Monday, November 11th. The shares were acquired at an average cost of $24.08 per share, for a total transaction of $16,559,816.00. Following the completion of the purchase, the director now owns 52,726,423 shares of the company's stock, valued at approximately $1,269,652,265.84. The trade was a 1.32 % increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CEO Bom Kim sold 15,000,000 shares of the firm's stock in a transaction dated Monday, November 11th. The stock was sold at an average price of $22.97, for a total transaction of $344,550,000.00. Following the transaction, the chief executive officer now directly owns 2,000,000 shares in the company, valued at approximately $45,940,000. This represents a 88.24 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 13.60% of the company's stock.

Analyst Upgrades and Downgrades

CPNG has been the subject of several recent research reports. CLSA raised Coupang from a "hold" rating to an "outperform" rating and increased their price target for the company from $18.00 to $31.00 in a research report on Wednesday, September 4th. Sanford C. Bernstein raised Coupang from an "underperform" rating to an "outperform" rating and set a $30.00 price target for the company in a research report on Monday, October 7th. One research analyst has rated the stock with a hold rating and eight have issued a buy rating to the stock. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average target price of $27.56.

Read Our Latest Stock Analysis on CPNG

Coupang Stock Performance

Shares of CPNG traded down $0.11 during mid-day trading on Friday, reaching $25.36. The company's stock had a trading volume of 2,561,144 shares, compared to its average volume of 9,664,550. Coupang, Inc. has a 1-year low of $13.51 and a 1-year high of $26.91. The stock has a market cap of $45.62 billion, a P/E ratio of 44.68, a PEG ratio of 229.25 and a beta of 1.10. The business has a 50-day simple moving average of $25.06 and a two-hundred day simple moving average of $23.01. The company has a current ratio of 1.13, a quick ratio of 0.86 and a debt-to-equity ratio of 0.28.

Coupang (NYSE:CPNG - Get Free Report) last released its quarterly earnings data on Tuesday, November 5th. The company reported $0.06 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.01 by $0.05. Coupang had a return on equity of 11.52% and a net margin of 3.57%. The company had revenue of $7.87 billion during the quarter, compared to analysts' expectations of $7.76 billion. During the same period last year, the firm posted $0.05 earnings per share. The business's revenue was up 27.2% on a year-over-year basis. As a group, equities research analysts anticipate that Coupang, Inc. will post 0.11 earnings per share for the current fiscal year.

Coupang Company Profile

(

Free Report)

Coupang, Inc, together with its subsidiaries owns and operates retail business through its mobile applications and Internet websites primarily in South Korea. The company operates through Product Commerce and Developing Offerings segments. It sells various products and services in the categories of home goods and décor products, apparel, beauty products, fresh food and groceries, sporting goods, electronics, and everyday consumables, as well as travel, and restaurant order and delivery services.

See Also

Before you consider Coupang, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coupang wasn't on the list.

While Coupang currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.