Ashford Capital Management Inc. decreased its position in shares of Skyward Specialty Insurance Group, Inc. (NASDAQ:SKWD - Free Report) by 15.6% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 633,836 shares of the company's stock after selling 116,924 shares during the quarter. Skyward Specialty Insurance Group makes up about 3.2% of Ashford Capital Management Inc.'s portfolio, making the stock its 6th biggest holding. Ashford Capital Management Inc. owned approximately 1.58% of Skyward Specialty Insurance Group worth $25,816,000 at the end of the most recent reporting period.

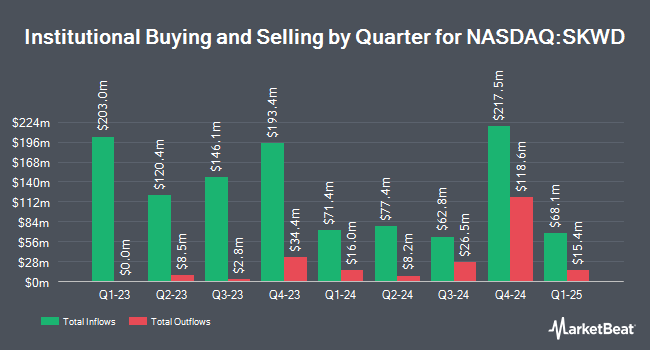

Several other hedge funds and other institutional investors have also recently bought and sold shares of the company. Arcadia Investment Management Corp MI acquired a new stake in shares of Skyward Specialty Insurance Group during the 3rd quarter worth approximately $41,000. Amalgamated Bank increased its stake in Skyward Specialty Insurance Group by 27.7% during the second quarter. Amalgamated Bank now owns 1,285 shares of the company's stock worth $46,000 after acquiring an additional 279 shares during the last quarter. Quarry LP raised its position in Skyward Specialty Insurance Group by 176.9% in the third quarter. Quarry LP now owns 1,376 shares of the company's stock valued at $56,000 after purchasing an additional 879 shares during the period. Ashton Thomas Private Wealth LLC acquired a new position in Skyward Specialty Insurance Group in the second quarter valued at about $160,000. Finally, CWM LLC increased its holdings in Skyward Specialty Insurance Group by 3,103.1% in the 3rd quarter. CWM LLC now owns 4,132 shares of the company's stock valued at $168,000 after purchasing an additional 4,003 shares during the last quarter. 94.83% of the stock is currently owned by institutional investors and hedge funds.

Skyward Specialty Insurance Group Price Performance

Shares of SKWD stock traded down $1.35 during trading hours on Tuesday, hitting $49.97. The stock had a trading volume of 306,863 shares, compared to its average volume of 349,083. The firm has a market capitalization of $2.00 billion, a PE ratio of 15.65, a PEG ratio of 0.97 and a beta of 0.76. The stock's 50 day moving average is $47.96 and its 200 day moving average is $41.47. Skyward Specialty Insurance Group, Inc. has a twelve month low of $29.40 and a twelve month high of $55.62.

Skyward Specialty Insurance Group (NASDAQ:SKWD - Get Free Report) last issued its quarterly earnings results on Tuesday, October 29th. The company reported $0.71 earnings per share for the quarter, topping the consensus estimate of $0.65 by $0.06. Skyward Specialty Insurance Group had a return on equity of 16.39% and a net margin of 12.24%. The firm had revenue of $300.89 million during the quarter, compared to the consensus estimate of $292.43 million. During the same period last year, the company earned $0.65 earnings per share. As a group, equities analysts predict that Skyward Specialty Insurance Group, Inc. will post 3.06 earnings per share for the current year.

Analyst Upgrades and Downgrades

Several equities analysts have weighed in on the company. Raymond James lifted their target price on Skyward Specialty Insurance Group from $45.00 to $55.00 and gave the company a "strong-buy" rating in a research report on Tuesday, November 5th. Keefe, Bruyette & Woods upped their price objective on Skyward Specialty Insurance Group from $46.00 to $47.00 and gave the stock an "outperform" rating in a research report on Monday, August 12th. William Blair began coverage on Skyward Specialty Insurance Group in a research note on Monday, August 19th. They set an "outperform" rating for the company. JMP Securities increased their price target on Skyward Specialty Insurance Group from $50.00 to $53.00 and gave the company a "market outperform" rating in a research report on Wednesday, October 30th. Finally, Barclays boosted their price objective on Skyward Specialty Insurance Group from $44.00 to $45.00 and gave the stock an "equal weight" rating in a research report on Wednesday, October 30th. Three equities research analysts have rated the stock with a hold rating, seven have issued a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat, Skyward Specialty Insurance Group presently has a consensus rating of "Moderate Buy" and an average target price of $46.89.

View Our Latest Analysis on SKWD

Insider Activity

In other Skyward Specialty Insurance Group news, Director James Charles Hays sold 25,000 shares of the stock in a transaction dated Tuesday, December 3rd. The shares were sold at an average price of $54.00, for a total value of $1,350,000.00. Following the completion of the transaction, the director now directly owns 747,261 shares of the company's stock, valued at approximately $40,352,094. This trade represents a 3.24 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Insiders own 8.01% of the company's stock.

Skyward Specialty Insurance Group Profile

(

Free Report)

Skyward Specialty Insurance Group, Inc, an insurance holding company, underwrites commercial property and casualty insurance products in the United States. It offers general liability, excess liability, professional liability, commercial auto, group accident and health, property, surety, and workers' compensation insurance products.

Featured Articles

Before you consider Skyward Specialty Insurance Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Skyward Specialty Insurance Group wasn't on the list.

While Skyward Specialty Insurance Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.