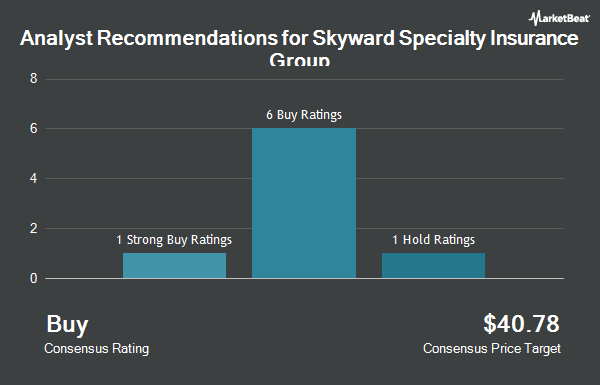

Skyward Specialty Insurance Group, Inc. (NASDAQ:SKWD - Get Free Report) has received a consensus rating of "Moderate Buy" from the eleven analysts that are presently covering the firm, MarketBeat reports. Three analysts have rated the stock with a hold recommendation, seven have given a buy recommendation and one has given a strong buy recommendation to the company. The average 12-month target price among brokers that have issued ratings on the stock in the last year is $46.89.

A number of equities analysts have recently weighed in on the company. JMP Securities increased their price target on Skyward Specialty Insurance Group from $50.00 to $53.00 and gave the stock a "market outperform" rating in a report on Wednesday, October 30th. Barclays increased their price target on Skyward Specialty Insurance Group from $44.00 to $45.00 and gave the stock an "equal weight" rating in a report on Wednesday, October 30th. William Blair assumed coverage on Skyward Specialty Insurance Group in a report on Monday, August 19th. They set an "outperform" rating for the company. Raymond James increased their price target on Skyward Specialty Insurance Group from $45.00 to $55.00 and gave the stock a "strong-buy" rating in a report on Tuesday, November 5th. Finally, Truist Financial reiterated a "buy" rating and set a $49.00 price target (up from $47.00) on shares of Skyward Specialty Insurance Group in a report on Wednesday, August 7th.

View Our Latest Stock Analysis on Skyward Specialty Insurance Group

Institutional Investors Weigh In On Skyward Specialty Insurance Group

A number of hedge funds have recently bought and sold shares of SKWD. Arcadia Investment Management Corp MI acquired a new stake in Skyward Specialty Insurance Group in the 3rd quarter valued at about $41,000. Amalgamated Bank raised its position in shares of Skyward Specialty Insurance Group by 27.7% during the 2nd quarter. Amalgamated Bank now owns 1,285 shares of the company's stock worth $46,000 after acquiring an additional 279 shares in the last quarter. Quarry LP raised its position in shares of Skyward Specialty Insurance Group by 176.9% during the 3rd quarter. Quarry LP now owns 1,376 shares of the company's stock worth $56,000 after acquiring an additional 879 shares in the last quarter. Ashton Thomas Private Wealth LLC acquired a new stake in shares of Skyward Specialty Insurance Group during the 2nd quarter worth about $160,000. Finally, CWM LLC raised its position in shares of Skyward Specialty Insurance Group by 3,103.1% during the 3rd quarter. CWM LLC now owns 4,132 shares of the company's stock worth $168,000 after acquiring an additional 4,003 shares in the last quarter. Institutional investors and hedge funds own 94.83% of the company's stock.

Skyward Specialty Insurance Group Trading Up 0.4 %

NASDAQ:SKWD traded up $0.19 during trading hours on Tuesday, hitting $54.16. The company had a trading volume of 225,333 shares, compared to its average volume of 351,052. The company has a 50-day moving average of $46.43 and a 200 day moving average of $40.73. The company has a market cap of $2.17 billion, a P/E ratio of 16.40, a P/E/G ratio of 0.98 and a beta of 0.76. Skyward Specialty Insurance Group has a 1 year low of $29.40 and a 1 year high of $54.86.

Skyward Specialty Insurance Group (NASDAQ:SKWD - Get Free Report) last issued its earnings results on Tuesday, October 29th. The company reported $0.71 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.65 by $0.06. The company had revenue of $300.89 million during the quarter, compared to analysts' expectations of $292.43 million. Skyward Specialty Insurance Group had a return on equity of 16.39% and a net margin of 12.24%. During the same period in the prior year, the business earned $0.65 EPS. On average, analysts forecast that Skyward Specialty Insurance Group will post 3.06 earnings per share for the current year.

About Skyward Specialty Insurance Group

(

Get Free ReportSkyward Specialty Insurance Group, Inc, an insurance holding company, underwrites commercial property and casualty insurance products in the United States. It offers general liability, excess liability, professional liability, commercial auto, group accident and health, property, surety, and workers' compensation insurance products.

Read More

Before you consider Skyward Specialty Insurance Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Skyward Specialty Insurance Group wasn't on the list.

While Skyward Specialty Insurance Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.