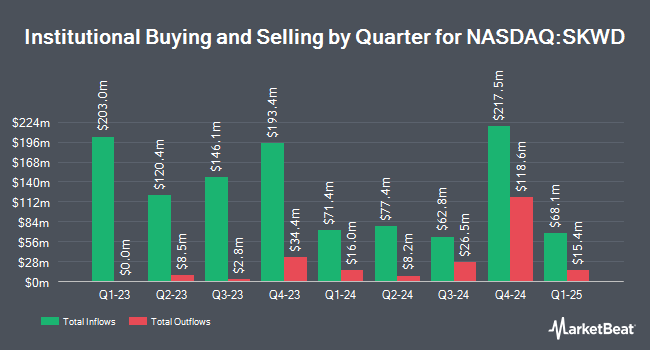

Bank of New York Mellon Corp lifted its position in shares of Skyward Specialty Insurance Group, Inc. (NASDAQ:SKWD - Free Report) by 11.3% during the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 122,402 shares of the company's stock after purchasing an additional 12,391 shares during the period. Bank of New York Mellon Corp owned about 0.31% of Skyward Specialty Insurance Group worth $6,186,000 as of its most recent SEC filing.

Several other institutional investors and hedge funds have also made changes to their positions in the company. Principal Financial Group Inc. boosted its holdings in Skyward Specialty Insurance Group by 49.8% in the third quarter. Principal Financial Group Inc. now owns 104,105 shares of the company's stock valued at $4,240,000 after purchasing an additional 34,612 shares during the last quarter. Victory Capital Management Inc. boosted its stake in shares of Skyward Specialty Insurance Group by 12.9% during the 3rd quarter. Victory Capital Management Inc. now owns 743,073 shares of the company's stock valued at $30,265,000 after buying an additional 84,623 shares during the last quarter. Royce & Associates LP acquired a new stake in shares of Skyward Specialty Insurance Group during the third quarter worth approximately $2,690,000. Jennison Associates LLC increased its stake in shares of Skyward Specialty Insurance Group by 1.0% in the third quarter. Jennison Associates LLC now owns 1,296,001 shares of the company's stock worth $52,786,000 after buying an additional 12,484 shares during the last quarter. Finally, Intech Investment Management LLC acquired a new stake in Skyward Specialty Insurance Group in the third quarter valued at $279,000. 94.83% of the stock is currently owned by hedge funds and other institutional investors.

Insider Activity at Skyward Specialty Insurance Group

In other news, Director Gena L. Ashe sold 1,000 shares of the stock in a transaction that occurred on Thursday, March 6th. The shares were sold at an average price of $50.62, for a total value of $50,620.00. Following the completion of the transaction, the director now directly owns 734 shares in the company, valued at $37,155.08. This trade represents a 57.67 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, insider Thomas N. Schmitt sold 546 shares of the company's stock in a transaction that occurred on Monday, January 6th. The stock was sold at an average price of $46.85, for a total value of $25,580.10. Following the completion of the sale, the insider now owns 10,246 shares of the company's stock, valued at $480,025.10. This trade represents a 5.06 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 27,450 shares of company stock worth $1,369,342 in the last three months. 8.01% of the stock is owned by company insiders.

Skyward Specialty Insurance Group Stock Performance

Shares of SKWD traded up $0.50 during midday trading on Thursday, hitting $49.93. 182,038 shares of the stock traded hands, compared to its average volume of 348,995. The business's 50 day moving average price is $47.62 and its two-hundred day moving average price is $47.03. The firm has a market capitalization of $2.00 billion, a PE ratio of 15.23, a price-to-earnings-growth ratio of 0.81 and a beta of 0.67. Skyward Specialty Insurance Group, Inc. has a 1-year low of $33.27 and a 1-year high of $55.62.

Skyward Specialty Insurance Group (NASDAQ:SKWD - Get Free Report) last posted its earnings results on Tuesday, February 25th. The company reported $0.80 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.77 by $0.03. The firm had revenue of $304.40 million during the quarter, compared to analyst estimates of $295.56 million. Skyward Specialty Insurance Group had a net margin of 12.24% and a return on equity of 16.39%. As a group, equities research analysts forecast that Skyward Specialty Insurance Group, Inc. will post 3.05 EPS for the current fiscal year.

Analysts Set New Price Targets

SKWD has been the subject of several recent analyst reports. Wolfe Research reissued a "peer perform" rating on shares of Skyward Specialty Insurance Group in a report on Friday, February 28th. JMP Securities reissued a "market outperform" rating and issued a $60.00 price objective on shares of Skyward Specialty Insurance Group in a report on Monday, February 10th. Barclays raised Skyward Specialty Insurance Group from an "equal weight" rating to an "overweight" rating and increased their target price for the stock from $53.00 to $63.00 in a report on Friday, March 14th. Keefe, Bruyette & Woods boosted their price target on Skyward Specialty Insurance Group from $60.00 to $62.00 and gave the company an "outperform" rating in a report on Friday, February 28th. Finally, TD Cowen assumed coverage on Skyward Specialty Insurance Group in a research note on Monday, January 13th. They set a "hold" rating and a $43.00 price objective on the stock. Three investment analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average target price of $56.25.

Check Out Our Latest Research Report on SKWD

About Skyward Specialty Insurance Group

(

Free Report)

Skyward Specialty Insurance Group, Inc, an insurance holding company, underwrites commercial property and casualty insurance products in the United States. It offers general liability, excess liability, professional liability, commercial auto, group accident and health, property, surety, and workers' compensation insurance products.

Read More

Before you consider Skyward Specialty Insurance Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Skyward Specialty Insurance Group wasn't on the list.

While Skyward Specialty Insurance Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.