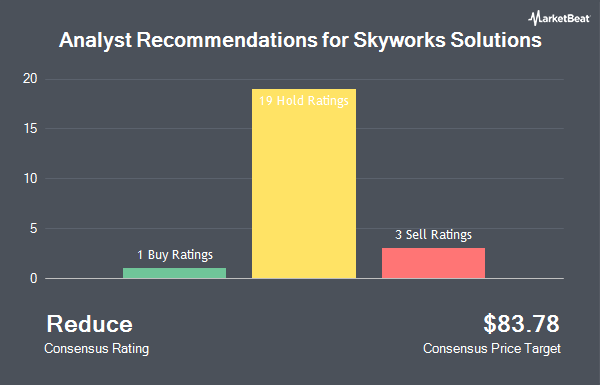

Skyworks Solutions, Inc. (NASDAQ:SWKS - Get Free Report) has been given an average recommendation of "Reduce" by the twenty-three research firms that are currently covering the stock, MarketBeat.com reports. Three investment analysts have rated the stock with a sell rating, nineteen have assigned a hold rating and one has given a buy rating to the company. The average twelve-month target price among brokers that have issued a report on the stock in the last year is $83.78.

A number of analysts recently commented on SWKS shares. Barclays decreased their price objective on shares of Skyworks Solutions from $80.00 to $70.00 and set an "underweight" rating on the stock in a report on Friday, January 17th. Stifel Nicolaus cut Skyworks Solutions from a "buy" rating to a "hold" rating and lowered their price target for the stock from $105.00 to $62.00 in a report on Thursday, February 6th. Piper Sandler lowered their target price on Skyworks Solutions from $85.00 to $70.00 and set a "neutral" rating on the stock in a report on Thursday, February 6th. Rosenblatt Securities reaffirmed a "neutral" rating and set a $80.00 price target (down previously from $120.00) on shares of Skyworks Solutions in a research note on Thursday, February 6th. Finally, Needham & Company LLC reiterated a "hold" rating on shares of Skyworks Solutions in a research report on Thursday, February 6th.

Get Our Latest Report on SWKS

Skyworks Solutions Stock Performance

SWKS traded up $0.49 during trading on Monday, reaching $71.07. The company's stock had a trading volume of 916,656 shares, compared to its average volume of 3,435,372. The company has a market capitalization of $11.42 billion, a price-to-earnings ratio of 21.81, a price-to-earnings-growth ratio of 1.79 and a beta of 1.18. The company's fifty day moving average price is $77.51 and its 200-day moving average price is $87.54. Skyworks Solutions has a 52-week low of $62.01 and a 52-week high of $120.86. The company has a debt-to-equity ratio of 0.16, a quick ratio of 4.73 and a current ratio of 5.94.

Skyworks Solutions (NASDAQ:SWKS - Get Free Report) last announced its quarterly earnings data on Wednesday, February 5th. The semiconductor manufacturer reported $1.31 earnings per share for the quarter, missing analysts' consensus estimates of $1.57 by ($0.26). Skyworks Solutions had a return on equity of 12.60% and a net margin of 13.02%. On average, equities analysts forecast that Skyworks Solutions will post 3.7 earnings per share for the current fiscal year.

Skyworks Solutions Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Monday, March 17th. Investors of record on Monday, February 24th were given a $0.70 dividend. The ex-dividend date of this dividend was Monday, February 24th. This represents a $2.80 annualized dividend and a dividend yield of 3.94%. Skyworks Solutions's dividend payout ratio is presently 85.89%.

Insider Buying and Selling

In other news, CEO Philip G. Brace purchased 10,000 shares of the company's stock in a transaction on Tuesday, February 25th. The stock was bought at an average cost of $66.13 per share, for a total transaction of $661,300.00. Following the completion of the purchase, the chief executive officer now directly owns 10,000 shares of the company's stock, valued at $661,300. The trade was a ∞ increase in their position. The purchase was disclosed in a document filed with the SEC, which is available at this hyperlink. 0.34% of the stock is currently owned by company insiders.

Institutional Trading of Skyworks Solutions

A number of institutional investors and hedge funds have recently bought and sold shares of the business. Lansforsakringar Fondforvaltning AB publ purchased a new stake in Skyworks Solutions during the fourth quarter worth approximately $250,000. Mattson Financial Services LLC acquired a new position in shares of Skyworks Solutions during the 4th quarter valued at $37,000. Siemens Fonds Invest GmbH boosted its position in Skyworks Solutions by 479.5% during the 4th quarter. Siemens Fonds Invest GmbH now owns 22,130 shares of the semiconductor manufacturer's stock worth $1,962,000 after purchasing an additional 18,311 shares during the period. Universal Beteiligungs und Servicegesellschaft mbH acquired a new stake in Skyworks Solutions in the 4th quarter valued at $19,890,000. Finally, Azzad Asset Management Inc. ADV raised its position in Skyworks Solutions by 4.7% in the fourth quarter. Azzad Asset Management Inc. ADV now owns 37,964 shares of the semiconductor manufacturer's stock valued at $3,367,000 after purchasing an additional 1,720 shares during the period. Institutional investors and hedge funds own 85.43% of the company's stock.

About Skyworks Solutions

(

Get Free ReportSkyworks Solutions, Inc, together with its subsidiaries, designs, develops, manufactures, and markets proprietary semiconductor products in the United States, China, South Korea, Taiwan, Europe, the Middle East, Africa, and the rest of Asia-Pacific. Its product portfolio includes amplifiers, antenna tuners, attenuators, automotive tuners and digital radios, DC/DC converters, demodulators, detectors, diodes, wireless analog system on chip products, directional couplers, diversity receive modules, filters, front-end modules, hybrids, light emitting diode drivers, low noise amplifiers, mixers, modulators, optocouplers/optoisolators, phase locked loops, phase shifters, power dividers/combiners, power over ethernet, power isolators, receivers, switches, synthesizers, timing devices, voltage controlled oscillators/synthesizers, and voltage regulators.

Featured Stories

Before you consider Skyworks Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Skyworks Solutions wasn't on the list.

While Skyworks Solutions currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report