Wellington Management Group LLP raised its stake in SL Green Realty Corp. (NYSE:SLG - Free Report) by 50.5% in the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 2,913,049 shares of the real estate investment trust's stock after buying an additional 977,321 shares during the quarter. Wellington Management Group LLP owned approximately 4.42% of SL Green Realty worth $202,777,000 at the end of the most recent quarter.

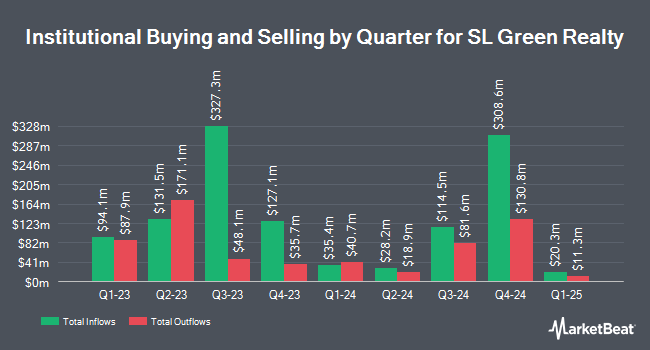

Several other large investors also recently added to or reduced their stakes in the stock. Sequoia Financial Advisors LLC grew its holdings in shares of SL Green Realty by 4.4% during the 2nd quarter. Sequoia Financial Advisors LLC now owns 14,352 shares of the real estate investment trust's stock worth $813,000 after purchasing an additional 606 shares during the period. Nisa Investment Advisors LLC grew its holdings in shares of SL Green Realty by 2.4% during the 2nd quarter. Nisa Investment Advisors LLC now owns 121,022 shares of the real estate investment trust's stock worth $6,885,000 after purchasing an additional 2,797 shares during the period. Louisiana State Employees Retirement System grew its holdings in shares of SL Green Realty by 1.6% during the 2nd quarter. Louisiana State Employees Retirement System now owns 32,600 shares of the real estate investment trust's stock worth $1,846,000 after purchasing an additional 500 shares during the period. Bank of New York Mellon Corp lifted its stake in SL Green Realty by 1.8% during the 2nd quarter. Bank of New York Mellon Corp now owns 810,490 shares of the real estate investment trust's stock worth $45,906,000 after acquiring an additional 14,167 shares in the last quarter. Finally, Allspring Global Investments Holdings LLC acquired a new position in SL Green Realty during the 2nd quarter worth about $29,000. 89.96% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Several equities analysts recently issued reports on SLG shares. BMO Capital Markets reissued an "outperform" rating and set a $87.00 target price (up previously from $72.00) on shares of SL Green Realty in a research note on Monday, October 21st. Piper Sandler reaffirmed an "overweight" rating and issued a $90.00 price target (up previously from $75.00) on shares of SL Green Realty in a research report on Monday, October 21st. Barclays raised their target price on SL Green Realty from $66.00 to $78.00 and gave the stock an "equal weight" rating in a research report on Tuesday, October 22nd. Compass Point set a $65.00 target price on SL Green Realty and gave the stock a "neutral" rating in a research report on Friday, October 18th. Finally, Citigroup raised SL Green Realty from a "sell" rating to a "neutral" rating and raised their target price for the stock from $44.00 to $66.00 in a research report on Friday, September 13th. Three analysts have rated the stock with a sell rating, eleven have assigned a hold rating and two have given a buy rating to the company's stock. Based on data from MarketBeat, the company has an average rating of "Hold" and a consensus target price of $66.00.

Get Our Latest Research Report on SLG

SL Green Realty Stock Performance

Shares of SLG stock traded up $1.28 during midday trading on Monday, hitting $76.44. The company had a trading volume of 1,315,775 shares, compared to its average volume of 981,946. The company's 50 day simple moving average is $75.18 and its 200 day simple moving average is $66.21. SL Green Realty Corp. has a 52-week low of $40.30 and a 52-week high of $82.81. The stock has a market cap of $5.04 billion, a price-to-earnings ratio of -30.58, a PEG ratio of 3.68 and a beta of 1.81. The company has a debt-to-equity ratio of 1.06, a current ratio of 2.58 and a quick ratio of 2.58.

SL Green Realty (NYSE:SLG - Get Free Report) last posted its quarterly earnings results on Wednesday, October 16th. The real estate investment trust reported ($0.21) earnings per share for the quarter, missing analysts' consensus estimates of $1.21 by ($1.42). SL Green Realty had a negative net margin of 16.78% and a negative return on equity of 3.76%. The business had revenue of $229.69 million during the quarter, compared to analysts' expectations of $136.66 million. During the same quarter last year, the firm earned $1.27 earnings per share. Research analysts anticipate that SL Green Realty Corp. will post 7.59 earnings per share for the current fiscal year.

SL Green Realty Increases Dividend

The firm also recently declared a monthly dividend, which will be paid on Wednesday, January 15th. Investors of record on Tuesday, December 31st will be paid a $0.2575 dividend. The ex-dividend date is Tuesday, December 31st. This is an increase from SL Green Realty's previous monthly dividend of $0.25. This represents a $3.09 dividend on an annualized basis and a dividend yield of 4.04%. SL Green Realty's payout ratio is -120.00%.

SL Green Realty Company Profile

(

Free Report)

3SL Green Realty Corp., Manhattan’s largest office landlord, is a fully integrated real estate investment trust, or REIT, that is focused primarily on acquiring, managing and maximizing value of Manhattan commercial properties. As of June 30, 2022, SL Green held interests in 64 buildings totaling 34.4 million square feet.

Further Reading

Before you consider SL Green Realty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SL Green Realty wasn't on the list.

While SL Green Realty currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.