Slotnik Capital LLC purchased a new position in Inhibrx, Inc. (NASDAQ:INBX - Free Report) during the fourth quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor purchased 388,000 shares of the company's stock, valued at approximately $5,975,000. Inhibrx accounts for about 2.7% of Slotnik Capital LLC's portfolio, making the stock its 12th largest holding. Slotnik Capital LLC owned approximately 2.68% of Inhibrx as of its most recent SEC filing.

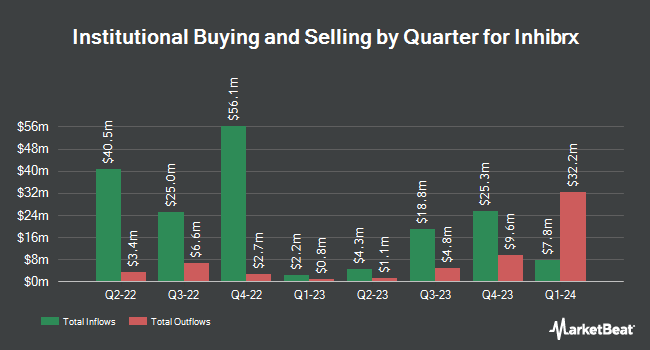

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in the business. PNC Financial Services Group Inc. purchased a new stake in shares of Inhibrx during the 4th quarter valued at $28,000. China Universal Asset Management Co. Ltd. acquired a new position in shares of Inhibrx during the fourth quarter worth $47,000. New York State Common Retirement Fund acquired a new position in Inhibrx in the 4th quarter worth $53,000. Corebridge Financial Inc. acquired a new stake in shares of Inhibrx during the fourth quarter valued at about $89,000. Finally, JPMorgan Chase & Co. lifted its stake in shares of Inhibrx by 47.8% in the fourth quarter. JPMorgan Chase & Co. now owns 7,592 shares of the company's stock worth $117,000 after acquiring an additional 2,457 shares in the last quarter. Institutional investors and hedge funds own 82.46% of the company's stock.

Inhibrx Price Performance

Shares of NASDAQ INBX traded up $0.47 during midday trading on Tuesday, reaching $12.47. 65,802 shares of the company traded hands, compared to its average volume of 214,925. The stock has a 50-day moving average price of $13.38 and a 200 day moving average price of $14.46. Inhibrx, Inc. has a 52 week low of $10.80 and a 52 week high of $35.42.

Inhibrx (NASDAQ:INBX - Get Free Report) last posted its quarterly earnings results on Monday, March 17th. The company reported ($3.09) earnings per share for the quarter, missing the consensus estimate of ($2.88) by ($0.21). The company had revenue of $0.10 million during the quarter. Equities analysts expect that Inhibrx, Inc. will post 104.88 EPS for the current year.

Wall Street Analyst Weigh In

Separately, JMP Securities reaffirmed a "market perform" rating on shares of Inhibrx in a report on Wednesday, January 22nd.

View Our Latest Research Report on INBX

Inhibrx Profile

(

Free Report)

Inhibrx, Inc, a clinical-stage biopharmaceutical company, develops a pipeline of novel biologic therapeutic candidates. The company's therapeutic candidate includes INBRX-101, an alpha-1 antitrypsin (AAT)-Fc fusion protein therapeutic candidate, which is in Phase 1 clinical trials for use in the treatment of patients with AAT deficiency.

See Also

Before you consider Inhibrx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Inhibrx wasn't on the list.

While Inhibrx currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.