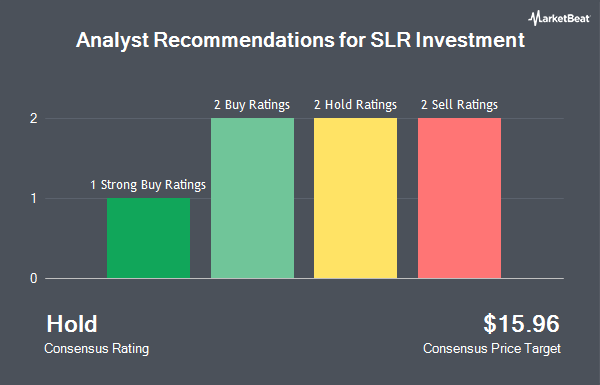

Shares of SLR Investment Corp. (NASDAQ:SLRC - Get Free Report) have been given an average rating of "Reduce" by the five ratings firms that are currently covering the firm, Marketbeat.com reports. Two equities research analysts have rated the stock with a sell recommendation and three have issued a hold recommendation on the company. The average 1 year price target among brokers that have issued a report on the stock in the last year is $15.85.

A number of analysts have issued reports on SLRC shares. Compass Point boosted their target price on SLR Investment from $16.50 to $17.25 and gave the company a "neutral" rating in a research report on Tuesday, March 11th. Keefe, Bruyette & Woods boosted their price objective on SLR Investment from $16.00 to $17.00 and gave the company a "market perform" rating in a report on Tuesday, March 4th.

View Our Latest Research Report on SLR Investment

SLR Investment Trading Down 3.4 %

Shares of SLR Investment stock traded down $0.52 during mid-day trading on Friday, hitting $14.59. The stock had a trading volume of 65,712 shares, compared to its average volume of 162,498. The firm has a 50-day moving average of $16.92 and a two-hundred day moving average of $16.33. The firm has a market cap of $796.08 million, a P/E ratio of 8.25 and a beta of 0.90. The company has a quick ratio of 1.06, a current ratio of 1.06 and a debt-to-equity ratio of 1.11. SLR Investment has a 12-month low of $13.64 and a 12-month high of $17.94.

SLR Investment (NASDAQ:SLRC - Get Free Report) last posted its earnings results on Tuesday, February 25th. The financial services provider reported $0.44 EPS for the quarter, beating analysts' consensus estimates of $0.43 by $0.01. The company had revenue of $55.58 million for the quarter, compared to the consensus estimate of $57.08 million. SLR Investment had a return on equity of 9.73% and a net margin of 40.89%. Sell-side analysts forecast that SLR Investment will post 1.76 earnings per share for the current year.

SLR Investment Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Friday, March 28th. Stockholders of record on Friday, March 14th were paid a dividend of $0.41 per share. The ex-dividend date was Friday, March 14th. This represents a $1.64 dividend on an annualized basis and a dividend yield of 11.24%. SLR Investment's dividend payout ratio (DPR) is presently 93.71%.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently added to or reduced their stakes in SLRC. Tower Research Capital LLC TRC grew its holdings in SLR Investment by 1,642.6% during the 4th quarter. Tower Research Capital LLC TRC now owns 3,398 shares of the financial services provider's stock valued at $55,000 after buying an additional 3,203 shares during the last quarter. BNP Paribas Financial Markets purchased a new position in SLR Investment in the 4th quarter valued at about $58,000. Quantbot Technologies LP acquired a new stake in shares of SLR Investment during the 3rd quarter worth about $90,000. Westend Capital Management LLC raised its position in shares of SLR Investment by 71.3% in the fourth quarter. Westend Capital Management LLC now owns 7,406 shares of the financial services provider's stock valued at $120,000 after buying an additional 3,082 shares during the last quarter. Finally, XTX Topco Ltd purchased a new position in shares of SLR Investment during the fourth quarter valued at approximately $191,000. 35.32% of the stock is currently owned by institutional investors and hedge funds.

About SLR Investment

(

Get Free ReportSLR Investment Corp. is a business development company specializing in secured debt (first lien unitranche and second lien), subordinated (unsecured) debt, minority equity, leveraged buyouts, acquisitions, recapitalizations, general refinancing, growth capital and strategic income-oriented control equity investments in leveraged middle market companies.

Further Reading

Before you consider SLR Investment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SLR Investment wasn't on the list.

While SLR Investment currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.