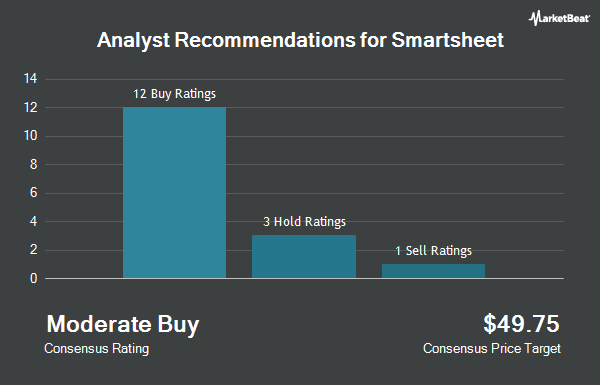

Shares of Smartsheet Inc (NYSE:SMAR - Get Free Report) have earned an average recommendation of "Hold" from the twenty ratings firms that are currently covering the firm, Marketbeat reports. One equities research analyst has rated the stock with a sell recommendation, seventeen have issued a hold recommendation and two have given a buy recommendation to the company. The average 1-year price target among brokers that have issued a report on the stock in the last year is $55.82.

A number of analysts have recently commented on the company. Guggenheim lowered Smartsheet from a "buy" rating to a "neutral" rating in a report on Monday, November 11th. Royal Bank of Canada restated a "sector perform" rating and issued a $56.50 target price on shares of Smartsheet in a research note on Thursday, October 24th. Wolfe Research reaffirmed a "peer perform" rating on shares of Smartsheet in a research report on Wednesday, September 25th. Citigroup reiterated a "neutral" rating and issued a $56.50 price objective (down from $63.00) on shares of Smartsheet in a report on Friday, September 27th. Finally, Morgan Stanley increased their target price on shares of Smartsheet from $55.00 to $57.00 and gave the stock an "overweight" rating in a report on Friday, September 6th.

Read Our Latest Report on Smartsheet

Smartsheet Trading Up 0.1 %

Shares of SMAR opened at $55.93 on Thursday. The stock has a 50 day simple moving average of $55.08 and a 200 day simple moving average of $48.22. Smartsheet has a 52-week low of $35.52 and a 52-week high of $56.55.

Smartsheet (NYSE:SMAR - Get Free Report) last issued its quarterly earnings data on Thursday, September 5th. The company reported $0.44 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.29 by $0.15. The company had revenue of $276.41 million during the quarter, compared to the consensus estimate of $274.23 million. Smartsheet had a negative net margin of 4.07% and a negative return on equity of 4.29%. The firm's revenue was up 17.3% compared to the same quarter last year. During the same quarter in the prior year, the firm earned ($0.23) earnings per share. As a group, equities research analysts anticipate that Smartsheet will post -0.05 earnings per share for the current fiscal year.

Smartsheet declared that its board has approved a stock buyback plan on Thursday, September 5th that authorizes the company to repurchase $150.00 million in outstanding shares. This repurchase authorization authorizes the company to purchase up to 2.1% of its stock through open market purchases. Stock repurchase plans are typically an indication that the company's board of directors believes its shares are undervalued.

Insiders Place Their Bets

In other Smartsheet news, insider Jolene Lau Marshall sold 3,571 shares of Smartsheet stock in a transaction dated Friday, September 13th. The shares were sold at an average price of $50.59, for a total value of $180,656.89. Following the completion of the sale, the insider now owns 13,529 shares in the company, valued at $684,432.11. The trade was a 20.88 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, COO Stephen Robert Branstetter sold 1,847 shares of the stock in a transaction that occurred on Monday, September 16th. The stock was sold at an average price of $53.00, for a total transaction of $97,891.00. Following the transaction, the chief operating officer now owns 64,215 shares in the company, valued at approximately $3,403,395. The trade was a 2.80 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 42,194 shares of company stock worth $2,248,098 over the last three months. Insiders own 4.52% of the company's stock.

Institutional Investors Weigh In On Smartsheet

A number of hedge funds and other institutional investors have recently made changes to their positions in SMAR. Swedbank AB acquired a new position in Smartsheet in the 1st quarter valued at $38,388,000. AQR Capital Management LLC increased its position in shares of Smartsheet by 188.0% in the second quarter. AQR Capital Management LLC now owns 1,349,639 shares of the company's stock worth $58,844,000 after purchasing an additional 881,004 shares during the period. Citigroup Inc. increased its position in shares of Smartsheet by 2,767.1% in the third quarter. Citigroup Inc. now owns 823,501 shares of the company's stock worth $45,589,000 after purchasing an additional 794,779 shares during the period. Polar Asset Management Partners Inc. acquired a new position in Smartsheet in the third quarter valued at about $39,029,000. Finally, Engaged Capital LLC bought a new stake in Smartsheet during the second quarter worth about $29,600,000. 90.01% of the stock is currently owned by institutional investors and hedge funds.

Smartsheet Company Profile

(

Get Free ReportSmartsheet, Inc engages in managing and automating collaborative work. Its platform provides solutions that eliminate the obstacles to capturing information, including a familiar and intuitive spreadsheet interface as well as easily customizable forms. The company was founded by W. Eric Browne, Maria Colacurcio, John D.

Further Reading

Before you consider Smartsheet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Smartsheet wasn't on the list.

While Smartsheet currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.