Smead Capital Management Inc. boosted its position in Ovintiv Inc. (NYSE:OVV - Free Report) by 3.5% during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 6,303,203 shares of the company's stock after acquiring an additional 212,535 shares during the period. Ovintiv accounts for 3.4% of Smead Capital Management Inc.'s investment portfolio, making the stock its 14th biggest position. Smead Capital Management Inc. owned approximately 2.39% of Ovintiv worth $241,476,000 at the end of the most recent reporting period.

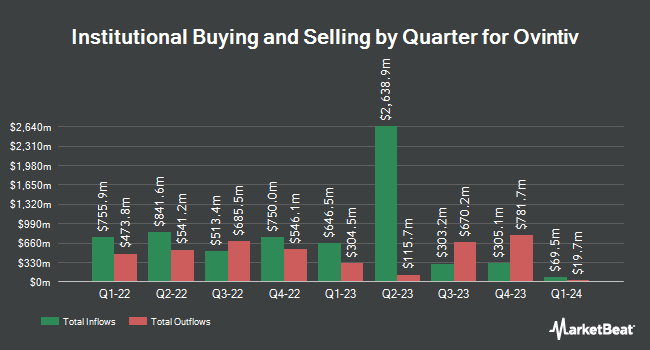

A number of other large investors have also added to or reduced their stakes in OVV. Envestnet Portfolio Solutions Inc. bought a new stake in Ovintiv in the 1st quarter worth $214,000. US Bancorp DE grew its holdings in Ovintiv by 4.5% in the 1st quarter. US Bancorp DE now owns 8,914 shares of the company's stock worth $463,000 after acquiring an additional 386 shares during the last quarter. Avantax Advisory Services Inc. bought a new stake in Ovintiv in the 1st quarter worth $233,000. Vanguard Group Inc. grew its holdings in Ovintiv by 3.8% in the 1st quarter. Vanguard Group Inc. now owns 28,055,344 shares of the company's stock worth $1,456,072,000 after acquiring an additional 1,024,931 shares during the last quarter. Finally, Acadian Asset Management LLC grew its holdings in Ovintiv by 1,228.3% in the 1st quarter. Acadian Asset Management LLC now owns 8,063 shares of the company's stock worth $418,000 after acquiring an additional 7,456 shares during the last quarter. Institutional investors own 83.81% of the company's stock.

Ovintiv Stock Performance

Shares of OVV traded down $0.34 during mid-day trading on Tuesday, hitting $44.62. 2,895,023 shares of the company traded hands, compared to its average volume of 3,086,275. The company has a debt-to-equity ratio of 0.46, a quick ratio of 0.52 and a current ratio of 0.52. The stock has a 50-day moving average price of $40.92 and a two-hundred day moving average price of $44.31. Ovintiv Inc. has a 1 year low of $36.90 and a 1 year high of $55.95. The stock has a market cap of $11.62 billion, a price-to-earnings ratio of 5.92 and a beta of 2.62.

Ovintiv Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 31st. Stockholders of record on Friday, December 13th will be issued a dividend of $0.30 per share. The ex-dividend date of this dividend is Friday, December 13th. This represents a $1.20 annualized dividend and a dividend yield of 2.69%. Ovintiv's payout ratio is 15.92%.

Wall Street Analysts Forecast Growth

Several equities research analysts have recently commented on OVV shares. JPMorgan Chase & Co. dropped their target price on shares of Ovintiv from $60.00 to $51.00 and set an "overweight" rating for the company in a research report on Thursday, September 12th. Royal Bank of Canada dropped their target price on shares of Ovintiv from $62.00 to $61.00 and set a "sector perform" rating for the company in a research report on Thursday, August 1st. Siebert Williams Shank raised shares of Ovintiv to a "strong-buy" rating in a research report on Tuesday, October 15th. Scotiabank raised their target price on shares of Ovintiv from $50.00 to $53.00 and gave the stock a "sector outperform" rating in a research report on Monday. Finally, Evercore ISI dropped their target price on shares of Ovintiv from $60.00 to $54.00 and set an "outperform" rating for the company in a research report on Monday, September 30th. Five research analysts have rated the stock with a hold rating, twelve have assigned a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, Ovintiv currently has a consensus rating of "Moderate Buy" and an average target price of $56.71.

Get Our Latest Stock Analysis on OVV

About Ovintiv

(

Free Report)

Ovintiv Inc, together with its subsidiaries, explores, develops, produces, and markets natural gas, oil, and natural gas liquids in the United States and Canada. The company operates through USA Operations, Canadian Operations, and Market Optimization segments. Its principal assets include Permian in west Texas and Anadarko in west-central Oklahoma; and Montney in northeast British Columbia and northwest Alberta.

See Also

Before you consider Ovintiv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ovintiv wasn't on the list.

While Ovintiv currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.