Townsquare Capital LLC lowered its position in Snowflake Inc. (NYSE:SNOW - Free Report) by 58.3% during the fourth quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 114,726 shares of the company's stock after selling 160,444 shares during the period. Townsquare Capital LLC's holdings in Snowflake were worth $17,715,000 as of its most recent SEC filing.

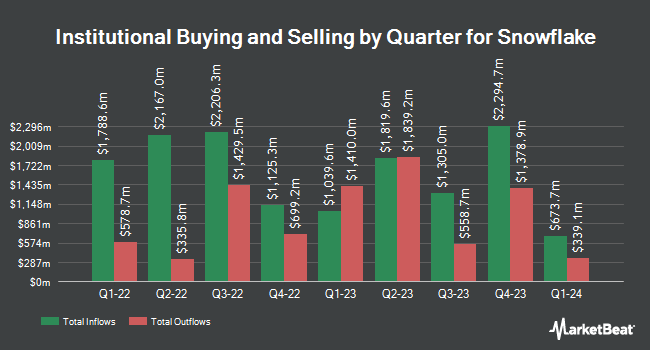

Other large investors have also recently modified their holdings of the company. Norges Bank acquired a new position in shares of Snowflake during the fourth quarter valued at about $988,950,000. GQG Partners LLC purchased a new position in shares of Snowflake in the fourth quarter worth $750,572,000. Jennison Associates LLC lifted its stake in shares of Snowflake by 92.2% during the fourth quarter. Jennison Associates LLC now owns 7,637,006 shares of the company's stock worth $1,179,230,000 after buying an additional 3,662,671 shares during the period. FMR LLC lifted its stake in shares of Snowflake by 84.9% during the fourth quarter. FMR LLC now owns 6,108,123 shares of the company's stock worth $943,155,000 after buying an additional 2,805,425 shares during the period. Finally, Groupama Asset Managment grew its holdings in shares of Snowflake by 930,132.6% during the fourth quarter. Groupama Asset Managment now owns 2,000,000 shares of the company's stock valued at $308,820,000 after buying an additional 1,999,785 shares during the last quarter. Institutional investors own 65.10% of the company's stock.

Insider Buying and Selling at Snowflake

In other news, CRO Christopher William Degnan sold 12,782 shares of Snowflake stock in a transaction that occurred on Monday, February 3rd. The shares were sold at an average price of $181.87, for a total transaction of $2,324,662.34. Following the sale, the executive now owns 308,164 shares of the company's stock, valued at approximately $56,045,786.68. The trade was a 3.98 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, Director Frank Slootman sold 127,247 shares of the stock in a transaction that occurred on Wednesday, January 22nd. The stock was sold at an average price of $176.25, for a total value of $22,427,283.75. Following the completion of the transaction, the director now owns 195,281 shares of the company's stock, valued at $34,418,276.25. The trade was a 39.45 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 491,589 shares of company stock worth $82,405,796 in the last three months. 7.80% of the stock is owned by corporate insiders.

Analysts Set New Price Targets

SNOW has been the subject of a number of research reports. Bank of America lifted their price target on Snowflake from $185.00 to $205.00 and gave the stock a "neutral" rating in a research report on Thursday, February 20th. Stifel Nicolaus upped their target price on Snowflake from $187.00 to $210.00 and gave the company a "buy" rating in a research report on Thursday, February 27th. Guggenheim reiterated a "neutral" rating on shares of Snowflake in a report on Thursday, February 27th. Rosenblatt Securities lifted their price objective on shares of Snowflake from $186.00 to $205.00 and gave the company a "buy" rating in a research note on Tuesday, February 25th. Finally, Needham & Company LLC increased their price objective on shares of Snowflake from $200.00 to $215.00 and gave the stock a "buy" rating in a research note on Thursday, February 27th. Ten analysts have rated the stock with a hold rating, thirty have issued a buy rating and two have assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, Snowflake currently has an average rating of "Moderate Buy" and a consensus target price of $202.51.

View Our Latest Analysis on SNOW

Snowflake Price Performance

Shares of SNOW stock traded up $2.04 during trading hours on Tuesday, reaching $146.59. The company had a trading volume of 2,381,015 shares, compared to its average volume of 6,422,453. Snowflake Inc. has a 12-month low of $107.13 and a 12-month high of $194.40. The company has a market capitalization of $48.39 billion, a price-to-earnings ratio of -43.24 and a beta of 1.13. The company has a debt-to-equity ratio of 0.77, a quick ratio of 1.88 and a current ratio of 1.88. The stock has a fifty day moving average of $161.48 and a 200-day moving average of $153.98.

Snowflake Profile

(

Free Report)

Snowflake Inc provides a cloud-based data platform for various organizations in the United States and internationally. Its platform offers Data Cloud, which enables customers to consolidate data into a single source of truth to drive meaningful business insights, build data-driven applications, and share data and data products, as well as applies artificial intelligence (AI) for solving business problems.

Further Reading

Before you consider Snowflake, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Snowflake wasn't on the list.

While Snowflake currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.