Robeco Institutional Asset Management B.V. reduced its holdings in Sociedad Química y Minera de Chile S.A. (NYSE:SQM - Free Report) by 23.2% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 122,617 shares of the basic materials company's stock after selling 37,000 shares during the quarter. Robeco Institutional Asset Management B.V.'s holdings in Sociedad Química y Minera de Chile were worth $5,111,000 at the end of the most recent quarter.

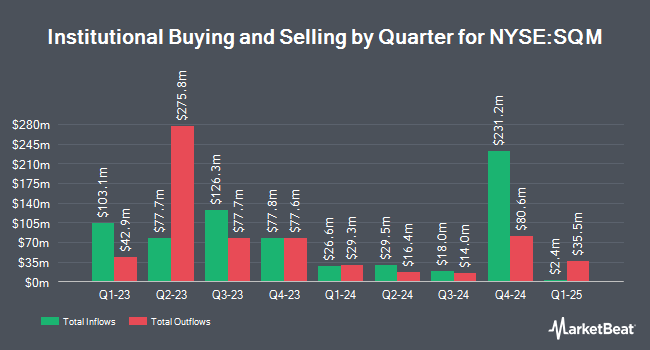

A number of other institutional investors have also recently modified their holdings of SQM. Zurcher Kantonalbank Zurich Cantonalbank boosted its position in shares of Sociedad Química y Minera de Chile by 0.3% during the 2nd quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 95,111 shares of the basic materials company's stock worth $3,876,000 after purchasing an additional 275 shares in the last quarter. MFA Wealth Advisors LLC boosted its holdings in Sociedad Química y Minera de Chile by 4.7% during the third quarter. MFA Wealth Advisors LLC now owns 7,006 shares of the basic materials company's stock worth $292,000 after buying an additional 313 shares in the last quarter. Wealth Enhancement Advisory Services LLC grew its position in Sociedad Química y Minera de Chile by 3.2% during the second quarter. Wealth Enhancement Advisory Services LLC now owns 13,037 shares of the basic materials company's stock worth $531,000 after buying an additional 401 shares during the period. Signaturefd LLC increased its holdings in Sociedad Química y Minera de Chile by 21.3% in the third quarter. Signaturefd LLC now owns 2,500 shares of the basic materials company's stock valued at $104,000 after buying an additional 439 shares in the last quarter. Finally, Bank of New York Mellon Corp lifted its position in shares of Sociedad Química y Minera de Chile by 9.2% during the 2nd quarter. Bank of New York Mellon Corp now owns 5,482 shares of the basic materials company's stock valued at $223,000 after acquiring an additional 464 shares during the period. 12.41% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Several equities analysts recently weighed in on SQM shares. Deutsche Bank Aktiengesellschaft dropped their price objective on Sociedad Química y Minera de Chile from $45.00 to $36.00 and set a "hold" rating for the company in a research note on Thursday, July 18th. Berenberg Bank assumed coverage on shares of Sociedad Química y Minera de Chile in a research report on Wednesday, July 31st. They issued a "hold" rating and a $35.00 price objective on the stock. The Goldman Sachs Group upgraded shares of Sociedad Química y Minera de Chile from a "neutral" rating to a "buy" rating in a report on Friday, August 9th. Bank of America reduced their price target on shares of Sociedad Química y Minera de Chile from $47.00 to $38.00 and set an "underperform" rating on the stock in a report on Wednesday, August 21st. Finally, Jefferies Financial Group cut their price objective on Sociedad Química y Minera de Chile from $62.80 to $55.00 and set a "buy" rating for the company in a research report on Monday, August 26th. Two research analysts have rated the stock with a sell rating, three have assigned a hold rating and four have issued a buy rating to the stock. Based on data from MarketBeat, the company presently has a consensus rating of "Hold" and an average price target of $48.69.

View Our Latest Stock Analysis on SQM

Sociedad Química y Minera de Chile Trading Down 2.7 %

Shares of SQM stock traded down $1.01 during mid-day trading on Friday, hitting $36.67. 934,438 shares of the company's stock were exchanged, compared to its average volume of 1,167,848. The stock has a market cap of $10.47 billion, a price-to-earnings ratio of 333.27 and a beta of 1.03. The stock has a 50-day simple moving average of $39.25 and a two-hundred day simple moving average of $41.20. Sociedad Química y Minera de Chile S.A. has a fifty-two week low of $32.24 and a fifty-two week high of $64.62. The company has a quick ratio of 1.47, a current ratio of 2.19 and a debt-to-equity ratio of 0.59.

Sociedad Química y Minera de Chile (NYSE:SQM - Get Free Report) last posted its quarterly earnings data on Wednesday, August 21st. The basic materials company reported $0.75 EPS for the quarter, missing analysts' consensus estimates of $0.99 by ($0.24). Sociedad Química y Minera de Chile had a net margin of 0.48% and a return on equity of 23.15%. The company had revenue of $1.29 billion for the quarter, compared to analyst estimates of $1.27 billion. During the same period in the prior year, the company earned $2.03 EPS. Equities analysts expect that Sociedad Química y Minera de Chile S.A. will post -0.92 EPS for the current fiscal year.

Sociedad Química y Minera de Chile Profile

(

Free Report)

Sociedad Química y Minera de Chile SA operates as a mining company worldwide. The company offers specialty plant nutrients, including sodium potassium nitrate, specialty blends, and other specialty fertilizers under Ultrasol, Qrop, Speedfol, Allganic, Ultrasoline, ProP, and Prohydric brands. It also provides iodine and its derivatives for use in medical, agricultural, industrial, and human and animal nutrition products comprising x-ray contrast media, biocides, antiseptics and disinfectants, pharmaceutical intermediates, polarizing films for LCD and LED screens, chemicals, organic compounds, and pigments, as well as added to edible salt to prevent iodine deficiency disorders.

Further Reading

Before you consider Sociedad Química y Minera de Chile, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sociedad Química y Minera de Chile wasn't on the list.

While Sociedad Química y Minera de Chile currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.