SolarEdge Technologies (NASDAQ:SEDG - Get Free Report) had its price target dropped by analysts at Wells Fargo & Company from $20.00 to $19.00 in a report issued on Thursday, March 27th,Benzinga reports. The brokerage presently has an "equal weight" rating on the semiconductor company's stock. Wells Fargo & Company's price objective suggests a potential upside of 23.62% from the stock's current price.

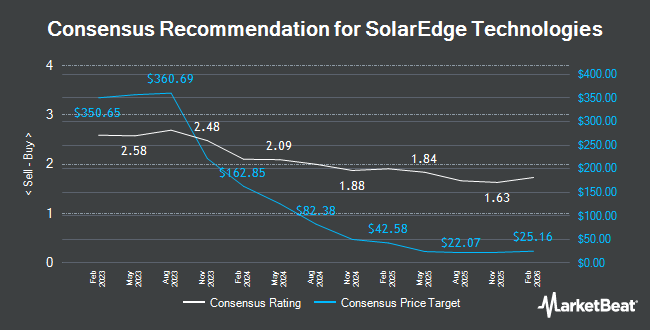

A number of other research analysts also recently issued reports on the company. BMO Capital Markets downgraded SolarEdge Technologies from a "market perform" rating to an "underperform" rating and boosted their price target for the company from $13.00 to $15.00 in a report on Thursday, February 20th. Truist Financial dropped their price target on shares of SolarEdge Technologies from $15.00 to $14.00 and set a "hold" rating on the stock in a research report on Thursday, January 16th. Citigroup reissued a "sell" rating and set a $9.00 target price (down from $12.00) on shares of SolarEdge Technologies in a research note on Wednesday, January 8th. JPMorgan Chase & Co. reduced their price target on SolarEdge Technologies from $21.00 to $19.00 and set an "overweight" rating for the company in a report on Thursday, January 23rd. Finally, Piper Sandler upped their target price on SolarEdge Technologies from $9.00 to $10.00 and gave the stock an "underweight" rating in a research note on Thursday, February 20th. Ten analysts have rated the stock with a sell rating, fifteen have assigned a hold rating, three have issued a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat.com, the company has a consensus rating of "Hold" and an average target price of $21.80.

View Our Latest Research Report on SolarEdge Technologies

SolarEdge Technologies Stock Performance

Shares of NASDAQ:SEDG traded down $1.46 during midday trading on Thursday, reaching $15.37. The company's stock had a trading volume of 1,250,061 shares, compared to its average volume of 4,087,348. SolarEdge Technologies has a twelve month low of $10.24 and a twelve month high of $73.60. The company has a quick ratio of 1.46, a current ratio of 1.95 and a debt-to-equity ratio of 0.56. The firm has a market capitalization of $903.49 million, a PE ratio of -0.49 and a beta of 1.63. The stock has a fifty day moving average of $15.82 and a 200 day moving average of $15.93.

Insider Buying and Selling at SolarEdge Technologies

In other SolarEdge Technologies news, Chairman More Avery bought 30,000 shares of SolarEdge Technologies stock in a transaction on Tuesday, March 4th. The shares were bought at an average price of $13.70 per share, for a total transaction of $411,000.00. Following the completion of the transaction, the chairman now directly owns 274,478 shares of the company's stock, valued at $3,760,348.60. This trade represents a 12.27 % increase in their ownership of the stock. The purchase was disclosed in a document filed with the SEC, which is available at this link. 0.67% of the stock is currently owned by company insiders.

Institutional Inflows and Outflows

Large investors have recently bought and sold shares of the stock. Millstone Evans Group LLC acquired a new stake in SolarEdge Technologies in the 4th quarter valued at approximately $27,000. Jones Financial Companies Lllp boosted its position in shares of SolarEdge Technologies by 401.2% during the fourth quarter. Jones Financial Companies Lllp now owns 2,441 shares of the semiconductor company's stock worth $33,000 after buying an additional 1,954 shares during the period. Y.D. More Investments Ltd boosted its position in shares of SolarEdge Technologies by 251.8% during the fourth quarter. Y.D. More Investments Ltd now owns 3,870 shares of the semiconductor company's stock worth $53,000 after buying an additional 2,770 shares during the period. R Squared Ltd acquired a new stake in shares of SolarEdge Technologies in the fourth quarter valued at $61,000. Finally, GAMMA Investing LLC raised its holdings in shares of SolarEdge Technologies by 655.2% in the 4th quarter. GAMMA Investing LLC now owns 5,264 shares of the semiconductor company's stock valued at $72,000 after buying an additional 4,567 shares during the period. Institutional investors and hedge funds own 95.10% of the company's stock.

SolarEdge Technologies Company Profile

(

Get Free Report)

SolarEdge Technologies, Inc, together with its subsidiaries, designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally. It operates in two segments, Solar and Energy Storage.

Featured Stories

Before you consider SolarEdge Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SolarEdge Technologies wasn't on the list.

While SolarEdge Technologies currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.