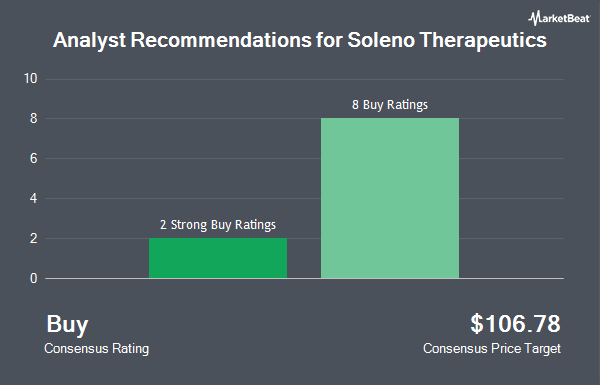

Shares of Soleno Therapeutics, Inc. (NASDAQ:SLNO - Get Free Report) have been given an average recommendation of "Buy" by the seven analysts that are covering the stock, Marketbeat.com reports. Six research analysts have rated the stock with a buy recommendation and one has issued a strong buy recommendation on the company. The average 12-month price target among brokers that have issued a report on the stock in the last year is $74.83.

Several research firms have weighed in on SLNO. Robert W. Baird reissued an "outperform" rating and issued a $72.00 price objective on shares of Soleno Therapeutics in a research report on Monday, December 2nd. Cantor Fitzgerald reissued an "overweight" rating and issued a $67.00 price target on shares of Soleno Therapeutics in a report on Friday, September 20th. HC Wainwright restated a "buy" rating and set a $70.00 price objective on shares of Soleno Therapeutics in a report on Monday, December 2nd. Stifel Nicolaus reaffirmed a "buy" rating and issued a $74.00 price objective on shares of Soleno Therapeutics in a research report on Monday, December 2nd. Finally, Oppenheimer increased their target price on shares of Soleno Therapeutics from $65.00 to $73.00 and gave the company an "outperform" rating in a research report on Monday, October 28th.

Read Our Latest Research Report on SLNO

Soleno Therapeutics Stock Performance

SLNO traded down $0.02 during mid-day trading on Friday, reaching $45.18. 1,282,833 shares of the stock were exchanged, compared to its average volume of 494,505. Soleno Therapeutics has a 1 year low of $35.70 and a 1 year high of $60.92. The stock has a market capitalization of $1.95 billion, a PE ratio of -13.61 and a beta of -1.47. The company has a 50 day moving average price of $52.93 and a two-hundred day moving average price of $49.08.

Soleno Therapeutics (NASDAQ:SLNO - Get Free Report) last posted its quarterly earnings data on Wednesday, November 6th. The company reported ($1.83) EPS for the quarter, missing the consensus estimate of ($0.61) by ($1.22). Sell-side analysts expect that Soleno Therapeutics will post -3.7 EPS for the current fiscal year.

Insider Buying and Selling

In other news, insider Kristen Yen sold 3,108 shares of the business's stock in a transaction on Tuesday, October 1st. The shares were sold at an average price of $49.43, for a total transaction of $153,628.44. Following the completion of the transaction, the insider now directly owns 81,465 shares in the company, valued at $4,026,814.95. The trade was a 3.67 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, CEO Bhatnagar Anish sold 21,633 shares of Soleno Therapeutics stock in a transaction on Tuesday, October 1st. The shares were sold at an average price of $49.43, for a total value of $1,069,319.19. Following the sale, the chief executive officer now directly owns 719,553 shares of the company's stock, valued at $35,567,504.79. This represents a 2.92 % decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 32,818 shares of company stock valued at $1,622,194. Company insiders own 12.30% of the company's stock.

Institutional Investors Weigh In On Soleno Therapeutics

A number of large investors have recently added to or reduced their stakes in SLNO. Bank of New York Mellon Corp purchased a new stake in Soleno Therapeutics during the second quarter valued at about $3,623,000. Allspring Global Investments Holdings LLC boosted its position in Soleno Therapeutics by 28.6% during the 2nd quarter. Allspring Global Investments Holdings LLC now owns 133,584 shares of the company's stock valued at $5,450,000 after buying an additional 29,745 shares during the period. Rhumbline Advisers bought a new stake in Soleno Therapeutics in the 2nd quarter worth $1,189,000. TD Asset Management Inc increased its position in shares of Soleno Therapeutics by 174.0% in the second quarter. TD Asset Management Inc now owns 57,534 shares of the company's stock valued at $2,347,000 after acquiring an additional 36,534 shares during the period. Finally, Victory Capital Management Inc. increased its position in shares of Soleno Therapeutics by 26.3% in the second quarter. Victory Capital Management Inc. now owns 10,727 shares of the company's stock valued at $438,000 after acquiring an additional 2,236 shares during the period. Hedge funds and other institutional investors own 97.42% of the company's stock.

About Soleno Therapeutics

(

Get Free ReportSoleno Therapeutics, Inc, a clinical-stage biopharmaceutical company, focuses on the development and commercialization of novel therapeutics for the treatment of rare diseases. Its lead candidate is Diazoxide Choline Extended-Release tablets, a once-daily oral tablet, which is in Phase III clinical trials for the treatment of Prader-Willi Syndrome.

Featured Stories

Before you consider Soleno Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Soleno Therapeutics wasn't on the list.

While Soleno Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.