JMP Securities started coverage on shares of Solid Biosciences (NASDAQ:SLDB - Free Report) in a research report released on Tuesday, Marketbeat reports. The firm issued an outperform rating and a $15.00 price target on the stock.

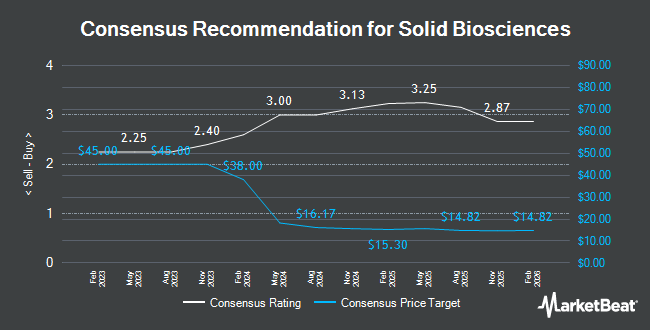

A number of other analysts have also recently commented on SLDB. HC Wainwright reaffirmed a "buy" rating and set a $16.00 target price on shares of Solid Biosciences in a report on Thursday, November 7th. Chardan Capital reaffirmed a "buy" rating and set a $15.00 target price on shares of Solid Biosciences in a report on Monday, November 11th. JPMorgan Chase & Co. reduced their target price on shares of Solid Biosciences from $15.00 to $12.00 and set an "overweight" rating for the company in a report on Tuesday, November 12th. Barclays reduced their price objective on shares of Solid Biosciences from $18.00 to $15.00 and set an "overweight" rating for the company in a research note on Wednesday, August 14th. Finally, William Blair raised shares of Solid Biosciences to a "strong-buy" rating in a research note on Friday, August 30th. Eight analysts have rated the stock with a buy rating and two have given a strong buy rating to the company. According to data from MarketBeat.com, Solid Biosciences presently has a consensus rating of "Buy" and an average target price of $15.13.

Check Out Our Latest Report on SLDB

Solid Biosciences Price Performance

Solid Biosciences stock traded down $0.06 during midday trading on Tuesday, reaching $5.05. 193,147 shares of the company traded hands, compared to its average volume of 341,002. The firm has a market capitalization of $201.80 million, a price-to-earnings ratio of -1.66 and a beta of 2.01. The business has a 50 day moving average of $5.83 and a two-hundred day moving average of $7.14. Solid Biosciences has a 12 month low of $3.80 and a 12 month high of $15.05.

Solid Biosciences (NASDAQ:SLDB - Get Free Report) last announced its earnings results on Wednesday, November 6th. The company reported ($0.79) EPS for the quarter, missing analysts' consensus estimates of ($0.67) by ($0.12). As a group, equities analysts forecast that Solid Biosciences will post -2.85 EPS for the current year.

Insider Buying and Selling

In related news, CEO Alexander Cumbo sold 11,114 shares of the business's stock in a transaction that occurred on Tuesday, December 3rd. The shares were sold at an average price of $5.60, for a total transaction of $62,238.40. Following the completion of the transaction, the chief executive officer now owns 38,484 shares in the company, valued at $215,510.40. The trade was a 22.41 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link. Also, COO David T. Howton sold 5,072 shares of the company's stock in a transaction on Tuesday, December 3rd. The shares were sold at an average price of $5.60, for a total transaction of $28,403.20. Following the completion of the sale, the chief operating officer now directly owns 15,663 shares in the company, valued at $87,712.80. This trade represents a 24.46 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 23,719 shares of company stock valued at $135,457. Company insiders own 13.63% of the company's stock.

Institutional Inflows and Outflows

Hedge funds have recently added to or reduced their stakes in the business. Vestal Point Capital LP grew its position in Solid Biosciences by 5.1% in the 3rd quarter. Vestal Point Capital LP now owns 2,800,000 shares of the company's stock valued at $19,516,000 after acquiring an additional 135,000 shares in the last quarter. Millennium Management LLC grew its stake in shares of Solid Biosciences by 135.7% in the second quarter. Millennium Management LLC now owns 1,728,065 shares of the company's stock worth $9,798,000 after acquiring an additional 994,984 shares in the last quarter. Vanguard Group Inc. increased its position in shares of Solid Biosciences by 283.9% during the first quarter. Vanguard Group Inc. now owns 1,244,575 shares of the company's stock worth $16,578,000 after acquiring an additional 920,404 shares during the period. Point72 Asset Management L.P. raised its stake in shares of Solid Biosciences by 292.8% in the third quarter. Point72 Asset Management L.P. now owns 443,010 shares of the company's stock valued at $3,088,000 after acquiring an additional 330,234 shares in the last quarter. Finally, State Street Corp grew its stake in Solid Biosciences by 9.2% during the 3rd quarter. State Street Corp now owns 441,540 shares of the company's stock worth $3,078,000 after purchasing an additional 37,130 shares in the last quarter. 81.46% of the stock is currently owned by hedge funds and other institutional investors.

About Solid Biosciences

(

Get Free Report)

Solid Biosciences Inc, a life science company, develops therapies for neuromuscular and cardiac diseases in the United States. The company's lead product candidate is SGT-003, a gene transfer candidate for the treatment of Duchenne muscular dystrophy; and SGT-501 to treat Catecholaminergic polymorphic ventricular tachycardia.

Featured Articles

Before you consider Solid Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Solid Biosciences wasn't on the list.

While Solid Biosciences currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.