Solid Biosciences (NASDAQ:SLDB - Get Free Report)'s stock had its "buy" rating reiterated by stock analysts at HC Wainwright in a research report issued to clients and investors on Thursday,Benzinga reports. They currently have a $16.00 price target on the stock. HC Wainwright's price target would suggest a potential upside of 174.44% from the stock's current price.

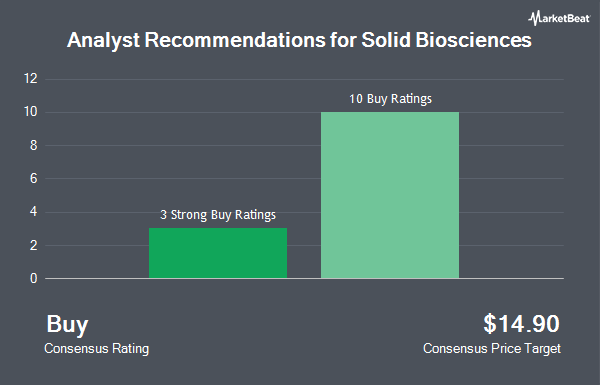

Several other equities analysts have also recently weighed in on SLDB. William Blair raised Solid Biosciences to a "strong-buy" rating in a research report on Friday, August 30th. Barclays cut their price target on Solid Biosciences from $18.00 to $15.00 and set an "overweight" rating on the stock in a research note on Wednesday, August 14th. Finally, JPMorgan Chase & Co. raised Solid Biosciences from a "neutral" rating to an "overweight" rating and increased their target price for the company from $10.00 to $15.00 in a research note on Monday, July 15th. Six investment analysts have rated the stock with a buy rating and two have assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has an average rating of "Buy" and an average price target of $15.67.

Get Our Latest Report on SLDB

Solid Biosciences Trading Down 5.0 %

SLDB traded down $0.31 during trading hours on Thursday, hitting $5.83. The company's stock had a trading volume of 158,875 shares, compared to its average volume of 344,111. The company has a 50-day simple moving average of $6.97 and a 200 day simple moving average of $7.80. The firm has a market capitalization of $225.04 million, a PE ratio of -1.86 and a beta of 1.92. Solid Biosciences has a fifty-two week low of $2.00 and a fifty-two week high of $15.05.

Solid Biosciences (NASDAQ:SLDB - Get Free Report) last released its earnings results on Tuesday, August 13th. The company reported ($0.61) EPS for the quarter, beating the consensus estimate of ($0.66) by $0.05. Research analysts expect that Solid Biosciences will post -2.61 earnings per share for the current fiscal year.

Hedge Funds Weigh In On Solid Biosciences

Several hedge funds and other institutional investors have recently bought and sold shares of SLDB. Point72 DIFC Ltd bought a new position in shares of Solid Biosciences in the second quarter worth approximately $58,000. Ground Swell Capital LLC bought a new position in Solid Biosciences during the second quarter valued at $76,000. Algert Global LLC purchased a new position in shares of Solid Biosciences in the 2nd quarter worth approximately $82,000. Susquehanna Fundamental Investments LLC bought a new stake in Solid Biosciences in the second quarter worth $92,000. Finally, Rhumbline Advisers bought a new position in Solid Biosciences during the second quarter valued at $191,000. Institutional investors own 81.46% of the company's stock.

Solid Biosciences Company Profile

(

Get Free Report)

Solid Biosciences Inc, a life science company, develops therapies for neuromuscular and cardiac diseases in the United States. The company's lead product candidate is SGT-003, a gene transfer candidate for the treatment of Duchenne muscular dystrophy; and SGT-501 to treat Catecholaminergic polymorphic ventricular tachycardia.

Recommended Stories

Before you consider Solid Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Solid Biosciences wasn't on the list.

While Solid Biosciences currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.