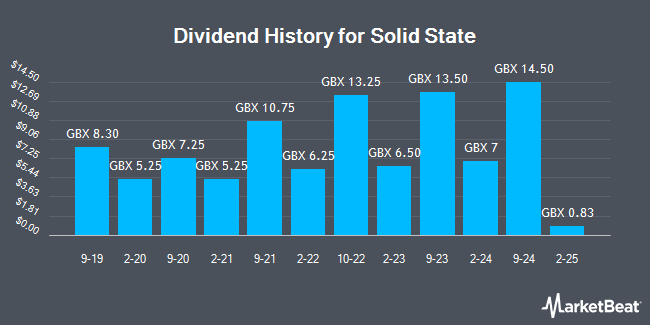

Solid State plc (LON:SOLI - Get Free Report) declared a dividend on Tuesday, December 10th,Upcoming Dividends.Co.Uk reports. Shareholders of record on Thursday, January 23rd will be paid a dividend of GBX 0.83 ($0.01) per share on Friday, February 14th. This represents a yield of 0.69%. The ex-dividend date of this dividend is Thursday, January 23rd. The official announcement can be viewed at this link.

Solid State Stock Performance

Shares of Solid State stock traded up GBX 9 ($0.11) on Tuesday, reaching GBX 129 ($1.64). 193,698 shares of the company were exchanged, compared to its average volume of 97,552. Solid State has a 1-year low of GBX 102.55 ($1.31) and a 1-year high of GBX 308 ($3.93). The firm has a market cap of £73.34 million, a price-to-earnings ratio of 860.17 and a beta of 1.05. The company has a debt-to-equity ratio of 25.82, a quick ratio of 0.98 and a current ratio of 1.92. The company's 50-day moving average is GBX 218.32 and its two-hundred day moving average is GBX 986.99.

Insider Buying and Selling at Solid State

In other news, insider Matthew Thomas Richards sold 17,450 shares of the stock in a transaction on Tuesday, October 29th. The stock was sold at an average price of GBX 215 ($2.74), for a total value of £37,517.50 ($47,823.45). Also, insider Peter Owen James sold 40,023 shares of the company's stock in a transaction dated Wednesday, October 23rd. The stock was sold at an average price of GBX 220 ($2.80), for a total transaction of £88,050.60 ($112,237.86). Over the last three months, insiders have sold 97,473 shares of company stock worth $22,156,810. 3.58% of the stock is owned by insiders.

Solid State Company Profile

(

Get Free Report)

Solid State plc, together with its subsidiaries, designs, manufactures, and supplies electronic equipment in the United Kingdom, rest of Europe, Asia, North America, and internationally. It also supplies electronic components and materials. The company operates through Components and Systems divisions.

See Also

Before you consider Solid State, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Solid State wasn't on the list.

While Solid State currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.