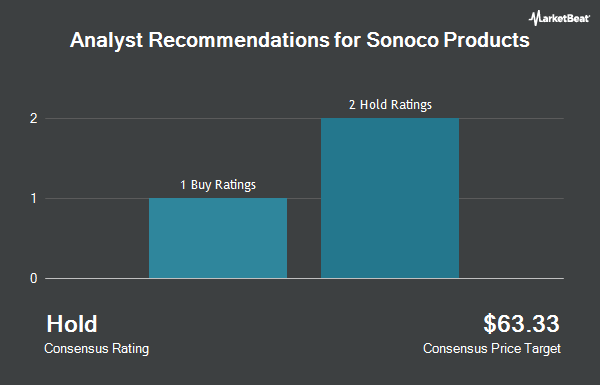

Sonoco Products (NYSE:SON - Get Free Report) has received a consensus rating of "Moderate Buy" from the six ratings firms that are covering the firm, MarketBeat Ratings reports. One analyst has rated the stock with a sell recommendation, one has assigned a hold recommendation and four have issued a buy recommendation on the company. The average 1-year price objective among brokers that have issued a report on the stock in the last year is $60.17.

SON has been the topic of a number of research analyst reports. Truist Financial boosted their price objective on shares of Sonoco Products from $63.00 to $68.00 and gave the company a "buy" rating in a report on Monday, January 6th. Citigroup lowered their price target on shares of Sonoco Products from $59.00 to $55.00 and set a "buy" rating on the stock in a report on Monday, January 6th. Bank of America upped their price target on shares of Sonoco Products from $66.00 to $71.00 and gave the company a "buy" rating in a report on Monday, January 6th. Robert W. Baird lowered their price target on shares of Sonoco Products from $58.00 to $55.00 and set a "neutral" rating on the stock in a report on Monday, November 4th. Finally, Wells Fargo & Company lowered their price target on shares of Sonoco Products from $52.00 to $50.00 and set an "underweight" rating on the stock in a report on Monday, January 6th.

Get Our Latest Analysis on SON

Insiders Place Their Bets

In related news, Director Robert R. Hill, Jr. sold 4,000 shares of the company's stock in a transaction dated Tuesday, January 7th. The shares were sold at an average price of $47.95, for a total transaction of $191,800.00. Following the completion of the transaction, the director now owns 16,065 shares in the company, valued at $770,316.75. This represents a 19.94 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Insiders own 0.51% of the company's stock.

Institutional Inflows and Outflows

Hedge funds have recently modified their holdings of the stock. Kennebec Savings Bank acquired a new position in shares of Sonoco Products during the 3rd quarter worth about $27,000. Capital Performance Advisors LLP acquired a new position in shares of Sonoco Products during the 3rd quarter worth about $33,000. Quarry LP raised its position in shares of Sonoco Products by 111.3% during the 4th quarter. Quarry LP now owns 970 shares of the industrial products company's stock worth $47,000 after purchasing an additional 511 shares during the last quarter. Principal Securities Inc. grew its stake in Sonoco Products by 35.0% during the 4th quarter. Principal Securities Inc. now owns 1,355 shares of the industrial products company's stock valued at $66,000 after acquiring an additional 351 shares in the last quarter. Finally, Wilmington Savings Fund Society FSB purchased a new stake in Sonoco Products during the 3rd quarter valued at about $71,000. Institutional investors and hedge funds own 77.69% of the company's stock.

Sonoco Products Stock Performance

Shares of SON traded down $0.41 during trading hours on Wednesday, reaching $47.79. 596,953 shares of the company traded hands, compared to its average volume of 684,358. The stock has a market capitalization of $4.70 billion, a P/E ratio of 16.42, a P/E/G ratio of 0.76 and a beta of 0.67. The company has a quick ratio of 1.91, a current ratio of 2.36 and a debt-to-equity ratio of 1.74. Sonoco Products has a 12-month low of $45.93 and a 12-month high of $61.73. The business has a fifty day moving average price of $48.61 and a 200-day moving average price of $51.19.

Sonoco Products Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Monday, March 10th. Shareholders of record on Wednesday, February 26th will be given a $0.52 dividend. The ex-dividend date is Wednesday, February 26th. This represents a $2.08 dividend on an annualized basis and a dividend yield of 4.35%. Sonoco Products's dividend payout ratio (DPR) is currently 71.48%.

About Sonoco Products

(

Get Free ReportSonoco Products Company, together with its subsidiaries, designs, develops, manufactures, and sells various engineered and sustainable packaging products in North and South America, Europe, Australia, and Asia. The company operates Consumer Packaging and Industrial Paper Packaging segments. The Consumer Packaging segment offers round and shaped rigid paper, steel, and plastic containers; metal and peelable membrane ends, closures, and components; thermoformed plastic trays and enclosures; and high-barrier flexible packaging products.

Further Reading

Before you consider Sonoco Products, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sonoco Products wasn't on the list.

While Sonoco Products currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.