Speece Thorson Capital Group Inc. increased its holdings in Sonoco Products (NYSE:SON - Free Report) by 18.6% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 305,971 shares of the industrial products company's stock after buying an additional 47,928 shares during the quarter. Sonoco Products comprises approximately 3.1% of Speece Thorson Capital Group Inc.'s investment portfolio, making the stock its 11th largest holding. Speece Thorson Capital Group Inc. owned 0.31% of Sonoco Products worth $16,715,000 at the end of the most recent quarter.

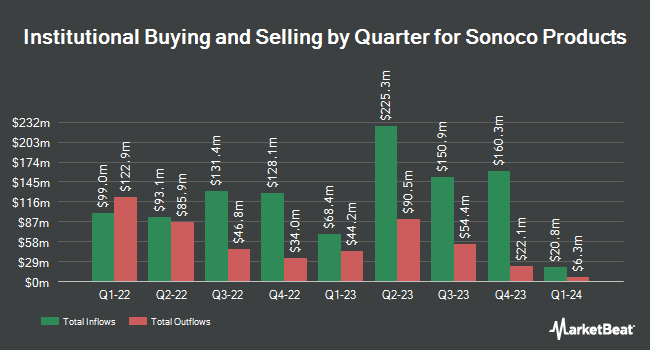

Several other hedge funds and other institutional investors also recently bought and sold shares of the business. Earnest Partners LLC grew its stake in shares of Sonoco Products by 2.5% during the 2nd quarter. Earnest Partners LLC now owns 2,645,744 shares of the industrial products company's stock worth $134,192,000 after purchasing an additional 64,915 shares during the period. Dimensional Fund Advisors LP grew its stake in shares of Sonoco Products by 11.0% during the 2nd quarter. Dimensional Fund Advisors LP now owns 2,631,259 shares of the industrial products company's stock worth $133,465,000 after purchasing an additional 261,062 shares during the period. Victory Capital Management Inc. grew its stake in shares of Sonoco Products by 2.4% during the 2nd quarter. Victory Capital Management Inc. now owns 2,195,155 shares of the industrial products company's stock worth $111,338,000 after purchasing an additional 50,577 shares during the period. Pacer Advisors Inc. grew its stake in shares of Sonoco Products by 13,464.6% during the 2nd quarter. Pacer Advisors Inc. now owns 1,980,297 shares of the industrial products company's stock worth $100,441,000 after purchasing an additional 1,965,698 shares during the period. Finally, Sei Investments Co. grew its stake in shares of Sonoco Products by 9.3% during the 2nd quarter. Sei Investments Co. now owns 1,490,580 shares of the industrial products company's stock worth $75,602,000 after purchasing an additional 126,643 shares during the period. Institutional investors and hedge funds own 77.69% of the company's stock.

Sonoco Products Price Performance

SON stock traded down $0.06 during midday trading on Wednesday, reaching $50.71. The stock had a trading volume of 634,751 shares, compared to its average volume of 617,113. The company's fifty day simple moving average is $53.43 and its 200 day simple moving average is $54.27. The company has a current ratio of 2.36, a quick ratio of 1.91 and a debt-to-equity ratio of 1.74. The company has a market cap of $4.98 billion, a price-to-earnings ratio of 17.43, a price-to-earnings-growth ratio of 2.09 and a beta of 0.69. Sonoco Products has a 52-week low of $48.22 and a 52-week high of $61.73.

Sonoco Products (NYSE:SON - Get Free Report) last issued its earnings results on Thursday, October 31st. The industrial products company reported $1.49 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.45 by $0.04. Sonoco Products had a return on equity of 19.92% and a net margin of 4.38%. The business had revenue of $1.68 billion during the quarter, compared to the consensus estimate of $1.72 billion. During the same period last year, the company earned $1.46 EPS. The company's revenue for the quarter was down 2.0% on a year-over-year basis. As a group, sell-side analysts predict that Sonoco Products will post 5.1 earnings per share for the current fiscal year.

Sonoco Products Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Tuesday, December 10th. Shareholders of record on Friday, November 8th will be paid a $0.52 dividend. This represents a $2.08 dividend on an annualized basis and a dividend yield of 4.10%. The ex-dividend date is Friday, November 8th. Sonoco Products's dividend payout ratio (DPR) is presently 71.48%.

Wall Street Analyst Weigh In

A number of equities research analysts have recently commented on SON shares. Raymond James started coverage on shares of Sonoco Products in a research note on Friday, July 19th. They set an "outperform" rating and a $62.00 price objective on the stock. Citigroup increased their target price on Sonoco Products from $62.00 to $63.00 and gave the company a "buy" rating in a research report on Wednesday, October 2nd. Robert W. Baird decreased their target price on Sonoco Products from $58.00 to $55.00 and set a "neutral" rating on the stock in a research report on Monday, November 4th. Finally, Wells Fargo & Company lowered Sonoco Products from an "equal weight" rating to an "underweight" rating and decreased their target price for the company from $54.00 to $52.00 in a research report on Wednesday, August 21st. One research analyst has rated the stock with a sell rating, one has given a hold rating and three have issued a buy rating to the company's stock. Based on data from MarketBeat, Sonoco Products presently has an average rating of "Hold" and an average price target of $58.00.

Get Our Latest Research Report on Sonoco Products

Sonoco Products Company Profile

(

Free Report)

Sonoco Products Company, together with its subsidiaries, designs, develops, manufactures, and sells various engineered and sustainable packaging products in North and South America, Europe, Australia, and Asia. The company operates Consumer Packaging and Industrial Paper Packaging segments. The Consumer Packaging segment offers round and shaped rigid paper, steel, and plastic containers; metal and peelable membrane ends, closures, and components; thermoformed plastic trays and enclosures; and high-barrier flexible packaging products.

Read More

Before you consider Sonoco Products, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sonoco Products wasn't on the list.

While Sonoco Products currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.