Robeco Institutional Asset Management B.V. boosted its position in Sonos, Inc. (NASDAQ:SONO - Free Report) by 535.7% during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 377,294 shares of the company's stock after acquiring an additional 317,945 shares during the period. Robeco Institutional Asset Management B.V. owned 0.31% of Sonos worth $4,637,000 at the end of the most recent reporting period.

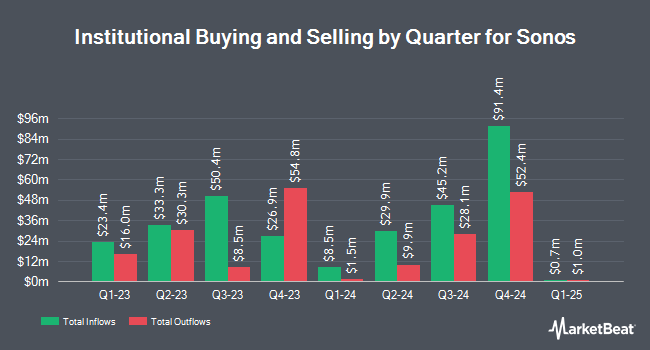

Several other hedge funds have also bought and sold shares of the business. Covestor Ltd lifted its position in Sonos by 376.7% during the first quarter. Covestor Ltd now owns 1,988 shares of the company's stock valued at $38,000 after purchasing an additional 1,571 shares during the period. Point72 Asia Singapore Pte. Ltd. purchased a new stake in shares of Sonos during the second quarter worth approximately $46,000. Quest Partners LLC raised its holdings in Sonos by 138.8% during the second quarter. Quest Partners LLC now owns 4,850 shares of the company's stock worth $72,000 after purchasing an additional 2,819 shares during the last quarter. nVerses Capital LLC acquired a new stake in Sonos during the second quarter worth approximately $81,000. Finally, International Assets Investment Management LLC grew its stake in Sonos by 927.0% during the third quarter. International Assets Investment Management LLC now owns 7,497 shares of the company's stock worth $92,000 after buying an additional 6,767 shares during the period. Institutional investors own 85.82% of the company's stock.

Sonos Trading Up 2.4 %

NASDAQ SONO traded up $0.32 during trading hours on Friday, hitting $13.84. 1,503,978 shares of the company's stock traded hands, compared to its average volume of 1,892,999. The firm has a market capitalization of $1.67 billion, a P/E ratio of -98.86 and a beta of 2.04. The business's fifty day moving average price is $12.37 and its two-hundred day moving average price is $13.87. Sonos, Inc. has a 52 week low of $10.23 and a 52 week high of $19.76.

Sonos (NASDAQ:SONO - Get Free Report) last issued its earnings results on Wednesday, August 7th. The company reported $0.03 earnings per share for the quarter, meeting the consensus estimate of $0.03. Sonos had a negative net margin of 1.04% and a positive return on equity of 0.42%. The firm had revenue of $397.15 million for the quarter, compared to analysts' expectations of $391.23 million. During the same quarter last year, the company earned $0.02 earnings per share. The firm's revenue was up 6.4% compared to the same quarter last year. On average, sell-side analysts expect that Sonos, Inc. will post -0.28 EPS for the current fiscal year.

Analysts Set New Price Targets

Several analysts have commented on the stock. Craig Hallum downgraded shares of Sonos from a "buy" rating to a "hold" rating and dropped their target price for the stock from $25.00 to $10.00 in a report on Thursday, August 8th. Morgan Stanley cut Sonos from an "overweight" rating to an "underweight" rating and lowered their target price for the stock from $25.00 to $11.00 in a research note on Thursday, September 26th.

Read Our Latest Analysis on Sonos

Insider Activity at Sonos

In related news, insider Shamayne Braman sold 6,438 shares of the stock in a transaction that occurred on Friday, August 16th. The stock was sold at an average price of $11.56, for a total transaction of $74,423.28. Following the completion of the sale, the insider now directly owns 26,588 shares of the company's stock, valued at approximately $307,357.28. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. 3.30% of the stock is owned by insiders.

About Sonos

(

Free Report)

Sonos, Inc, together with its subsidiaries, designs, develops, manufactures, and sells audio products and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. It offers wireless, portable, and home theater speakers; components; and accessories. The company offers its products through approximately 10,000 third-party retail stores, including custom installers of home audio systems; and e-commerce retailers, as well as through its website.

Further Reading

Before you consider Sonos, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sonos wasn't on the list.

While Sonos currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.