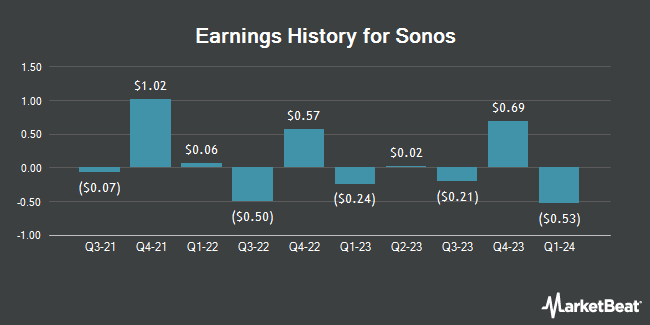

Sonos (NASDAQ:SONO - Get Free Report) will post its quarterly earnings results after the market closes on Wednesday, November 13th. Analysts expect Sonos to post earnings of ($0.22) per share for the quarter. Individual interested in registering for the company's earnings conference call can do so using this link.

Sonos (NASDAQ:SONO - Get Free Report) last issued its quarterly earnings data on Wednesday, August 7th. The company reported $0.03 earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of $0.03. Sonos had a negative net margin of 1.04% and a positive return on equity of 0.42%. The firm had revenue of $397.15 million during the quarter, compared to analysts' expectations of $391.23 million. During the same period in the prior year, the company posted $0.02 earnings per share. Sonos's revenue for the quarter was up 6.4% on a year-over-year basis. On average, analysts expect Sonos to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Sonos Stock Down 1.0 %

SONO stock traded down $0.14 during mid-day trading on Wednesday, reaching $13.63. 1,922,125 shares of the stock traded hands, compared to its average volume of 1,896,280. Sonos has a 52 week low of $10.10 and a 52 week high of $19.76. The business has a 50-day moving average of $12.28 and a two-hundred day moving average of $13.90.

Insider Activity

In related news, insider Shamayne Braman sold 6,438 shares of the stock in a transaction dated Friday, August 16th. The shares were sold at an average price of $11.56, for a total value of $74,423.28. Following the completion of the transaction, the insider now owns 26,588 shares of the company's stock, valued at $307,357.28. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. 3.30% of the stock is owned by company insiders.

Analyst Ratings Changes

SONO has been the subject of a number of recent analyst reports. Craig Hallum cut shares of Sonos from a "buy" rating to a "hold" rating and decreased their price target for the company from $25.00 to $10.00 in a report on Thursday, August 8th. Morgan Stanley cut shares of Sonos from an "overweight" rating to an "underweight" rating and decreased their price target for the company from $25.00 to $11.00 in a report on Thursday, September 26th. One analyst has rated the stock with a sell rating, two have given a hold rating and one has assigned a buy rating to the company's stock. According to MarketBeat, the company has a consensus rating of "Hold" and an average target price of $14.25.

Get Our Latest Analysis on SONO

Sonos Company Profile

(

Get Free Report)

Sonos, Inc, together with its subsidiaries, designs, develops, manufactures, and sells audio products and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. It offers wireless, portable, and home theater speakers; components; and accessories. The company offers its products through approximately 10,000 third-party retail stores, including custom installers of home audio systems; and e-commerce retailers, as well as through its website.

See Also

Before you consider Sonos, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sonos wasn't on the list.

While Sonos currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.