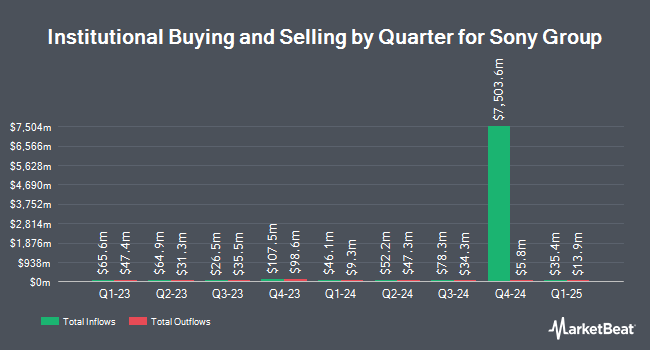

Highland Capital Management LLC raised its holdings in shares of Sony Group Co. (NYSE:SONY - Free Report) by 383.6% during the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 214,525 shares of the company's stock after acquiring an additional 170,165 shares during the quarter. Highland Capital Management LLC's holdings in Sony Group were worth $4,539,000 as of its most recent SEC filing.

Several other hedge funds and other institutional investors have also added to or reduced their stakes in the business. General Partner Inc. increased its position in Sony Group by 400.0% during the fourth quarter. General Partner Inc. now owns 1,245 shares of the company's stock valued at $26,000 after acquiring an additional 996 shares during the last quarter. Hilltop National Bank grew its position in shares of Sony Group by 346.3% in the 4th quarter. Hilltop National Bank now owns 1,513 shares of the company's stock worth $32,000 after buying an additional 1,174 shares during the last quarter. Thurston Springer Miller Herd & Titak Inc. grew its stake in Sony Group by 400.0% during the 4th quarter. Thurston Springer Miller Herd & Titak Inc. now owns 1,505 shares of the company's stock worth $32,000 after buying an additional 1,204 shares during the last quarter. Rise Advisors LLC raised its position in shares of Sony Group by 399.1% in the 4th quarter. Rise Advisors LLC now owns 1,747 shares of the company's stock valued at $37,000 after purchasing an additional 1,397 shares during the last quarter. Finally, Pacific Capital Wealth Advisors Inc. lifted its stake in shares of Sony Group by 400.0% during the fourth quarter. Pacific Capital Wealth Advisors Inc. now owns 1,810 shares of the company's stock worth $38,000 after buying an additional 1,448 shares during the period. 14.05% of the stock is currently owned by institutional investors.

Sony Group Stock Up 0.6 %

Shares of NYSE:SONY traded up $0.14 during trading on Thursday, hitting $22.27. 2,257,446 shares of the company were exchanged, compared to its average volume of 3,637,368. The firm's 50 day moving average price is $20.83 and its 200-day moving average price is $13.61. The stock has a market capitalization of $134.66 billion, a P/E ratio of 18.29, a PEG ratio of 13.02 and a beta of 0.95. Sony Group Co. has a 12-month low of $15.02 and a 12-month high of $22.71. The company has a debt-to-equity ratio of 0.25, a current ratio of 0.66 and a quick ratio of 0.49.

Wall Street Analysts Forecast Growth

Several research analysts recently issued reports on the stock. StockNews.com cut shares of Sony Group from a "strong-buy" rating to a "buy" rating in a report on Tuesday, November 19th. TD Cowen decreased their price objective on shares of Sony Group from $107.00 to $23.00 and set a "buy" rating on the stock in a report on Friday, October 11th. Oppenheimer dropped their price target on Sony Group from $108.00 to $25.00 and set an "outperform" rating for the company in a research report on Tuesday, November 12th. Finally, Sanford C. Bernstein initiated coverage on Sony Group in a report on Thursday, January 16th. They set an "outperform" rating on the stock. One research analyst has rated the stock with a hold rating, four have issued a buy rating and one has given a strong buy rating to the stock. According to MarketBeat, Sony Group currently has a consensus rating of "Buy" and a consensus target price of $24.00.

Read Our Latest Stock Report on SONY

About Sony Group

(

Free Report)

Sony Group Corporation designs, develops, produces, and sells electronic equipment, instruments, and devices for the consumer, professional, and industrial markets in Japan, the United States, Europe, China, the Asia-Pacific, and internationally. The company distributes software titles and add-on content through digital networks; network services related to game, video, and music content; and home gaming consoles, packaged and game software, and peripheral devices.

Featured Articles

Before you consider Sony Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sony Group wasn't on the list.

While Sony Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.