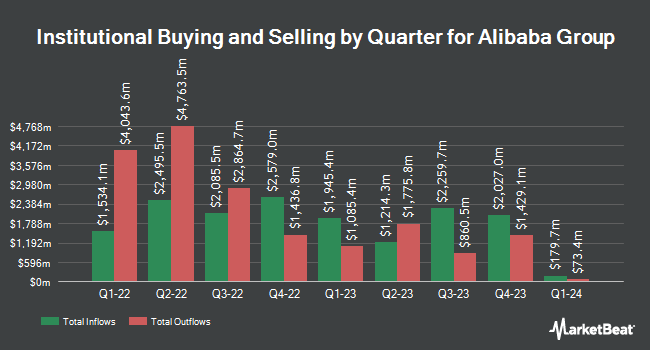

Soros Capital Management LLC acquired a new position in shares of Alibaba Group Holding Limited (NYSE:BABA - Free Report) in the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund acquired 114,000 shares of the specialty retailer's stock, valued at approximately $12,098,000. Alibaba Group accounts for about 2.9% of Soros Capital Management LLC's holdings, making the stock its 13th biggest holding.

Other institutional investors and hedge funds also recently bought and sold shares of the company. Primecap Management Co. CA boosted its stake in shares of Alibaba Group by 5.2% during the second quarter. Primecap Management Co. CA now owns 21,870,987 shares of the specialty retailer's stock valued at $1,574,711,000 after purchasing an additional 1,074,175 shares during the period. Sanders Capital LLC boosted its stake in shares of Alibaba Group by 0.3% during the third quarter. Sanders Capital LLC now owns 18,460,434 shares of the specialty retailer's stock valued at $1,959,021,000 after purchasing an additional 60,667 shares during the period. Assenagon Asset Management S.A. boosted its stake in shares of Alibaba Group by 1,392.6% during the third quarter. Assenagon Asset Management S.A. now owns 6,125,542 shares of the specialty retailer's stock valued at $650,043,000 after purchasing an additional 5,715,155 shares during the period. FMR LLC boosted its stake in shares of Alibaba Group by 454.2% during the third quarter. FMR LLC now owns 3,611,571 shares of the specialty retailer's stock valued at $383,260,000 after purchasing an additional 2,959,954 shares during the period. Finally, AMF Tjanstepension AB boosted its stake in shares of Alibaba Group by 6.9% during the third quarter. AMF Tjanstepension AB now owns 2,789,883 shares of the specialty retailer's stock valued at $296,062,000 after purchasing an additional 178,999 shares during the period. 13.47% of the stock is owned by hedge funds and other institutional investors.

Alibaba Group Stock Performance

Alibaba Group stock traded up $1.79 during mid-day trading on Wednesday, hitting $86.97. The company had a trading volume of 9,943,606 shares, compared to its average volume of 17,618,652. The company has a current ratio of 1.37, a quick ratio of 1.37 and a debt-to-equity ratio of 0.16. The company's fifty day moving average is $98.47 and its 200-day moving average is $86.00. Alibaba Group Holding Limited has a 12-month low of $66.63 and a 12-month high of $117.82. The company has a market capitalization of $208.09 billion, a price-to-earnings ratio of 17.68, a P/E/G ratio of 0.42 and a beta of 0.35.

Alibaba Group (NYSE:BABA - Get Free Report) last posted its earnings results on Friday, November 15th. The specialty retailer reported $15.06 EPS for the quarter, beating analysts' consensus estimates of $1.87 by $13.19. The firm had revenue of $236.50 billion for the quarter, compared to analysts' expectations of $239.45 billion. Alibaba Group had a return on equity of 12.28% and a net margin of 8.98%. The company's quarterly revenue was up 5.2% on a year-over-year basis. During the same period last year, the firm earned $1.82 EPS. Equities research analysts predict that Alibaba Group Holding Limited will post 8.44 EPS for the current year.

Analysts Set New Price Targets

Several research firms recently weighed in on BABA. Barclays decreased their price objective on Alibaba Group from $137.00 to $130.00 and set an "overweight" rating for the company in a report on Tuesday, November 19th. Bank of America lifted their price objective on Alibaba Group from $106.00 to $124.00 and gave the company a "buy" rating in a report on Wednesday, October 9th. Loop Capital restated a "buy" rating and issued a $115.00 price objective on shares of Alibaba Group in a report on Thursday, August 29th. Morgan Stanley restated an "equal weight" rating and issued a $90.00 price objective on shares of Alibaba Group in a report on Friday, August 23rd. Finally, Macquarie upgraded shares of Alibaba Group from a "neutral" rating to an "outperform" rating and set a $145.00 target price for the company in a report on Monday, October 7th. Two investment analysts have rated the stock with a hold rating and fourteen have given a buy rating to the stock. According to MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $114.07.

View Our Latest Stock Analysis on Alibaba Group

About Alibaba Group

(

Free Report)

Alibaba Group Holding Limited, through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally. The company operates through seven segments: China Commerce, International Commerce, Local Consumer Services, Cainiao, Cloud, Digital Media and Entertainment, and Innovation Initiatives and Others.

Featured Articles

Before you consider Alibaba Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alibaba Group wasn't on the list.

While Alibaba Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.