Soros Capital Management LLC purchased a new position in shares of Danaher Co. (NYSE:DHR - Free Report) during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund purchased 20,837 shares of the conglomerate's stock, valued at approximately $5,793,000. Danaher accounts for 1.4% of Soros Capital Management LLC's portfolio, making the stock its 24th biggest holding.

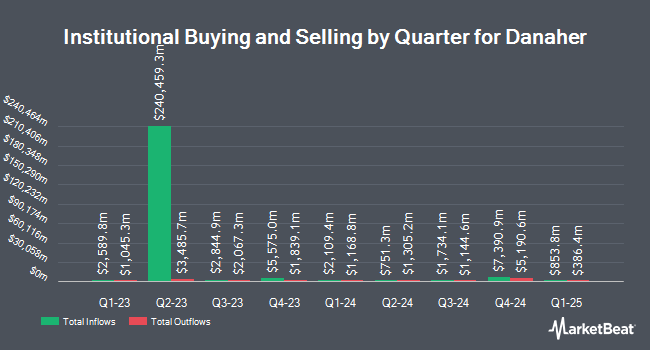

Several other hedge funds have also made changes to their positions in the business. FMR LLC increased its holdings in Danaher by 15.8% in the 3rd quarter. FMR LLC now owns 23,617,424 shares of the conglomerate's stock worth $6,566,116,000 after purchasing an additional 3,217,631 shares in the last quarter. Legal & General Group Plc increased its stake in Danaher by 2.4% during the second quarter. Legal & General Group Plc now owns 5,964,031 shares of the conglomerate's stock worth $1,490,112,000 after purchasing an additional 139,989 shares during the period. Fisher Asset Management LLC grew its holdings in Danaher by 2.6% during the third quarter. Fisher Asset Management LLC now owns 4,552,640 shares of the conglomerate's stock worth $1,265,725,000 after acquiring an additional 116,299 shares during the period. Massachusetts Financial Services Co. MA boosted its stake in shares of Danaher by 17.6% during the 3rd quarter. Massachusetts Financial Services Co. MA now owns 3,582,982 shares of the conglomerate's stock valued at $996,141,000 after buying an additional 535,254 shares during the last quarter. Finally, Dimensional Fund Advisors LP raised its holdings in shares of Danaher by 2.6% in the 2nd quarter. Dimensional Fund Advisors LP now owns 3,398,649 shares of the conglomerate's stock worth $849,195,000 after purchasing an additional 85,081 shares in the last quarter. Institutional investors and hedge funds own 79.05% of the company's stock.

Analysts Set New Price Targets

DHR has been the topic of a number of recent research reports. Wolfe Research upgraded Danaher from a "peer perform" rating to an "outperform" rating and set a $285.00 target price for the company in a research report on Thursday, October 31st. TD Cowen raised their price objective on shares of Danaher from $310.00 to $315.00 and gave the stock a "buy" rating in a research report on Wednesday, October 23rd. Stifel Nicolaus lifted their price objective on Danaher from $250.00 to $265.00 and gave the company a "hold" rating in a research note on Wednesday, October 23rd. Robert W. Baird lowered their target price on shares of Danaher from $278.00 to $277.00 and set an "outperform" rating on the stock in a research note on Wednesday, October 23rd. Finally, Royal Bank of Canada decreased their price target on shares of Danaher from $333.00 to $311.00 and set an "outperform" rating for the company in a research report on Wednesday, October 23rd. Six analysts have rated the stock with a hold rating and fourteen have given a buy rating to the company's stock. According to MarketBeat, Danaher currently has an average rating of "Moderate Buy" and an average price target of $287.16.

Check Out Our Latest Analysis on DHR

Danaher Stock Performance

Shares of NYSE:DHR traded up $2.79 on Wednesday, reaching $239.37. 1,470,657 shares of the company's stock were exchanged, compared to its average volume of 2,761,183. The company has a market capitalization of $172.89 billion, a price-to-earnings ratio of 45.14, a PEG ratio of 4.37 and a beta of 0.85. The company has a current ratio of 1.37, a quick ratio of 1.01 and a debt-to-equity ratio of 0.32. The company has a fifty day moving average of $256.66 and a 200-day moving average of $259.81. Danaher Co. has a twelve month low of $215.68 and a twelve month high of $281.70.

Danaher (NYSE:DHR - Get Free Report) last released its quarterly earnings results on Tuesday, October 22nd. The conglomerate reported $1.71 EPS for the quarter, beating analysts' consensus estimates of $1.57 by $0.14. Danaher had a return on equity of 10.62% and a net margin of 16.39%. The business had revenue of $5.80 billion during the quarter, compared to analyst estimates of $5.59 billion. During the same quarter in the prior year, the company posted $2.02 EPS. Danaher's quarterly revenue was up 3.1% compared to the same quarter last year. On average, research analysts predict that Danaher Co. will post 7.5 EPS for the current fiscal year.

Danaher Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Friday, October 25th. Investors of record on Friday, September 27th were given a dividend of $0.27 per share. This represents a $1.08 annualized dividend and a yield of 0.45%. The ex-dividend date of this dividend was Friday, September 27th. Danaher's dividend payout ratio is currently 20.61%.

About Danaher

(

Free Report)

Danaher Corporation designs, manufactures, and markets professional, medical, industrial, and commercial products and services worldwide. The Biotechnology segments offers bioprocess technologies, consumables, and services that advance, accelerate, and integrate the development and manufacture of therapeutics; cell line and cell culture media development services; cell culture media, process liquids and buffers for manufacturing, chromatography resins, filtration technologies, aseptic fill finish; single-use hardware and consumables and services, such as the design and installation of full manufacturing suites; lab filtration, separation, and purification; lab-scale protein purification and analytical tools; reagents, membranes, and services; and healthcare filtration solutions.

See Also

Before you consider Danaher, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Danaher wasn't on the list.

While Danaher currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.