Soros Fund Management LLC boosted its holdings in shares of CSX Co. (NASDAQ:CSX - Free Report) by 9.9% during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 928,118 shares of the transportation company's stock after acquiring an additional 83,597 shares during the quarter. Soros Fund Management LLC's holdings in CSX were worth $32,048,000 at the end of the most recent reporting period.

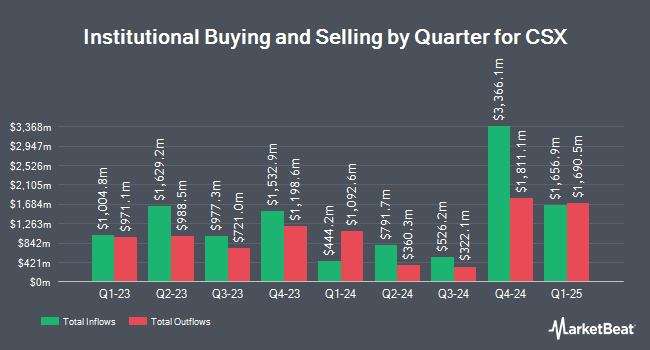

Other institutional investors have also recently added to or reduced their stakes in the company. CWM LLC boosted its holdings in CSX by 2.4% during the second quarter. CWM LLC now owns 97,267 shares of the transportation company's stock valued at $3,254,000 after acquiring an additional 2,313 shares during the period. Lion Street Advisors LLC acquired a new position in shares of CSX during the second quarter worth approximately $251,000. QRG Capital Management Inc. boosted its position in shares of CSX by 15.8% in the second quarter. QRG Capital Management Inc. now owns 285,648 shares of the transportation company's stock valued at $9,555,000 after acquiring an additional 38,977 shares during the period. Country Trust Bank acquired a new stake in shares of CSX in the second quarter worth $201,000. Finally, Jacobs & Co. CA increased its position in CSX by 8.3% during the second quarter. Jacobs & Co. CA now owns 381,716 shares of the transportation company's stock worth $12,768,000 after acquiring an additional 29,294 shares during the period. 73.57% of the stock is currently owned by institutional investors and hedge funds.

CSX Stock Performance

CSX stock traded down $0.16 during trading hours on Friday, reaching $34.46. The stock had a trading volume of 2,977,985 shares, compared to its average volume of 11,626,756. CSX Co. has a fifty-two week low of $31.74 and a fifty-two week high of $40.12. The company has a debt-to-equity ratio of 1.43, a current ratio of 1.39 and a quick ratio of 1.23. The stock has a market capitalization of $66.45 billion, a PE ratio of 18.61, a price-to-earnings-growth ratio of 2.28 and a beta of 1.20. The stock has a 50-day simple moving average of $34.84 and a 200 day simple moving average of $34.07.

CSX (NASDAQ:CSX - Get Free Report) last released its quarterly earnings data on Wednesday, October 16th. The transportation company reported $0.46 EPS for the quarter, missing the consensus estimate of $0.48 by ($0.02). The company had revenue of $3.62 billion during the quarter, compared to analyst estimates of $3.68 billion. CSX had a net margin of 24.77% and a return on equity of 28.92%. CSX's revenue for the quarter was up 1.3% on a year-over-year basis. During the same quarter in the prior year, the firm earned $0.42 earnings per share. Analysts predict that CSX Co. will post 1.84 EPS for the current fiscal year.

CSX Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Friday, December 13th. Stockholders of record on Friday, November 29th will be given a $0.12 dividend. This represents a $0.48 annualized dividend and a dividend yield of 1.39%. The ex-dividend date is Friday, November 29th. CSX's payout ratio is presently 25.81%.

Wall Street Analyst Weigh In

CSX has been the topic of a number of analyst reports. Citigroup upped their price target on CSX from $42.00 to $44.00 and gave the company a "buy" rating in a research report on Tuesday, November 12th. BMO Capital Markets reduced their price target on shares of CSX from $40.00 to $39.00 and set an "outperform" rating on the stock in a research report on Thursday, October 17th. Stifel Nicolaus reduced their target price on CSX from $39.00 to $37.00 and set a "buy" rating on the stock in a report on Thursday, October 17th. TD Cowen cut their price objective on CSX from $36.00 to $35.00 and set a "hold" rating for the company in a research report on Thursday, October 17th. Finally, Barclays lifted their price target on CSX from $40.00 to $41.00 and gave the company an "overweight" rating in a report on Wednesday, November 13th. Seven analysts have rated the stock with a hold rating and twelve have issued a buy rating to the stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average price target of $38.78.

Read Our Latest Analysis on CSX

CSX Company Profile

(

Free Report)

CSX Corporation, together with its subsidiaries, provides rail-based freight transportation services. The company offers rail services; and transportation of intermodal containers and trailers, as well as other transportation services, such as rail-to-truck transfers and bulk commodity operations. It also transports chemicals, agricultural and food products, minerals, automotive, forest products, fertilizers, and metals and equipment; and coal, coke, and iron ore to electricity-generating power plants, steel manufacturers, and industrial plants, as well as exports coal to deep-water port facilities.

Read More

Before you consider CSX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CSX wasn't on the list.

While CSX currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.