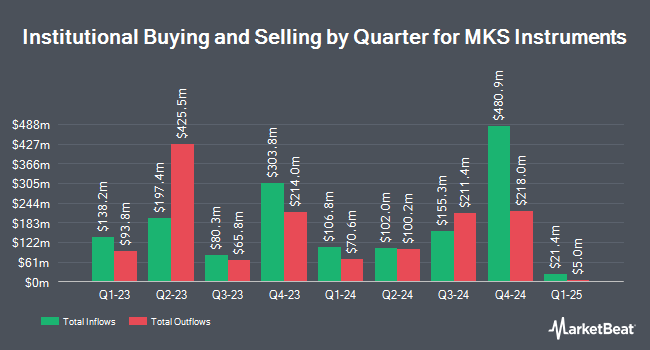

Soros Fund Management LLC grew its stake in shares of MKS Instruments, Inc. (NASDAQ:MKSI - Free Report) by 56.9% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 134,770 shares of the scientific and technical instruments company's stock after buying an additional 48,856 shares during the quarter. Soros Fund Management LLC owned 0.20% of MKS Instruments worth $14,651,000 at the end of the most recent quarter.

Other institutional investors and hedge funds have also recently modified their holdings of the company. Shellback Capital LP purchased a new stake in MKS Instruments during the 2nd quarter valued at about $34,541,000. Millennium Management LLC boosted its stake in shares of MKS Instruments by 219.5% during the second quarter. Millennium Management LLC now owns 348,024 shares of the scientific and technical instruments company's stock valued at $45,445,000 after purchasing an additional 239,099 shares during the period. Artemis Investment Management LLP bought a new position in shares of MKS Instruments in the third quarter worth approximately $21,690,000. Mizuho Markets Americas LLC purchased a new position in shares of MKS Instruments in the second quarter worth $23,171,000. Finally, Natixis Advisors LLC raised its holdings in MKS Instruments by 239.2% during the 2nd quarter. Natixis Advisors LLC now owns 247,695 shares of the scientific and technical instruments company's stock valued at $32,344,000 after buying an additional 174,675 shares during the last quarter. 99.79% of the stock is owned by institutional investors.

MKS Instruments Stock Up 0.8 %

Shares of NASDAQ MKSI traded up $0.87 on Friday, reaching $114.24. 127,505 shares of the company's stock traded hands, compared to its average volume of 820,881. The business's 50 day simple moving average is $107.88 and its two-hundred day simple moving average is $117.79. MKS Instruments, Inc. has a 12 month low of $81.04 and a 12 month high of $147.40. The company has a market cap of $7.69 billion, a price-to-earnings ratio of 251.93, a price-to-earnings-growth ratio of 0.68 and a beta of 1.65. The company has a quick ratio of 2.21, a current ratio of 3.42 and a debt-to-equity ratio of 1.98.

MKS Instruments (NASDAQ:MKSI - Get Free Report) last announced its quarterly earnings data on Wednesday, November 6th. The scientific and technical instruments company reported $1.72 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.45 by $0.27. MKS Instruments had a return on equity of 15.79% and a net margin of 0.90%. The business had revenue of $896.00 million during the quarter, compared to analysts' expectations of $874.29 million. During the same quarter in the previous year, the business earned $1.46 earnings per share. The firm's quarterly revenue was down 3.9% compared to the same quarter last year. As a group, equities research analysts forecast that MKS Instruments, Inc. will post 6.33 EPS for the current fiscal year.

MKS Instruments Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Friday, December 6th. Shareholders of record on Monday, November 25th will be paid a dividend of $0.22 per share. The ex-dividend date of this dividend is Monday, November 25th. This represents a $0.88 dividend on an annualized basis and a yield of 0.77%. MKS Instruments's dividend payout ratio is currently 195.56%.

Insiders Place Their Bets

In other MKS Instruments news, Director Elizabeth Mora sold 275 shares of the company's stock in a transaction dated Monday, December 2nd. The shares were sold at an average price of $113.41, for a total transaction of $31,187.75. Following the transaction, the director now owns 17,659 shares in the company, valued at approximately $2,002,707.19. This represents a 1.53 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, Director Jacqueline F. Moloney sold 250 shares of the firm's stock in a transaction that occurred on Tuesday, October 1st. The stock was sold at an average price of $108.90, for a total transaction of $27,225.00. Following the completion of the sale, the director now owns 10,283 shares in the company, valued at $1,119,818.70. This represents a 2.37 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 0.46% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research firms have issued reports on MKSI. Mizuho upgraded shares of MKS Instruments to a "strong-buy" rating in a research report on Monday, October 7th. Citigroup lowered MKS Instruments from a "buy" rating to a "neutral" rating and lowered their price target for the company from $145.00 to $120.00 in a research report on Monday, September 16th. The Goldman Sachs Group initiated coverage on MKS Instruments in a research report on Tuesday, September 3rd. They issued a "neutral" rating and a $129.00 price objective on the stock. Benchmark restated a "buy" rating and set a $142.00 target price on shares of MKS Instruments in a report on Monday, November 18th. Finally, Wells Fargo & Company cut their price target on shares of MKS Instruments from $120.00 to $110.00 and set an "equal weight" rating on the stock in a report on Thursday, October 3rd. Five research analysts have rated the stock with a hold rating, seven have given a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $141.09.

Check Out Our Latest Report on MKSI

MKS Instruments Profile

(

Free Report)

MKS Instruments, Inc provides foundational technology solutions to semiconductor manufacturing, electronics and packaging, and specialty industrial applications in the United States, Germany, China, South Korea, and internationally. It operates through Vacuum Solutions Division (VSD), Photonics Solutions Division (PSD), and Material Solutions Division (MSD) segments.

Further Reading

Before you consider MKS Instruments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MKS Instruments wasn't on the list.

While MKS Instruments currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.