Soros Fund Management LLC purchased a new stake in The Cooper Companies, Inc. (NASDAQ:COO - Free Report) during the third quarter, according to its most recent filing with the SEC. The firm purchased 175,000 shares of the medical device company's stock, valued at approximately $19,310,000. Soros Fund Management LLC owned 0.09% of Cooper Companies at the end of the most recent quarter.

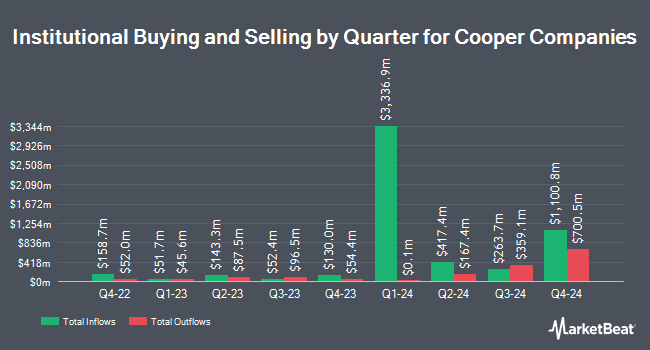

A number of other institutional investors and hedge funds have also made changes to their positions in COO. B. Riley Wealth Advisors Inc. increased its holdings in shares of Cooper Companies by 84.6% in the 1st quarter. B. Riley Wealth Advisors Inc. now owns 1,187 shares of the medical device company's stock valued at $120,000 after acquiring an additional 544 shares during the period. Cetera Investment Advisers grew its stake in Cooper Companies by 1,634.5% during the 1st quarter. Cetera Investment Advisers now owns 20,935 shares of the medical device company's stock valued at $2,124,000 after purchasing an additional 19,728 shares during the last quarter. Cetera Advisors LLC raised its position in Cooper Companies by 717.7% during the 1st quarter. Cetera Advisors LLC now owns 4,751 shares of the medical device company's stock worth $482,000 after buying an additional 4,170 shares during the last quarter. Mather Group LLC. lifted its stake in Cooper Companies by 291.8% during the 2nd quarter. Mather Group LLC. now owns 1,579 shares of the medical device company's stock valued at $138,000 after acquiring an additional 1,176 shares during the period. Finally, Harbor Capital Advisors Inc. boosted its holdings in shares of Cooper Companies by 19.4% in the 2nd quarter. Harbor Capital Advisors Inc. now owns 4,682 shares of the medical device company's stock valued at $409,000 after acquiring an additional 760 shares during the last quarter. 24.39% of the stock is currently owned by hedge funds and other institutional investors.

Cooper Companies Price Performance

Shares of NASDAQ:COO traded down $4.48 during trading on Friday, reaching $98.75. The stock had a trading volume of 1,860,198 shares, compared to its average volume of 1,146,507. The business has a fifty day moving average price of $104.72 and a 200-day moving average price of $98.77. The Cooper Companies, Inc. has a 1-year low of $82.69 and a 1-year high of $112.38. The company has a debt-to-equity ratio of 0.33, a quick ratio of 1.18 and a current ratio of 1.99. The stock has a market cap of $19.67 billion, a PE ratio of 55.10, a PEG ratio of 2.24 and a beta of 0.97.

Cooper Companies (NASDAQ:COO - Get Free Report) last released its earnings results on Thursday, December 5th. The medical device company reported $1.04 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.00 by $0.04. The business had revenue of $1.02 billion during the quarter, compared to analyst estimates of $1.03 billion. Cooper Companies had a net margin of 9.45% and a return on equity of 9.08%. The company's revenue for the quarter was up 9.8% compared to the same quarter last year. During the same quarter in the prior year, the firm earned $0.87 earnings per share. On average, equities analysts forecast that The Cooper Companies, Inc. will post 3.65 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

A number of equities analysts have weighed in on the company. Needham & Company LLC reiterated a "hold" rating on shares of Cooper Companies in a research note on Friday. StockNews.com raised shares of Cooper Companies from a "hold" rating to a "buy" rating in a report on Tuesday. Wells Fargo & Company increased their price target on shares of Cooper Companies from $115.00 to $118.00 and gave the stock an "overweight" rating in a report on Friday. Robert W. Baird increased their target price on shares of Cooper Companies from $118.00 to $125.00 and gave the stock an "outperform" rating in a research note on Thursday, August 29th. Finally, Stifel Nicolaus restated a "buy" rating and issued a $115.00 price target (up previously from $110.00) on shares of Cooper Companies in a research note on Thursday, August 29th. Three equities research analysts have rated the stock with a hold rating and ten have given a buy rating to the stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average target price of $117.10.

Read Our Latest Stock Report on COO

Insiders Place Their Bets

In related news, CAO Agostino Ricupati sold 1,601 shares of the stock in a transaction that occurred on Tuesday, September 10th. The stock was sold at an average price of $108.03, for a total value of $172,956.03. Following the completion of the transaction, the chief accounting officer now directly owns 4,818 shares in the company, valued at approximately $520,488.54. This represents a 24.94 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Also, CEO Albert G. White III sold 114,992 shares of Cooper Companies stock in a transaction on Thursday, September 19th. The shares were sold at an average price of $110.53, for a total value of $12,710,065.76. Following the completion of the sale, the chief executive officer now owns 165,273 shares in the company, valued at $18,267,624.69. This represents a 41.03 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 2.00% of the company's stock.

Cooper Companies Company Profile

(

Free Report)

The Cooper Companies, Inc, together with its subsidiaries, develops, manufactures, and markets contact lens wearers. The company operates in two segments, CooperVision and CooperSurgical. The CooperVision segment provides spherical lense, including lenses that correct near and farsightedness; and toric and multifocal lenses comprising lenses correcting vision challenges, such as astigmatism, presbyopia, and myopia in the Americas, Europe, Middle East, Africa, and Asia Pacific.

Featured Stories

Before you consider Cooper Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cooper Companies wasn't on the list.

While Cooper Companies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.