Sound View Wealth Advisors Group LLC lifted its position in The Coca-Cola Company (NYSE:KO - Free Report) by 3.1% in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 120,395 shares of the company's stock after acquiring an additional 3,607 shares during the quarter. Sound View Wealth Advisors Group LLC's holdings in Coca-Cola were worth $7,496,000 as of its most recent SEC filing.

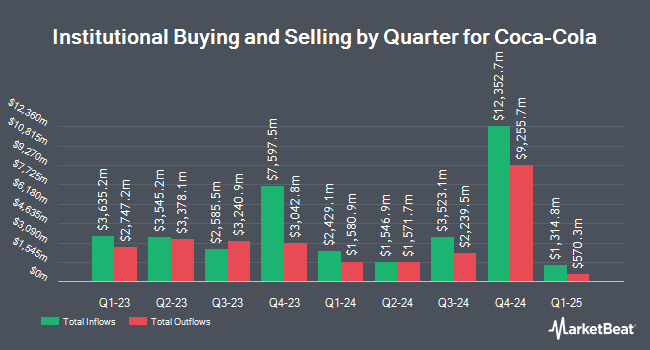

Other institutional investors have also made changes to their positions in the company. Mainstream Capital Management LLC bought a new position in Coca-Cola in the fourth quarter worth about $31,000. Retirement Wealth Solutions LLC bought a new stake in shares of Coca-Cola in the 4th quarter worth approximately $37,000. MilWealth Group LLC acquired a new position in Coca-Cola during the 4th quarter valued at approximately $40,000. MidAtlantic Capital Management Inc. bought a new position in Coca-Cola during the 3rd quarter worth $43,000. Finally, Sugar Maple Asset Management LLC acquired a new stake in Coca-Cola in the fourth quarter worth $43,000. 70.26% of the stock is currently owned by institutional investors.

Insider Buying and Selling

In other Coca-Cola news, insider Nikolaos Koumettis sold 55,500 shares of Coca-Cola stock in a transaction on Friday, March 7th. The shares were sold at an average price of $71.01, for a total transaction of $3,941,055.00. Following the sale, the insider now owns 246,909 shares in the company, valued at $17,533,008.09. The trade was a 18.35 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, insider Bruno Pietracci sold 19,058 shares of the stock in a transaction on Monday, February 24th. The shares were sold at an average price of $70.56, for a total transaction of $1,344,732.48. The disclosure for this sale can be found here. Insiders have sold a total of 288,146 shares of company stock valued at $20,456,524 over the last three months. 0.97% of the stock is owned by corporate insiders.

Coca-Cola Stock Performance

NYSE:KO traded down $0.45 during mid-day trading on Tuesday, hitting $71.00. 28,060,174 shares of the company's stock traded hands, compared to its average volume of 14,037,473. The company has a current ratio of 1.03, a quick ratio of 0.84 and a debt-to-equity ratio of 1.61. The firm has a 50 day moving average of $65.55 and a two-hundred day moving average of $66.57. The firm has a market capitalization of $305.37 billion, a price-to-earnings ratio of 28.74, a price-to-earnings-growth ratio of 3.79 and a beta of 0.57. The Coca-Cola Company has a 12 month low of $57.93 and a 12 month high of $73.53.

Coca-Cola (NYSE:KO - Get Free Report) last announced its quarterly earnings data on Tuesday, February 11th. The company reported $0.55 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.51 by $0.04. Coca-Cola had a net margin of 22.59% and a return on equity of 45.37%. On average, equities analysts forecast that The Coca-Cola Company will post 2.96 earnings per share for the current fiscal year.

Coca-Cola Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Tuesday, April 1st. Investors of record on Friday, March 14th will be paid a $0.51 dividend. This represents a $2.04 annualized dividend and a dividend yield of 2.87%. The ex-dividend date of this dividend is Friday, March 14th. This is a boost from Coca-Cola's previous quarterly dividend of $0.49. Coca-Cola's dividend payout ratio (DPR) is presently 82.59%.

Analyst Upgrades and Downgrades

KO has been the subject of several analyst reports. Royal Bank of Canada reissued an "outperform" rating and set a $69.00 price target on shares of Coca-Cola in a report on Thursday, February 6th. Wells Fargo & Company boosted their target price on shares of Coca-Cola from $70.00 to $75.00 and gave the company an "overweight" rating in a research note on Wednesday, February 12th. Evercore ISI raised their price target on shares of Coca-Cola from $72.00 to $75.00 and gave the company an "outperform" rating in a research note on Wednesday, February 12th. UBS Group boosted their price objective on Coca-Cola from $72.00 to $78.00 and gave the stock a "buy" rating in a research report on Wednesday, February 12th. Finally, Morgan Stanley increased their price objective on Coca-Cola from $76.00 to $78.00 and gave the stock an "overweight" rating in a report on Wednesday, February 12th. Two research analysts have rated the stock with a hold rating, seventeen have assigned a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average target price of $74.24.

Read Our Latest Stock Analysis on Coca-Cola

Coca-Cola Profile

(

Free Report)

The Coca-Cola Company, a beverage company, manufactures, markets, and sells various nonalcoholic beverages worldwide. The company provides sparkling soft drinks, sparkling flavors; water, sports, coffee, and tea; juice, value-added dairy, and plant-based beverages; and other beverages. It also offers beverage concentrates and syrups, as well as fountain syrups to fountain retailers, such as restaurants and convenience stores.

Featured Articles

Before you consider Coca-Cola, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coca-Cola wasn't on the list.

While Coca-Cola currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.