DnB Asset Management AS reduced its position in shares of Southern Copper Co. (NYSE:SCCO - Free Report) by 33.8% in the fourth quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 20,656 shares of the basic materials company's stock after selling 10,535 shares during the quarter. DnB Asset Management AS's holdings in Southern Copper were worth $1,882,000 as of its most recent filing with the Securities & Exchange Commission.

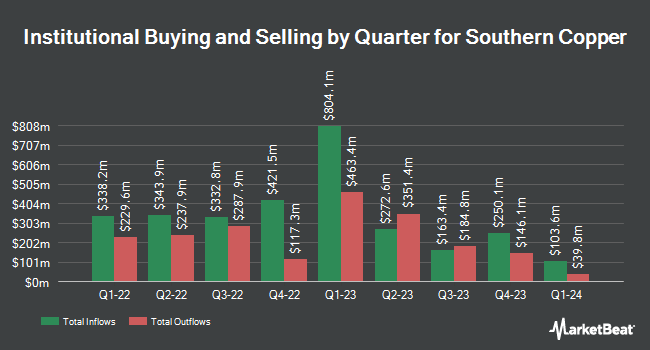

Several other institutional investors have also added to or reduced their stakes in SCCO. Level Four Advisory Services LLC bought a new position in shares of Southern Copper during the fourth quarter valued at about $202,000. denkapparat Operations GmbH purchased a new position in shares of Southern Copper during the fourth quarter valued at about $319,000. Boussard & Gavaudan Investment Management LLP bought a new position in Southern Copper in the fourth quarter worth about $2,862,000. New Age Alpha Advisors LLC purchased a new stake in Southern Copper in the fourth quarter worth about $209,000. Finally, Norges Bank purchased a new stake in Southern Copper in the fourth quarter worth about $52,738,000. Hedge funds and other institutional investors own 7.94% of the company's stock.

Southern Copper Stock Down 9.5 %

NYSE:SCCO traded down $8.27 during trading hours on Friday, reaching $78.46. 2,936,729 shares of the company traded hands, compared to its average volume of 1,201,397. The company has a current ratio of 2.77, a quick ratio of 2.31 and a debt-to-equity ratio of 0.64. The business's 50-day moving average price is $93.61 and its two-hundred day moving average price is $100.37. Southern Copper Co. has a 1 year low of $77.43 and a 1 year high of $127.34. The stock has a market capitalization of $62.47 billion, a P/E ratio of 18.16, a P/E/G ratio of 1.90 and a beta of 1.04.

Southern Copper (NYSE:SCCO - Get Free Report) last posted its quarterly earnings results on Wednesday, February 12th. The basic materials company reported $1.01 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.02 by ($0.01). Southern Copper had a return on equity of 40.27% and a net margin of 29.53%. Analysts predict that Southern Copper Co. will post 4.66 earnings per share for the current year.

Southern Copper Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Thursday, February 27th. Stockholders of record on Tuesday, February 11th were paid a $0.70 dividend. This represents a $2.80 annualized dividend and a dividend yield of 3.57%. The ex-dividend date of this dividend was Tuesday, February 11th. This is an increase from Southern Copper's previous quarterly dividend of $0.60. Southern Copper's dividend payout ratio is currently 64.81%.

Analysts Set New Price Targets

A number of research analysts have weighed in on the company. UBS Group upgraded Southern Copper from a "neutral" rating to a "buy" rating and set a $120.00 target price on the stock in a report on Thursday, March 13th. Morgan Stanley upgraded Southern Copper from an "underweight" rating to an "equal weight" rating and decreased their price objective for the stock from $106.30 to $102.00 in a report on Thursday, December 12th. Finally, Scotiabank boosted their target price on shares of Southern Copper from $52.00 to $72.00 and gave the company a "sector underperform" rating in a report on Monday, March 10th. Three research analysts have rated the stock with a sell rating, two have issued a hold rating and three have issued a buy rating to the stock. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and a consensus target price of $94.42.

Get Our Latest Analysis on Southern Copper

About Southern Copper

(

Free Report)

Southern Copper Corporation engages in mining, exploring, smelting, and refining copper and other minerals in Peru, Mexico, Argentina, Ecuador, and Chile. The company is involved in the mining, milling, and flotation of copper ore to produce copper and molybdenum concentrates; smelting of copper concentrates to produce blister and anode copper; refining of anode copper to produce copper cathodes; production of molybdenum concentrate and sulfuric acid; production of refined silver, gold, and other materials; and mining and processing of zinc, copper, molybdenum, silver, gold, and lead.

Read More

Before you consider Southern Copper, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Southern Copper wasn't on the list.

While Southern Copper currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.