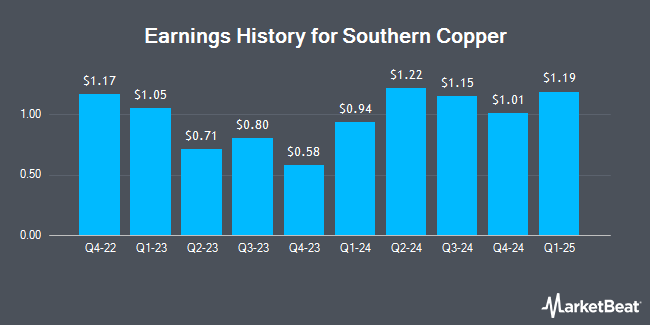

Southern Copper (NYSE:SCCO - Get Free Report) is expected to be issuing its Q1 2025 quarterly earnings results before the market opens on Thursday, April 24th. Analysts expect the company to announce earnings of $1.05 per share and revenue of $3.05 billion for the quarter.

Southern Copper (NYSE:SCCO - Get Free Report) last issued its quarterly earnings data on Wednesday, February 12th. The basic materials company reported $1.01 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.02 by ($0.01). Southern Copper had a return on equity of 40.27% and a net margin of 29.53%. On average, analysts expect Southern Copper to post $5 EPS for the current fiscal year and $5 EPS for the next fiscal year.

Southern Copper Stock Up 2.9 %

NYSE SCCO traded up $2.48 during trading on Tuesday, hitting $89.12. 1,020,872 shares of the company traded hands, compared to its average volume of 1,222,067. Southern Copper has a 12 month low of $74.84 and a 12 month high of $127.34. The business has a fifty day simple moving average of $90.92 and a 200 day simple moving average of $97.67. The company has a market capitalization of $70.95 billion, a P/E ratio of 20.63, a PEG ratio of 1.90 and a beta of 1.04. The company has a current ratio of 2.77, a quick ratio of 2.31 and a debt-to-equity ratio of 0.64.

Southern Copper Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Thursday, February 27th. Investors of record on Tuesday, February 11th were issued a $0.70 dividend. This is a positive change from Southern Copper's previous quarterly dividend of $0.60. This represents a $2.80 annualized dividend and a yield of 3.14%. The ex-dividend date was Tuesday, February 11th. Southern Copper's payout ratio is 64.81%.

Analyst Upgrades and Downgrades

A number of brokerages have recently weighed in on SCCO. UBS Group reduced their price objective on shares of Southern Copper from $120.00 to $100.00 and set a "buy" rating for the company in a research note on Tuesday, April 15th. Scotiabank upped their price target on Southern Copper from $52.00 to $72.00 and gave the stock a "sector underperform" rating in a report on Monday, March 10th. Finally, JPMorgan Chase & Co. lowered their price objective on shares of Southern Copper from $84.00 to $83.50 and set a "neutral" rating on the stock in a research note on Monday, April 14th. Three equities research analysts have rated the stock with a sell rating, two have given a hold rating and three have assigned a buy rating to the company. According to MarketBeat.com, the company presently has an average rating of "Hold" and a consensus target price of $89.58.

Get Our Latest Analysis on SCCO

About Southern Copper

(

Get Free Report)

Southern Copper Corporation engages in mining, exploring, smelting, and refining copper and other minerals in Peru, Mexico, Argentina, Ecuador, and Chile. The company is involved in the mining, milling, and flotation of copper ore to produce copper and molybdenum concentrates; smelting of copper concentrates to produce blister and anode copper; refining of anode copper to produce copper cathodes; production of molybdenum concentrate and sulfuric acid; production of refined silver, gold, and other materials; and mining and processing of zinc, copper, molybdenum, silver, gold, and lead.

Featured Articles

Before you consider Southern Copper, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Southern Copper wasn't on the list.

While Southern Copper currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.