Southernsun Asset Management LLC reduced its stake in shares of Louisiana-Pacific Co. (NYSE:LPX - Free Report) by 10.8% in the third quarter, according to its most recent filing with the SEC. The institutional investor owned 478,906 shares of the building manufacturing company's stock after selling 57,760 shares during the period. Louisiana-Pacific comprises approximately 6.1% of Southernsun Asset Management LLC's portfolio, making the stock its 5th biggest position. Southernsun Asset Management LLC owned about 0.68% of Louisiana-Pacific worth $51,463,000 as of its most recent SEC filing.

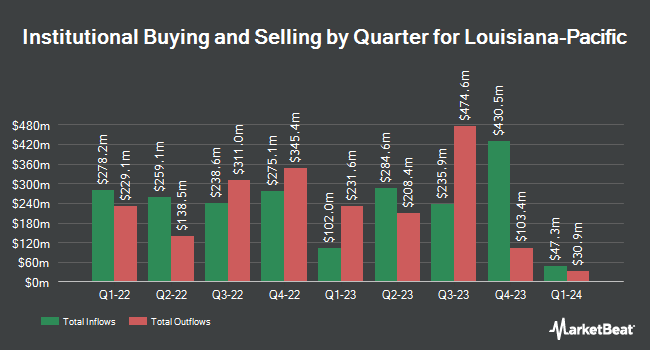

A number of other hedge funds have also recently bought and sold shares of the company. State Street Corp increased its stake in shares of Louisiana-Pacific by 10.8% during the 3rd quarter. State Street Corp now owns 2,154,561 shares of the building manufacturing company's stock worth $231,529,000 after purchasing an additional 210,113 shares during the last quarter. Point72 Asset Management L.P. bought a new position in Louisiana-Pacific in the 3rd quarter valued at $7,617,000. Polar Asset Management Partners Inc. grew its position in Louisiana-Pacific by 104.8% during the third quarter. Polar Asset Management Partners Inc. now owns 34,000 shares of the building manufacturing company's stock worth $3,654,000 after buying an additional 17,400 shares in the last quarter. Merewether Investment Management LP increased its position in shares of Louisiana-Pacific by 10.2% in the third quarter. Merewether Investment Management LP now owns 135,780 shares of the building manufacturing company's stock worth $14,591,000 after purchasing an additional 12,600 shares during the last quarter. Finally, Janus Henderson Group PLC increased its holdings in shares of Louisiana-Pacific by 142.0% in the 3rd quarter. Janus Henderson Group PLC now owns 75,522 shares of the building manufacturing company's stock worth $8,114,000 after buying an additional 44,318 shares during the last quarter. 94.73% of the stock is owned by hedge funds and other institutional investors.

Insider Transactions at Louisiana-Pacific

In other Louisiana-Pacific news, Director Ozey K. Horton, Jr. sold 300 shares of the company's stock in a transaction that occurred on Tuesday, November 12th. The stock was sold at an average price of $113.41, for a total value of $34,023.00. Following the sale, the director now owns 28,638 shares in the company, valued at approximately $3,247,835.58. This represents a 1.04 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this link. Also, Director Lizanne C. Gottung sold 2,500 shares of the stock in a transaction that occurred on Monday, September 16th. The stock was sold at an average price of $98.30, for a total value of $245,750.00. Following the transaction, the director now owns 21,005 shares in the company, valued at $2,064,791.50. This represents a 10.64 % decrease in their position. The disclosure for this sale can be found here. Insiders own 1.26% of the company's stock.

Louisiana-Pacific Trading Down 0.2 %

Shares of NYSE LPX traded down $0.22 during trading hours on Friday, reaching $119.74. The stock had a trading volume of 89,867 shares, compared to its average volume of 820,208. Louisiana-Pacific Co. has a 52-week low of $61.25 and a 52-week high of $122.87. The company has a current ratio of 2.92, a quick ratio of 1.69 and a debt-to-equity ratio of 0.21. The business's fifty day moving average price is $108.62 and its two-hundred day moving average price is $97.99. The firm has a market cap of $8.41 billion, a price-to-earnings ratio of 20.68, a P/E/G ratio of 2.82 and a beta of 1.91.

Louisiana-Pacific Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Wednesday, November 27th. Shareholders of record on Wednesday, November 20th were given a dividend of $0.26 per share. This represents a $1.04 annualized dividend and a dividend yield of 0.87%. The ex-dividend date was Wednesday, November 20th. Louisiana-Pacific's payout ratio is 17.93%.

Wall Street Analysts Forecast Growth

Several research analysts have commented on the stock. BMO Capital Markets lifted their price target on shares of Louisiana-Pacific from $99.00 to $103.00 and gave the stock a "market perform" rating in a research note on Tuesday, November 12th. DA Davidson raised their target price on shares of Louisiana-Pacific from $110.00 to $125.00 and gave the stock a "buy" rating in a research report on Wednesday, November 6th. TD Securities increased their price objective on Louisiana-Pacific from $115.00 to $123.00 and gave the stock a "hold" rating in a report on Wednesday, November 6th. The Goldman Sachs Group lifted their target price on shares of Louisiana-Pacific from $90.00 to $99.00 and gave the stock a "sell" rating in a report on Wednesday, November 6th. Finally, StockNews.com cut shares of Louisiana-Pacific from a "buy" rating to a "hold" rating in a report on Sunday, November 10th. Two investment analysts have rated the stock with a sell rating, six have issued a hold rating and three have assigned a buy rating to the stock. According to data from MarketBeat.com, the company has an average rating of "Hold" and a consensus price target of $102.22.

Read Our Latest Analysis on LPX

About Louisiana-Pacific

(

Free Report)

Louisiana-Pacific Corporation, together with its subsidiaries, provides building solutions primarily for use in new home construction, repair and remodeling, and outdoor structure markets. It operates through Siding, Oriented Strand Board, LP South America, and Other segments. The Siding segment offers LP SmartSide trim and siding products, LP SmartSide ExpertFinish trim and siding products, LP BuilderSeries lap siding products, and LP Outdoor Building Solutions; and engineered wood siding, trim, soffit, and fascia products.

Featured Articles

Before you consider Louisiana-Pacific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Louisiana-Pacific wasn't on the list.

While Louisiana-Pacific currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.