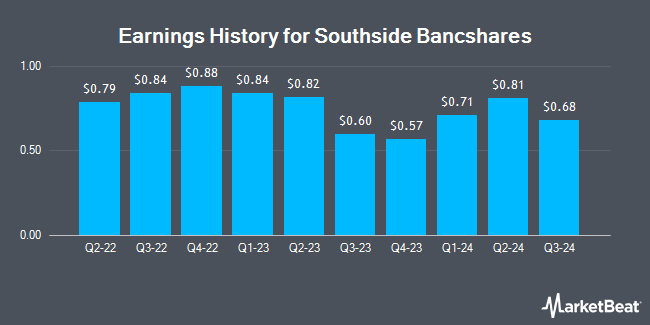

Southside Bancshares (NASDAQ:SBSI - Get Free Report) is expected to be posting its quarterly earnings results before the market opens on Tuesday, April 29th. Analysts expect Southside Bancshares to post earnings of $0.67 per share and revenue of $67.37 million for the quarter.

Southside Bancshares Stock Up 0.2 %

Shares of SBSI opened at $27.64 on Tuesday. The company has a quick ratio of 0.76, a current ratio of 0.76 and a debt-to-equity ratio of 1.18. The business has a fifty day moving average of $29.03 and a 200 day moving average of $31.76. The company has a market cap of $839.98 million, a PE ratio of 9.50 and a beta of 0.58. Southside Bancshares has a 52-week low of $25.30 and a 52-week high of $38.00.

Southside Bancshares Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Thursday, March 6th. Stockholders of record on Thursday, February 20th were issued a $0.36 dividend. The ex-dividend date was Thursday, February 20th. This represents a $1.44 annualized dividend and a dividend yield of 5.21%. Southside Bancshares's dividend payout ratio (DPR) is presently 49.48%.

Analysts Set New Price Targets

SBSI has been the topic of a number of recent analyst reports. Raymond James assumed coverage on shares of Southside Bancshares in a research report on Tuesday, January 14th. They issued a "market perform" rating on the stock. StockNews.com raised Southside Bancshares from a "sell" rating to a "hold" rating in a research note on Tuesday, April 15th. Finally, Stephens cut their price objective on Southside Bancshares from $38.00 to $37.00 and set an "equal weight" rating on the stock in a research report on Thursday, January 30th.

View Our Latest Report on Southside Bancshares

Southside Bancshares Company Profile

(

Get Free Report)

Southside Bancshares, Inc operates as the bank holding company for Southside Bank that provides a range of financial services to individuals, businesses, municipal entities, and nonprofit organizations. Its deposit products include savings, money market, and interest and noninterest bearing checking accounts, as well as certificates of deposits.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Southside Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Southside Bancshares wasn't on the list.

While Southside Bancshares currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.