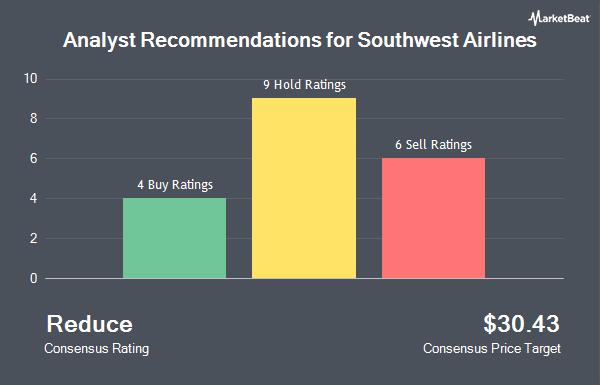

Southwest Airlines Co. (NYSE:LUV - Get Free Report) has been assigned a consensus rating of "Hold" from the seventeen brokerages that are presently covering the stock, MarketBeat reports. Two research analysts have rated the stock with a sell recommendation, eleven have assigned a hold recommendation and four have issued a buy recommendation on the company. The average 1 year price target among brokerages that have issued ratings on the stock in the last year is $30.96.

LUV has been the topic of a number of research reports. BNP Paribas upgraded shares of Southwest Airlines to a "strong sell" rating in a report on Thursday, September 19th. Sanford C. Bernstein decreased their target price on Southwest Airlines from $26.00 to $24.00 and set a "market perform" rating on the stock in a report on Monday, August 5th. Citigroup upped their target price on Southwest Airlines from $28.25 to $31.50 and gave the company a "neutral" rating in a report on Thursday, October 3rd. Jefferies Financial Group raised Southwest Airlines from an "underperform" rating to a "hold" rating and lifted their price target for the stock from $24.00 to $32.00 in a research note on Wednesday, October 9th. Finally, Susquehanna upped their price objective on shares of Southwest Airlines from $25.00 to $30.00 and gave the company a "neutral" rating in a research note on Wednesday, October 9th.

Check Out Our Latest Stock Analysis on Southwest Airlines

Insider Activity

In other news, Director Rakesh Gangwal bought 643,788 shares of the company's stock in a transaction that occurred on Tuesday, October 1st. The shares were purchased at an average price of $29.98 per share, for a total transaction of $19,300,764.24. Following the acquisition, the director now directly owns 3,606,311 shares of the company's stock, valued at $108,117,203.78. The trade was a 0.00 % increase in their position. The purchase was disclosed in a legal filing with the SEC, which is accessible through the SEC website. In related news, Director Rakesh Gangwal purchased 643,788 shares of Southwest Airlines stock in a transaction on Tuesday, October 1st. The stock was purchased at an average cost of $29.98 per share, with a total value of $19,300,764.24. Following the acquisition, the director now directly owns 3,606,311 shares in the company, valued at approximately $108,117,203.78. This trade represents a 0.00 % increase in their ownership of the stock. The acquisition was disclosed in a filing with the SEC, which is accessible through this link. Also, major shareholder Elliott Investment Management sold 1,203,920 shares of the company's stock in a transaction dated Monday, October 28th. The shares were sold at an average price of $29.83, for a total transaction of $35,912,933.60. Following the transaction, the insider now directly owns 59,912,580 shares of the company's stock, valued at $1,787,192,261.40. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. 0.33% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

Several hedge funds have recently bought and sold shares of LUV. Ashton Thomas Private Wealth LLC acquired a new position in Southwest Airlines in the second quarter valued at about $29,000. CVA Family Office LLC lifted its holdings in Southwest Airlines by 179.5% during the second quarter. CVA Family Office LLC now owns 1,034 shares of the airline's stock worth $30,000 after acquiring an additional 664 shares in the last quarter. Innealta Capital LLC bought a new stake in shares of Southwest Airlines during the 2nd quarter worth approximately $33,000. Ashton Thomas Securities LLC acquired a new stake in shares of Southwest Airlines in the 3rd quarter valued at approximately $33,000. Finally, AM Squared Ltd acquired a new stake in Southwest Airlines in the second quarter valued at $37,000. 80.82% of the stock is currently owned by institutional investors and hedge funds.

Southwest Airlines Stock Performance

NYSE:LUV traded down $0.62 during mid-day trading on Tuesday, hitting $32.03. The stock had a trading volume of 6,502,943 shares, compared to its average volume of 9,299,749. The company has a current ratio of 0.88, a quick ratio of 0.83 and a debt-to-equity ratio of 0.49. The company has a 50 day simple moving average of $30.07 and a 200-day simple moving average of $28.30. The stock has a market capitalization of $19.21 billion, a price-to-earnings ratio of -466.43, a P/E/G ratio of 7.90 and a beta of 1.15. Southwest Airlines has a 52 week low of $22.58 and a 52 week high of $35.18.

Southwest Airlines (NYSE:LUV - Get Free Report) last announced its earnings results on Thursday, October 24th. The airline reported $0.15 earnings per share for the quarter, beating the consensus estimate of $0.05 by $0.10. The firm had revenue of $6.87 billion for the quarter, compared to the consensus estimate of $6.77 billion. Southwest Airlines had a positive return on equity of 4.56% and a negative net margin of 0.06%. The firm's revenue for the quarter was up 5.3% on a year-over-year basis. During the same quarter in the previous year, the business earned $0.38 EPS. On average, research analysts expect that Southwest Airlines will post 0.7 earnings per share for the current fiscal year.

Southwest Airlines Company Profile

(

Get Free ReportSouthwest Airlines Co operates as a passenger airline company that provides scheduled air transportation services in the United States and near-international markets. As of December 31, 2023, the company operated a total fleet of 817 Boeing 737 aircraft; and served 121 destinations in 42 states, the District of Columbia, and the Commonwealth of Puerto Rico, as well as ten near-international countries, including Mexico, Jamaica, the Bahamas, Aruba, the Dominican Republic, Costa Rica, Belize, Cuba, the Cayman Islands, and Turks and Caicos.

Further Reading

Before you consider Southwest Airlines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Southwest Airlines wasn't on the list.

While Southwest Airlines currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.