Public Employees Retirement System of Ohio reduced its position in Southwest Airlines Co. (NYSE:LUV - Free Report) by 7.4% during the third quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 217,005 shares of the airline's stock after selling 17,453 shares during the quarter. Public Employees Retirement System of Ohio's holdings in Southwest Airlines were worth $6,430,000 as of its most recent filing with the SEC.

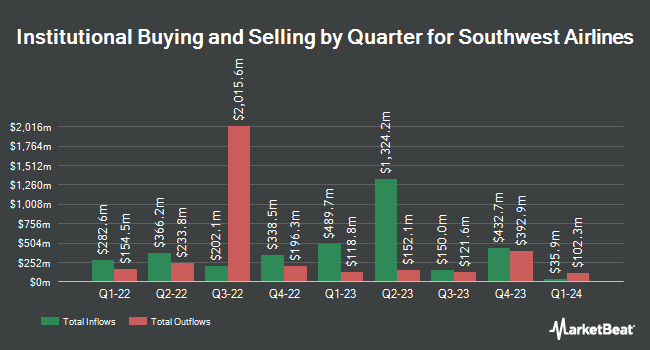

Several other large investors also recently modified their holdings of LUV. Dimensional Fund Advisors LP boosted its position in Southwest Airlines by 21.6% during the second quarter. Dimensional Fund Advisors LP now owns 5,828,166 shares of the airline's stock valued at $166,742,000 after acquiring an additional 1,034,496 shares during the last quarter. Jacobs Levy Equity Management Inc. lifted its stake in shares of Southwest Airlines by 608.5% in the 3rd quarter. Jacobs Levy Equity Management Inc. now owns 3,623,333 shares of the airline's stock valued at $107,359,000 after purchasing an additional 3,111,946 shares during the period. Charles Schwab Investment Management Inc. boosted its position in shares of Southwest Airlines by 1.4% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 3,377,660 shares of the airline's stock valued at $100,080,000 after purchasing an additional 46,110 shares in the last quarter. Mizuho Securities USA LLC boosted its position in shares of Southwest Airlines by 6,414.5% during the 3rd quarter. Mizuho Securities USA LLC now owns 3,006,000 shares of the airline's stock valued at $89,068,000 after purchasing an additional 2,959,857 shares in the last quarter. Finally, Healthcare of Ontario Pension Plan Trust Fund acquired a new stake in Southwest Airlines during the second quarter worth approximately $48,551,000. 80.82% of the stock is currently owned by institutional investors and hedge funds.

Southwest Airlines Stock Down 0.6 %

Southwest Airlines stock traded down $0.21 during trading on Friday, hitting $33.02. 5,863,951 shares of the company were exchanged, compared to its average volume of 9,076,443. The company has a market capitalization of $19.80 billion, a P/E ratio of -471.71, a PEG ratio of 7.66 and a beta of 1.16. The business's 50 day moving average is $31.71 and its 200 day moving average is $29.22. Southwest Airlines Co. has a 52 week low of $23.58 and a 52 week high of $36.12. The company has a current ratio of 0.88, a quick ratio of 0.83 and a debt-to-equity ratio of 0.49.

Southwest Airlines (NYSE:LUV - Get Free Report) last posted its earnings results on Thursday, October 24th. The airline reported $0.15 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.05 by $0.10. Southwest Airlines had a negative net margin of 0.06% and a positive return on equity of 4.56%. The firm had revenue of $6.87 billion during the quarter, compared to analyst estimates of $6.77 billion. During the same quarter in the prior year, the business posted $0.38 EPS. The business's revenue was up 5.3% compared to the same quarter last year. Analysts predict that Southwest Airlines Co. will post 0.76 earnings per share for the current year.

Southwest Airlines Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, January 16th. Shareholders of record on Thursday, December 26th will be paid a $0.18 dividend. The ex-dividend date of this dividend is Thursday, December 26th. This represents a $0.72 annualized dividend and a yield of 2.18%. Southwest Airlines's dividend payout ratio (DPR) is -1,028.57%.

Wall Street Analysts Forecast Growth

LUV has been the topic of several recent analyst reports. JPMorgan Chase & Co. boosted their price target on Southwest Airlines from $20.00 to $26.00 and gave the company a "neutral" rating in a research note on Friday, October 25th. StockNews.com upgraded shares of Southwest Airlines from a "sell" rating to a "hold" rating in a research report on Monday, October 28th. Susquehanna raised their price target on shares of Southwest Airlines from $25.00 to $30.00 and gave the stock a "neutral" rating in a report on Wednesday, October 9th. Bank of America assumed coverage on shares of Southwest Airlines in a research note on Monday, November 4th. They issued a "neutral" rating and a $33.00 price target for the company. Finally, UBS Group reissued a "sell" rating and set a $27.00 price objective on shares of Southwest Airlines in a research report on Tuesday, November 26th. Four analysts have rated the stock with a sell rating, twelve have assigned a hold rating and three have given a buy rating to the company. According to data from MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus target price of $31.37.

View Our Latest Stock Report on Southwest Airlines

Insiders Place Their Bets

In related news, insider Linda B. Rutherford sold 3,849 shares of the business's stock in a transaction dated Friday, December 6th. The shares were sold at an average price of $34.40, for a total value of $132,405.60. Following the transaction, the insider now directly owns 89,376 shares of the company's stock, valued at approximately $3,074,534.40. The trade was a 4.13 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director Rakesh Gangwal acquired 643,788 shares of the firm's stock in a transaction that occurred on Tuesday, October 1st. The shares were bought at an average price of $29.98 per share, with a total value of $19,300,764.24. Following the acquisition, the director now directly owns 3,606,311 shares of the company's stock, valued at $108,117,203.78. The trade was a 21.73 % increase in their position. The disclosure for this purchase can be found here. Insiders own 0.33% of the company's stock.

Southwest Airlines Profile

(

Free Report)

Southwest Airlines Co operates as a passenger airline company that provides scheduled air transportation services in the United States and near-international markets. As of December 31, 2023, the company operated a total fleet of 817 Boeing 737 aircraft; and served 121 destinations in 42 states, the District of Columbia, and the Commonwealth of Puerto Rico, as well as ten near-international countries, including Mexico, Jamaica, the Bahamas, Aruba, the Dominican Republic, Costa Rica, Belize, Cuba, the Cayman Islands, and Turks and Caicos.

See Also

Before you consider Southwest Airlines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Southwest Airlines wasn't on the list.

While Southwest Airlines currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report