Sowell Financial Services LLC lowered its stake in shares of Wells Fargo & Company (NYSE:WFC) by 8.4% in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 111,945 shares of the financial services provider's stock after selling 10,233 shares during the period. Sowell Financial Services LLC's holdings in Wells Fargo & Company were worth $7,863,000 as of its most recent filing with the Securities & Exchange Commission.

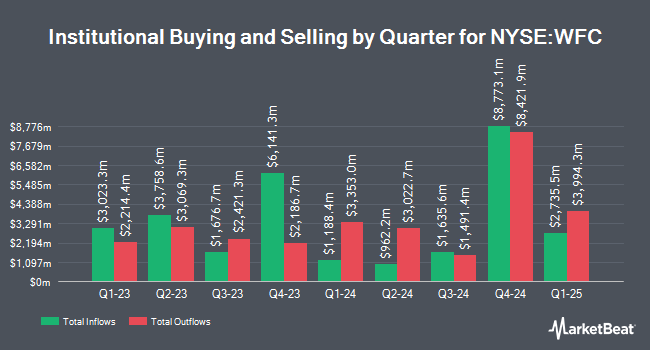

Several other hedge funds and other institutional investors have also bought and sold shares of WFC. Diamond Hill Capital Management Inc. lifted its stake in shares of Wells Fargo & Company by 2.5% during the third quarter. Diamond Hill Capital Management Inc. now owns 6,641,581 shares of the financial services provider's stock worth $375,183,000 after buying an additional 162,066 shares during the period. Nordea Investment Management AB grew its stake in Wells Fargo & Company by 10.1% during the 4th quarter. Nordea Investment Management AB now owns 6,284,421 shares of the financial services provider's stock valued at $441,983,000 after purchasing an additional 575,892 shares during the last quarter. Two Sigma Advisers LP lifted its stake in Wells Fargo & Company by 730.4% during the 3rd quarter. Two Sigma Advisers LP now owns 5,954,600 shares of the financial services provider's stock valued at $336,375,000 after acquiring an additional 5,237,500 shares during the period. Caisse DE Depot ET Placement DU Quebec grew its position in Wells Fargo & Company by 158.1% during the 3rd quarter. Caisse DE Depot ET Placement DU Quebec now owns 2,709,659 shares of the financial services provider's stock worth $153,069,000 after purchasing an additional 1,659,716 shares during the period. Finally, Public Sector Pension Investment Board raised its stake in shares of Wells Fargo & Company by 81.6% during the 3rd quarter. Public Sector Pension Investment Board now owns 1,981,130 shares of the financial services provider's stock valued at $111,914,000 after buying an additional 889,953 shares during the last quarter. Institutional investors own 75.90% of the company's stock.

Wells Fargo & Company Stock Performance

Shares of Wells Fargo & Company stock opened at $71.01 on Friday. The company has a debt-to-equity ratio of 1.07, a quick ratio of 0.85 and a current ratio of 0.86. Wells Fargo & Company has a 1 year low of $50.15 and a 1 year high of $81.50. The firm's 50-day simple moving average is $76.10 and its 200-day simple moving average is $68.50. The firm has a market cap of $233.50 billion, a PE ratio of 13.20, a price-to-earnings-growth ratio of 1.18 and a beta of 1.16.

Wells Fargo & Company (NYSE:WFC - Get Free Report) last released its quarterly earnings data on Wednesday, January 15th. The financial services provider reported $1.43 EPS for the quarter, topping analysts' consensus estimates of $1.34 by $0.09. Wells Fargo & Company had a net margin of 15.73% and a return on equity of 12.38%. The firm had revenue of $20.38 billion during the quarter, compared to the consensus estimate of $20.58 billion. During the same quarter in the previous year, the company posted $0.86 earnings per share. The firm's revenue was down .5% on a year-over-year basis. Equities analysts forecast that Wells Fargo & Company will post 5.89 earnings per share for the current fiscal year.

Wells Fargo & Company Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Saturday, March 1st. Shareholders of record on Tuesday, January 7th were paid a $0.40 dividend. This represents a $1.60 dividend on an annualized basis and a yield of 2.25%. The ex-dividend date of this dividend was Friday, February 7th. Wells Fargo & Company's payout ratio is 29.74%.

Analyst Upgrades and Downgrades

A number of brokerages have issued reports on WFC. Compass Point increased their price target on Wells Fargo & Company from $60.00 to $83.00 and gave the stock a "neutral" rating in a research report on Tuesday, December 10th. The Goldman Sachs Group boosted their target price on shares of Wells Fargo & Company from $72.00 to $82.00 and gave the stock a "buy" rating in a research note on Friday, December 6th. Keefe, Bruyette & Woods raised their price target on shares of Wells Fargo & Company from $81.00 to $86.00 and gave the company a "market perform" rating in a research note on Thursday, January 16th. UBS Group boosted their price objective on Wells Fargo & Company from $69.00 to $85.00 and gave the stock a "buy" rating in a research note on Monday, December 9th. Finally, Citigroup raised their target price on Wells Fargo & Company from $67.00 to $82.00 and gave the company a "neutral" rating in a research report on Tuesday, November 19th. Eleven investment analysts have rated the stock with a hold rating and ten have given a buy rating to the company's stock. According to MarketBeat, the stock has an average rating of "Hold" and a consensus target price of $73.39.

View Our Latest Stock Report on WFC

Wells Fargo & Company Company Profile

(

Free Report)

Wells Fargo & Co is a diversified and community-based financial services company, which engages in the provision of banking, insurance, investments, mortgage, and consumer and commercial finance products and services. It operates through the following segments: Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth and Investment Management.

Featured Stories

Want to see what other hedge funds are holding WFC? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Wells Fargo & Company (NYSE:WFC - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Wells Fargo & Company, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wells Fargo & Company wasn't on the list.

While Wells Fargo & Company currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.