Baader Bank Aktiengesellschaft lowered its stake in S&P Global Inc. (NYSE:SPGI - Free Report) by 2.6% during the 4th quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 21,602 shares of the business services provider's stock after selling 583 shares during the quarter. S&P Global comprises 0.7% of Baader Bank Aktiengesellschaft's portfolio, making the stock its 17th biggest holding. Baader Bank Aktiengesellschaft's holdings in S&P Global were worth $10,758,000 as of its most recent filing with the Securities & Exchange Commission.

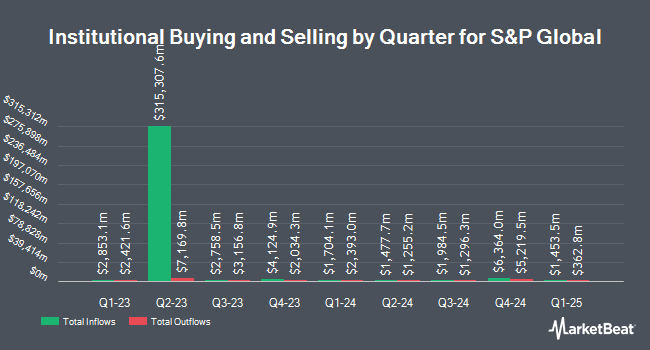

Several other institutional investors and hedge funds also recently added to or reduced their stakes in SPGI. International Assets Investment Management LLC increased its stake in S&P Global by 174,815.4% in the 3rd quarter. International Assets Investment Management LLC now owns 467,024 shares of the business services provider's stock worth $241,274,000 after acquiring an additional 466,757 shares during the last quarter. B. Metzler seel. Sohn & Co. Holding AG purchased a new position in shares of S&P Global in the 3rd quarter worth approximately $224,976,000. FMR LLC boosted its holdings in shares of S&P Global by 6.6% in the 3rd quarter. FMR LLC now owns 5,965,369 shares of the business services provider's stock worth $3,081,830,000 after purchasing an additional 369,598 shares during the period. Union Bancaire Privee UBP SA purchased a new position in shares of S&P Global in the 4th quarter worth approximately $144,091,000. Finally, Wellington Management Group LLP boosted its holdings in shares of S&P Global by 3.4% in the 3rd quarter. Wellington Management Group LLP now owns 8,868,375 shares of the business services provider's stock worth $4,581,580,000 after purchasing an additional 292,436 shares during the period. Institutional investors own 87.17% of the company's stock.

Wall Street Analyst Weigh In

A number of brokerages have recently commented on SPGI. Citigroup began coverage on S&P Global in a report on Friday, December 20th. They issued a "buy" rating and a $600.00 target price for the company. JPMorgan Chase & Co. dropped their price objective on S&P Global from $600.00 to $585.00 and set an "overweight" rating for the company in a report on Friday, October 25th. Morgan Stanley boosted their price objective on S&P Global from $570.00 to $595.00 and gave the company an "overweight" rating in a report on Thursday, December 12th. Evercore ISI initiated coverage on S&P Global in a report on Wednesday, October 2nd. They set an "outperform" rating and a $599.00 price objective for the company. Finally, Robert W. Baird boosted their price objective on S&P Global from $536.00 to $575.00 and gave the company an "outperform" rating in a report on Friday, October 25th. Two analysts have rated the stock with a hold rating and thirteen have assigned a buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $584.54.

View Our Latest Stock Analysis on SPGI

S&P Global Stock Up 1.5 %

Shares of SPGI stock traded up $7.73 during mid-day trading on Thursday, hitting $524.95. The stock had a trading volume of 333,133 shares, compared to its average volume of 1,218,233. S&P Global Inc. has a 12-month low of $407.69 and a 12-month high of $533.29. The firm has a market capitalization of $162.89 billion, a P/E ratio of 46.33, a price-to-earnings-growth ratio of 2.36 and a beta of 1.20. The firm's 50-day moving average is $506.04 and its two-hundred day moving average is $504.08. The company has a debt-to-equity ratio of 0.33, a current ratio of 0.94 and a quick ratio of 0.94.

S&P Global Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Wednesday, March 12th. Stockholders of record on Wednesday, February 26th will be given a $0.96 dividend. This represents a $3.84 annualized dividend and a dividend yield of 0.73%. This is a positive change from S&P Global's previous quarterly dividend of $0.91. The ex-dividend date is Wednesday, February 26th. S&P Global's payout ratio is presently 32.13%.

About S&P Global

(

Free Report)

S&P Global, Inc engages in the provision of transparent and independent ratings, benchmarks, analytics, and data to the capital and commodity markets worldwide. It operates through the following segments: Market Intelligence, Ratings, Commodity Insights, Mobility, Indices, and Engineering Solutions.

Recommended Stories

Before you consider S&P Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and S&P Global wasn't on the list.

While S&P Global currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.