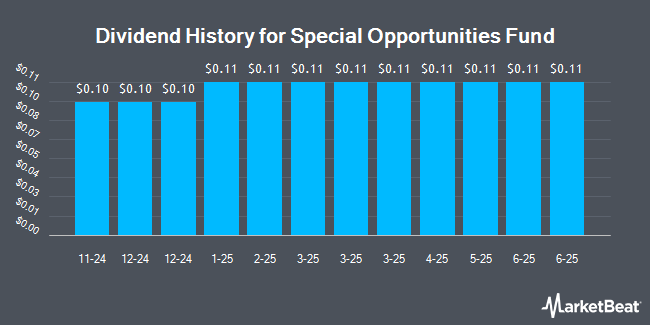

Special Opportunities Fund, Inc. (NYSE:SPE - Get Free Report) declared a monthly dividend on Wednesday, January 8th,Wall Street Journal reports. Stockholders of record on Tuesday, March 18th will be given a dividend of 0.1098 per share by the closed-end fund on Monday, March 31st. This represents a $1.32 annualized dividend and a dividend yield of 8.78%. The ex-dividend date of this dividend is Tuesday, March 18th.

Special Opportunities Fund has increased its dividend by an average of 1.3% annually over the last three years.

Special Opportunities Fund Price Performance

Shares of SPE stock remained flat at $15.00 on Wednesday. The stock had a trading volume of 14,038 shares, compared to its average volume of 30,068. The business has a fifty day moving average of $14.98 and a 200-day moving average of $14.14. Special Opportunities Fund has a 52 week low of $11.83 and a 52 week high of $15.74.

Special Opportunities Fund Company Profile

(

Get Free Report)

Special Opportunities Fund, Inc is a close-ended balanced fund of funds launched and managed by Bulldog Investors, LLC. It invests in close-ended funds investing in public equity and fixed income markets. The fund employs a combination of value, opportunistic and special situations strategies to make its investments.

Further Reading

Before you consider Special Opportunities Fund, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Special Opportunities Fund wasn't on the list.

While Special Opportunities Fund currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.