StockNews.com assumed coverage on shares of Spirit AeroSystems (NYSE:SPR - Free Report) in a report issued on Friday morning. The firm issued a sell rating on the aerospace company's stock.

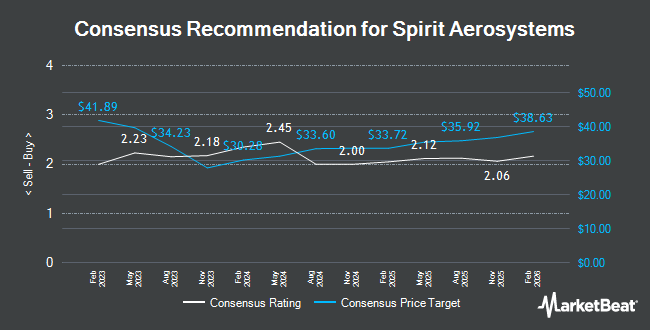

A number of other brokerages also recently commented on SPR. Baird R W downgraded shares of Spirit AeroSystems from a "strong-buy" rating to a "hold" rating in a report on Friday, July 12th. Susquehanna reissued a "neutral" rating and issued a $37.00 price objective (down from $40.00) on shares of Spirit AeroSystems in a research report on Wednesday, July 17th. Royal Bank of Canada reiterated a "sector perform" rating and issued a $37.25 price target on shares of Spirit AeroSystems in a report on Tuesday, August 20th. Truist Financial boosted their price objective on Spirit AeroSystems from $30.00 to $35.00 and gave the company a "hold" rating in a report on Wednesday, July 17th. Finally, Robert W. Baird reiterated a "neutral" rating and issued a $37.25 target price (up previously from $36.00) on shares of Spirit AeroSystems in a research note on Friday, July 12th. One analyst has rated the stock with a sell rating, sixteen have assigned a hold rating and one has given a buy rating to the company's stock. According to data from MarketBeat, the stock presently has an average rating of "Hold" and a consensus target price of $35.54.

Check Out Our Latest Research Report on Spirit AeroSystems

Spirit AeroSystems Price Performance

Shares of NYSE:SPR traded up $0.31 during trading on Friday, hitting $31.17. The company's stock had a trading volume of 4,400,635 shares, compared to its average volume of 3,055,380. The firm has a market cap of $3.63 billion, a price-to-earnings ratio of -2.51 and a beta of 1.84. The company has a 50-day moving average of $32.61 and a 200-day moving average of $32.81. Spirit AeroSystems has a 12 month low of $23.61 and a 12 month high of $37.08.

Spirit AeroSystems (NYSE:SPR - Get Free Report) last released its earnings results on Wednesday, October 23rd. The aerospace company reported ($3.03) earnings per share for the quarter, missing the consensus estimate of ($0.16) by ($2.87). The company had revenue of $1.47 billion during the quarter, compared to the consensus estimate of $1.83 billion. As a group, research analysts anticipate that Spirit AeroSystems will post -9.91 earnings per share for the current year.

Institutional Investors Weigh In On Spirit AeroSystems

Several large investors have recently bought and sold shares of SPR. Vanguard Group Inc. raised its position in shares of Spirit AeroSystems by 1.0% in the first quarter. Vanguard Group Inc. now owns 10,954,485 shares of the aerospace company's stock valued at $395,128,000 after buying an additional 109,632 shares during the last quarter. Allspring Global Investments Holdings LLC lifted its stake in Spirit AeroSystems by 148.7% in the 1st quarter. Allspring Global Investments Holdings LLC now owns 1,211 shares of the aerospace company's stock worth $44,000 after purchasing an additional 724 shares in the last quarter. International Assets Investment Management LLC boosted its holdings in shares of Spirit AeroSystems by 180,792.9% during the 3rd quarter. International Assets Investment Management LLC now owns 25,325 shares of the aerospace company's stock worth $779,000 after purchasing an additional 25,311 shares during the last quarter. Earnest Partners LLC grew its position in shares of Spirit AeroSystems by 2.6% in the second quarter. Earnest Partners LLC now owns 4,096,268 shares of the aerospace company's stock valued at $134,644,000 after purchasing an additional 105,350 shares in the last quarter. Finally, Susquehanna Fundamental Investments LLC acquired a new stake in shares of Spirit AeroSystems in the first quarter valued at approximately $5,078,000. 93.59% of the stock is currently owned by hedge funds and other institutional investors.

Spirit AeroSystems Company Profile

(

Get Free Report)

Spirit AeroSystems Holdings, Inc engages in the design, engineering, manufacture, and marketing of commercial aerostructures worldwide. It operates through three segments: Commercial, Defense & Space, and Aftermarket. The Commercial segment offers forward, mid, and rear fuselage sections and systems, floor beams, nacelles, struts/pylons, horizontal and vertical stabilizers, flaps and slats flight control surfaces, wing structures, and wing systems.

Read More

Before you consider Spirit AeroSystems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Spirit AeroSystems wasn't on the list.

While Spirit AeroSystems currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.