Two Sigma Advisers LP raised its stake in shares of Spotify Technology S.A. (NYSE:SPOT - Free Report) by 19.0% during the 3rd quarter, according to the company in its most recent filing with the SEC. The firm owned 980,000 shares of the company's stock after purchasing an additional 156,300 shares during the quarter. Spotify Technology accounts for about 0.8% of Two Sigma Advisers LP's investment portfolio, making the stock its 26th biggest position. Two Sigma Advisers LP owned about 0.49% of Spotify Technology worth $361,159,000 as of its most recent filing with the SEC.

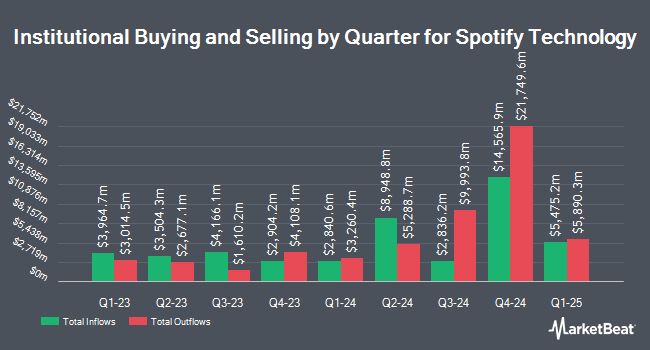

Other institutional investors and hedge funds also recently made changes to their positions in the company. Transcendent Capital Group LLC bought a new stake in Spotify Technology in the second quarter valued at about $25,000. Benjamin Edwards Inc. increased its stake in Spotify Technology by 214.8% in the second quarter. Benjamin Edwards Inc. now owns 85 shares of the company's stock valued at $27,000 after acquiring an additional 58 shares during the period. Larson Financial Group LLC increased its stake in Spotify Technology by 51.6% in the third quarter. Larson Financial Group LLC now owns 97 shares of the company's stock valued at $36,000 after acquiring an additional 33 shares during the period. Mather Group LLC. increased its stake in Spotify Technology by 9,900.0% in the second quarter. Mather Group LLC. now owns 100 shares of the company's stock valued at $31,000 after acquiring an additional 99 shares during the period. Finally, V Square Quantitative Management LLC bought a new stake in Spotify Technology in the third quarter valued at about $40,000. Institutional investors own 84.09% of the company's stock.

Spotify Technology Stock Performance

NYSE:SPOT traded up $0.66 during trading hours on Friday, hitting $494.17. The stock had a trading volume of 1,164,604 shares, compared to its average volume of 2,058,710. Spotify Technology S.A. has a one year low of $185.37 and a one year high of $506.47. The company has a market cap of $98.36 billion, a price-to-earnings ratio of 134.11 and a beta of 1.61. The business's 50 day moving average is $413.44 and its 200-day moving average is $355.61.

Spotify Technology (NYSE:SPOT - Get Free Report) last issued its earnings results on Tuesday, November 12th. The company reported $1.45 EPS for the quarter, missing the consensus estimate of $1.75 by ($0.30). Spotify Technology had a net margin of 4.66% and a return on equity of 19.07%. The firm had revenue of $3.99 billion during the quarter, compared to the consensus estimate of $4.03 billion. During the same period in the previous year, the company posted $0.36 EPS. The firm's revenue for the quarter was up 18.8% on a year-over-year basis. On average, sell-side analysts anticipate that Spotify Technology S.A. will post 6.02 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

SPOT has been the topic of a number of analyst reports. TD Cowen upped their target price on shares of Spotify Technology from $356.00 to $416.00 and gave the company a "hold" rating in a research note on Wednesday, November 13th. KeyCorp boosted their price target on shares of Spotify Technology from $490.00 to $520.00 and gave the company an "overweight" rating in a research report on Wednesday, November 13th. Pivotal Research boosted their price target on shares of Spotify Technology from $510.00 to $565.00 and gave the company a "buy" rating in a research report on Wednesday, November 13th. Cantor Fitzgerald restated a "neutral" rating and issued a $340.00 price target on shares of Spotify Technology in a research report on Monday, October 7th. Finally, Wells Fargo & Company boosted their price target on shares of Spotify Technology from $470.00 to $520.00 and gave the company an "overweight" rating in a research report on Wednesday, November 13th. One equities research analyst has rated the stock with a sell rating, five have issued a hold rating and twenty-three have assigned a buy rating to the company's stock. According to MarketBeat, Spotify Technology presently has an average rating of "Moderate Buy" and a consensus target price of $422.90.

View Our Latest Analysis on Spotify Technology

Spotify Technology Company Profile

(

Free Report)

Spotify Technology SA, together with its subsidiaries, provides audio streaming subscription services worldwide. It operates through two segments, Premium and Ad-Supported. The Premium segment offers unlimited online and offline streaming access to its catalog of music and podcasts without commercial breaks to its subscribers.

Recommended Stories

Before you consider Spotify Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Spotify Technology wasn't on the list.

While Spotify Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.