Axxcess Wealth Management LLC raised its position in Spotify Technology S.A. (NYSE:SPOT - Free Report) by 232.5% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 2,939 shares of the company's stock after acquiring an additional 2,055 shares during the quarter. Axxcess Wealth Management LLC's holdings in Spotify Technology were worth $1,083,000 at the end of the most recent quarter.

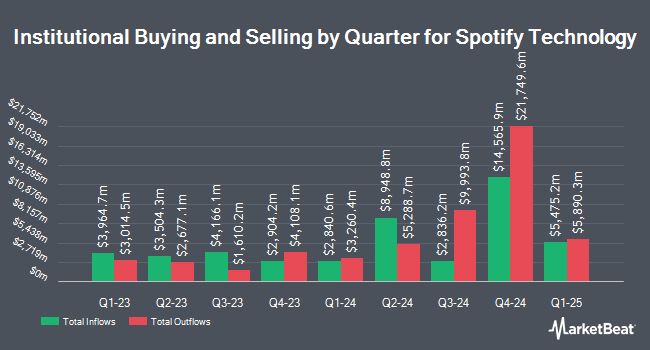

Other hedge funds and other institutional investors have also recently modified their holdings of the company. West Bancorporation Inc. raised its stake in Spotify Technology by 3.4% in the third quarter. West Bancorporation Inc. now owns 827 shares of the company's stock worth $305,000 after buying an additional 27 shares in the last quarter. Washington Trust Advisors Inc. raised its position in shares of Spotify Technology by 12.0% in the 3rd quarter. Washington Trust Advisors Inc. now owns 299 shares of the company's stock worth $110,000 after acquiring an additional 32 shares in the last quarter. Custom Index Systems LLC lifted its stake in shares of Spotify Technology by 3.0% in the 3rd quarter. Custom Index Systems LLC now owns 1,150 shares of the company's stock valued at $424,000 after purchasing an additional 33 shares during the period. Clearbridge Investments LLC boosted its position in shares of Spotify Technology by 0.6% during the first quarter. Clearbridge Investments LLC now owns 6,892 shares of the company's stock valued at $1,819,000 after purchasing an additional 38 shares in the last quarter. Finally, Cigna Investments Inc. New boosted its position in shares of Spotify Technology by 3.3% during the second quarter. Cigna Investments Inc. New now owns 1,260 shares of the company's stock valued at $395,000 after purchasing an additional 40 shares in the last quarter. 84.09% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

Several equities analysts have commented on the company. TD Cowen raised their price objective on Spotify Technology from $356.00 to $416.00 and gave the company a "hold" rating in a research report on Wednesday. Evercore ISI lifted their price target on shares of Spotify Technology from $420.00 to $460.00 and gave the company an "outperform" rating in a research report on Thursday, August 29th. Benchmark upped their price objective on shares of Spotify Technology from $430.00 to $440.00 and gave the stock a "buy" rating in a report on Monday. Rosenblatt Securities raised their target price on shares of Spotify Technology from $399.00 to $438.00 and gave the company a "buy" rating in a research note on Thursday, October 17th. Finally, Barclays boosted their price target on Spotify Technology from $385.00 to $475.00 and gave the stock an "overweight" rating in a research report on Wednesday. One investment analyst has rated the stock with a sell rating, five have given a hold rating and twenty-three have given a buy rating to the stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $412.72.

Get Our Latest Report on Spotify Technology

Spotify Technology Stock Performance

Shares of Spotify Technology stock traded up $47.95 during trading hours on Wednesday, reaching $467.34. 12,045,073 shares of the stock traded hands, compared to its average volume of 1,916,959. Spotify Technology S.A. has a one year low of $170.62 and a one year high of $473.00. The firm has a market capitalization of $93.03 billion, a price-to-earnings ratio of 127.00 and a beta of 1.56. The company has a quick ratio of 1.56, a current ratio of 1.56 and a debt-to-equity ratio of 0.31. The company has a 50 day moving average price of $369.70 and a 200 day moving average price of $334.73.

Spotify Technology Profile

(

Free Report)

Spotify Technology SA, together with its subsidiaries, provides audio streaming subscription services worldwide. It operates through two segments, Premium and Ad-Supported. The Premium segment offers unlimited online and offline streaming access to its catalog of music and podcasts without commercial breaks to its subscribers.

Featured Articles

Before you consider Spotify Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Spotify Technology wasn't on the list.

While Spotify Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.